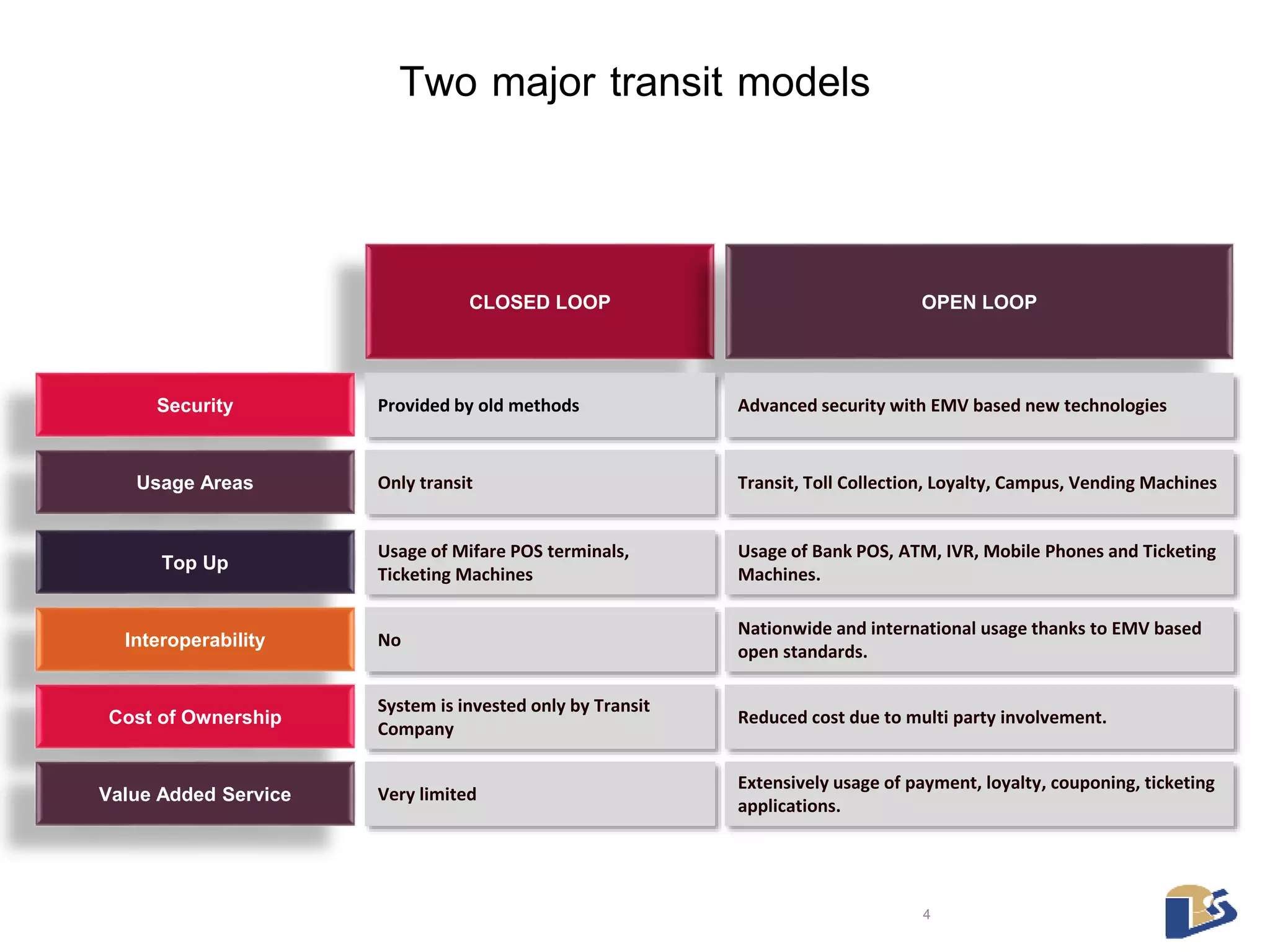

PayCraft is a payment solutions provider that works with banks, transit operators, and other clients to design, develop, test, deploy, and support payment products. It has experience implementing both closed-loop and open-loop transit payment systems using technologies like contactless cards. PayCraft aims to provide sustainable and affordable solutions while avoiding vendor lock-in through the use of open standards.