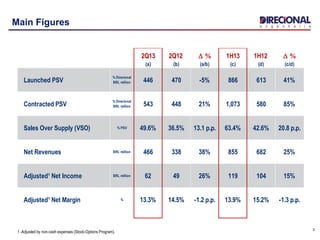

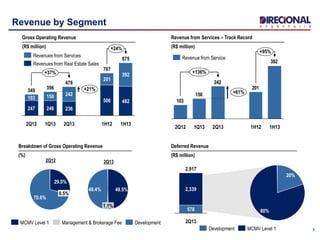

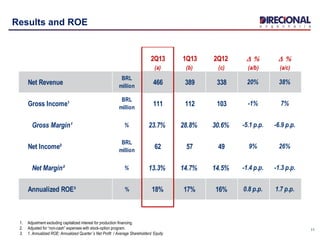

1) Directional Engenharia reported financial results for the second quarter of 2013, with net revenues increasing 38% compared to the second quarter of 2012.

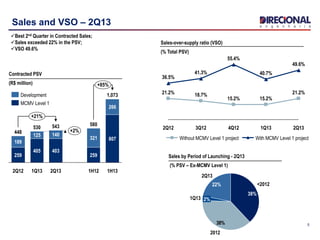

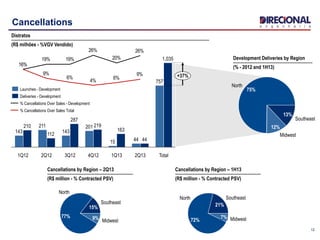

2) Contracted PSV sales increased 21% compared to the second quarter of 2012, with a sales over supply ratio of 49.6%.

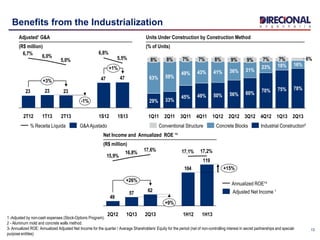

3) Adjusted net income increased 26% compared to the second quarter of 2012, with an annualized return on equity of 18%.