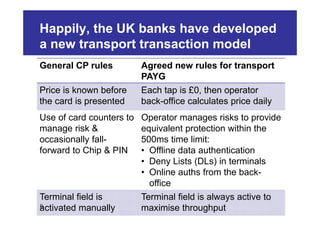

The document outlines the advancements and challenges of contactless ticketing in London's public transport system, highlighting Oyster's current success and shortcomings. It discusses new models emerging for urban transit fare collection that enhance customer experience while reducing operational burdens. The future scope includes interoperability with contactless credit and debit cards, aimed at facilitating ease of travel for both locals and visitors.