This document provides a summary of Telecom Italia Group's FY 2013 results. Key highlights include:

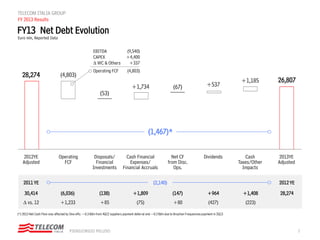

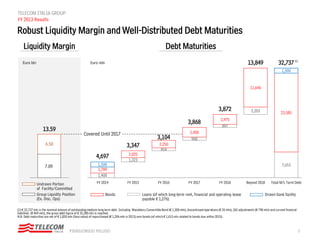

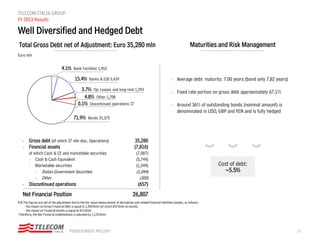

- Net debt decreased from €28.3 billion to €26.8 billion due to positive operating free cash flow of €4.8 billion.

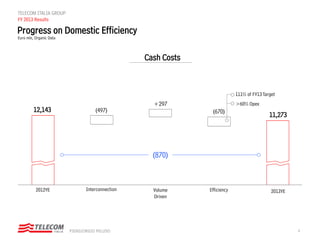

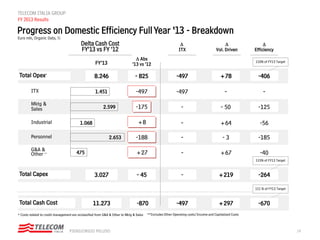

- Domestic cash costs were reduced by €497 million, achieving 111% of the annual target through efficiency gains.

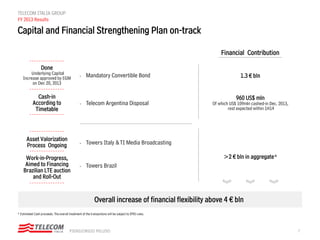

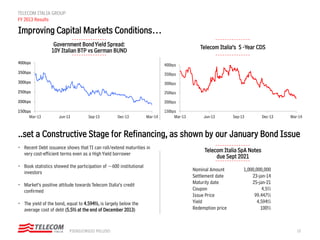

- Plans are outlined to strengthen the capital position through various asset sales and refinancing activities projected to increase financial flexibility by over €4 billion.

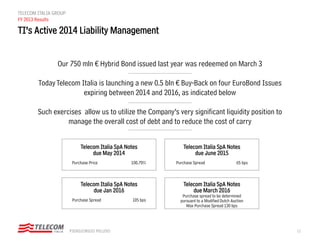

- The company is launching a €0.5 billion bond buyback and focusing resources on investments to support its broadband upgrade plans in 2014.