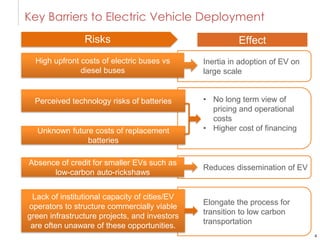

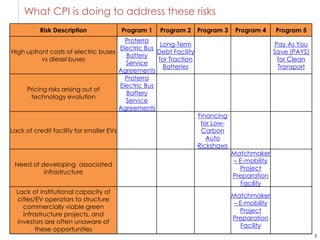

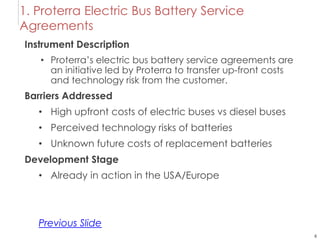

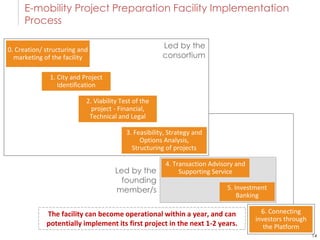

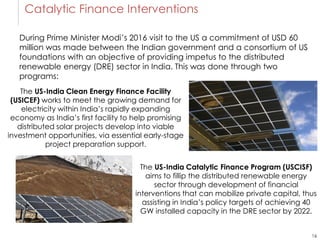

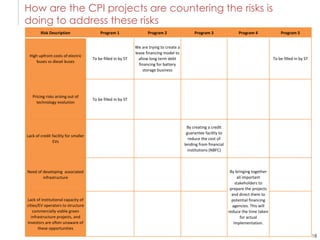

The document discusses key barriers to electric vehicle deployment in India and programs that Climate Policy Initiative (CPI) is undertaking to address these barriers. The major barriers include high upfront costs of electric vehicles compared to diesel, pricing risks due to evolving battery technologies, lack of long term financing for batteries, lack of credit for smaller electric vehicles, need for charging infrastructure development, and lack of institutional capacity. CPI's programs seek to address these through initiatives like battery service agreements, long term debt facilities for batteries, financing for auto rickshaws, pay-as-you-save models, and project preparation facilities to connect cities and investors.