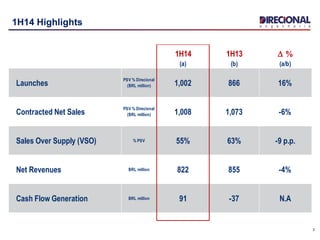

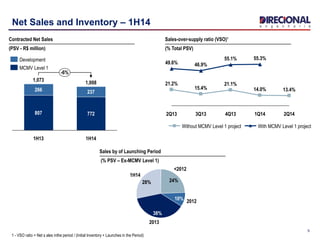

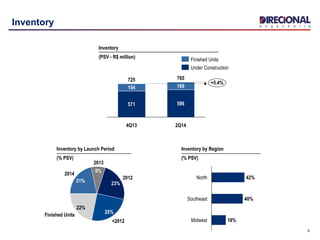

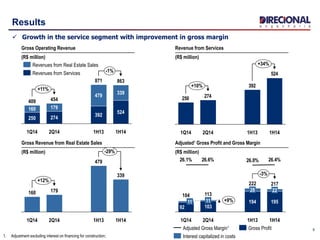

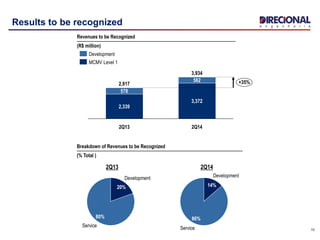

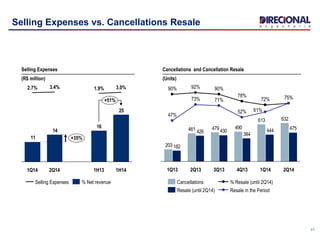

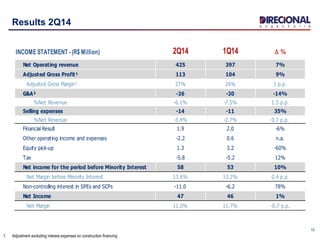

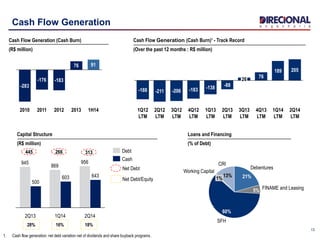

Direcional reported its 2Q14 earnings release and conference call. Key highlights included a 16% increase in launches and a 6% decrease in contracted net sales compared to 1H13. Inventory increased 5.4% over the previous quarter. Financial results showed a 10% increase in gross operating revenue and a 1% increase in net income compared to 1Q14. Cash flow generation was positive at R$91 million for 1H14 compared to negative R$37 million in 1H13. The presentation provided additional financial and operational metrics for the quarter and discussion of future opportunities.