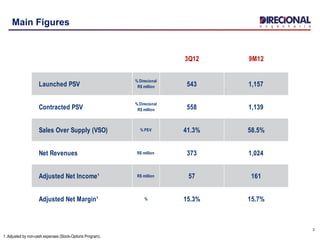

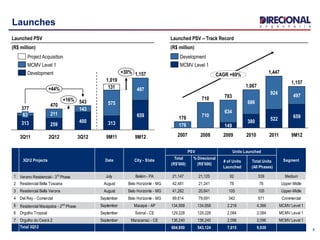

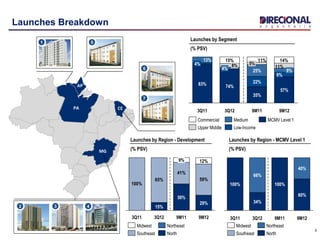

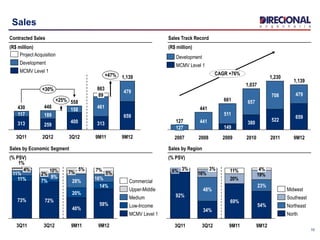

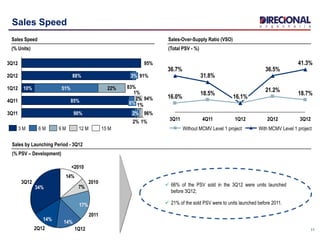

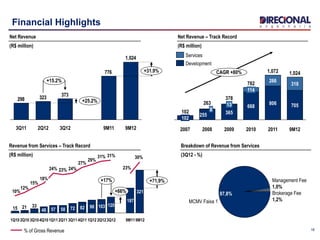

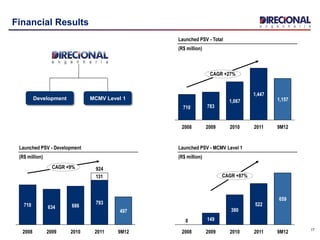

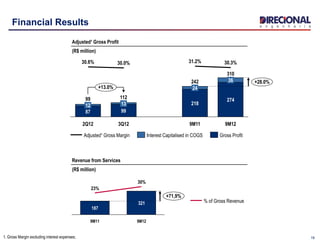

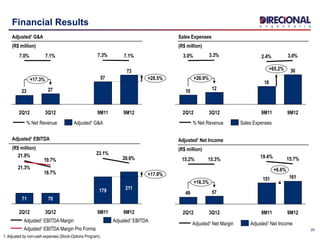

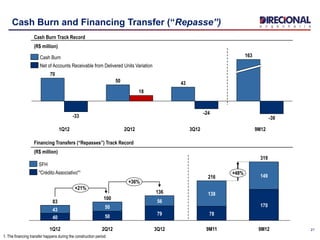

This document provides an earnings release and conference call agenda for 3Q12 results. Financial highlights include net revenues of R$373 million for 3Q12, up 15.2% year-over-year. Adjusted net income was R$57 million, with an adjusted net margin of 15.3%. Operational highlights include launches of 7,015 units with PSV of R$544 million in 3Q12. Contracted sales reached R$558 million for the quarter. The company continues focusing on industrialized construction methods to increase efficiencies.