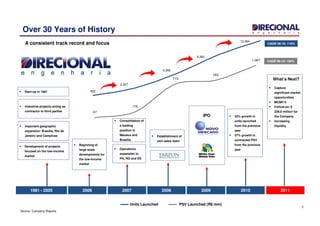

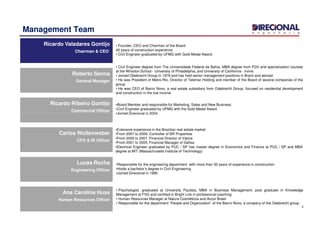

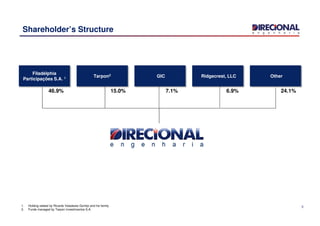

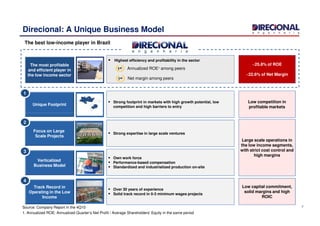

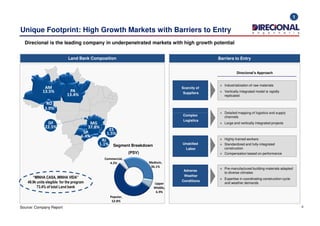

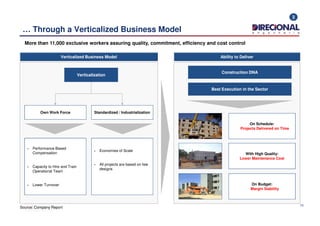

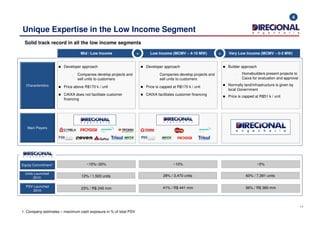

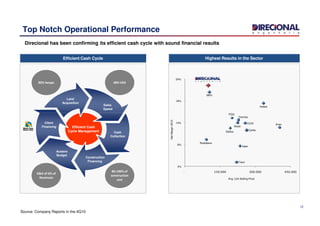

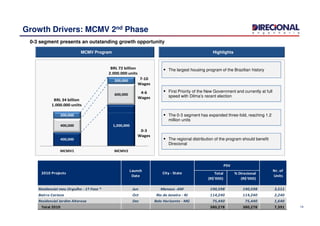

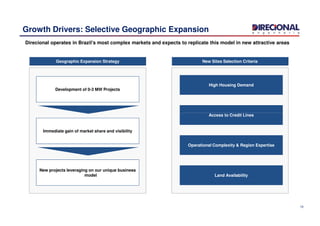

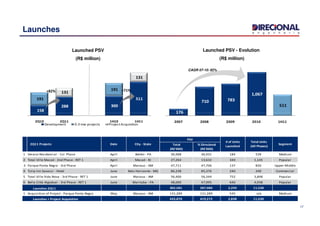

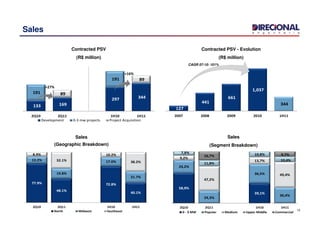

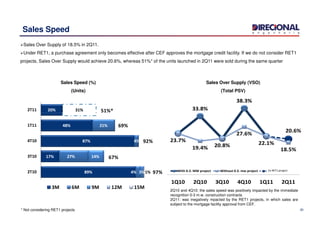

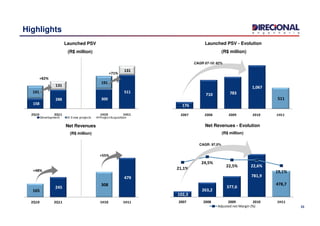

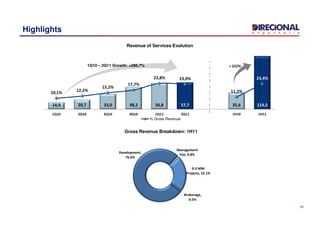

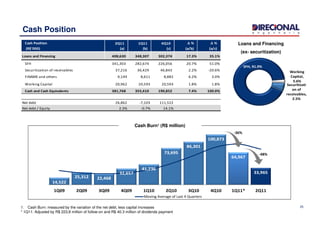

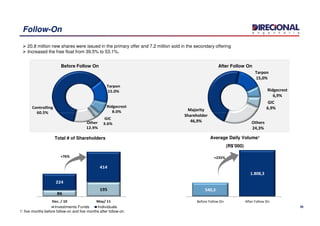

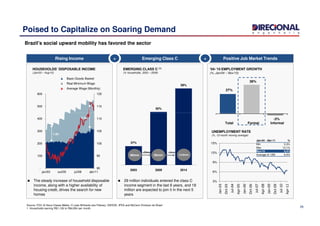

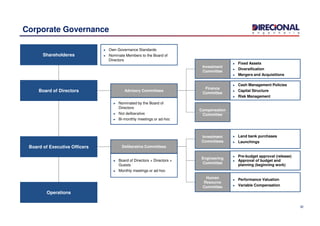

This corporate presentation by Direcional discusses the company's history and operations over 30 years focusing on developing low-income residential real estate projects in Brazil. Direcional has established itself as the leading player in the low-income segment through its large-scale, vertically integrated development model and expertise in this market. The presentation outlines Direcional's unique business model and footprint in high-growth, underserved markets and discusses its continued focus on large projects and expertise in all low-income segments.