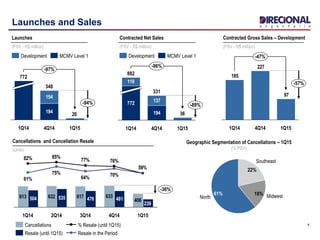

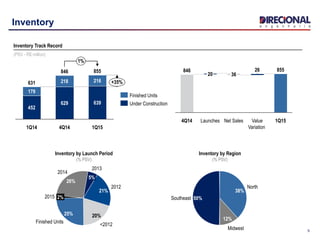

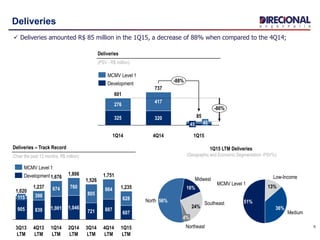

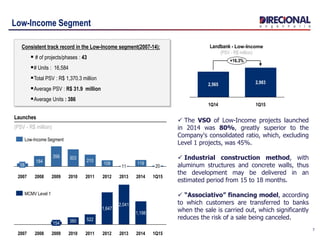

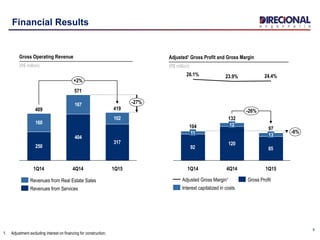

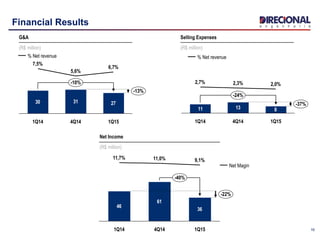

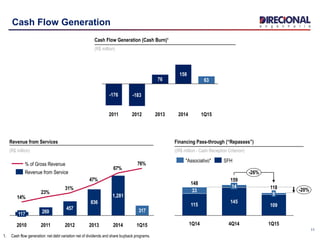

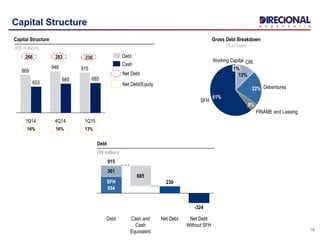

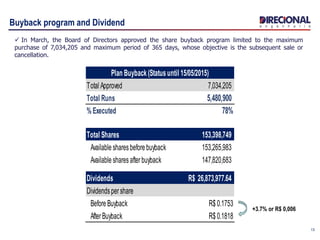

The document provides an earnings release and conference call summary for a real estate company for the first quarter of 2015. It highlights that the company generated cash flow of R$63 million in 1Q15, saw a 27% increase in services revenue, and reduced its leverage ratio to 13%. Inventory levels increased 35% to R$855 million compared to the previous quarter. Deliveries decreased 88% to R$85 million in 1Q15. The company also discussed its financial results, capital structure, buyback program, and contacts for investor relations.