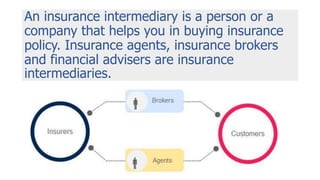

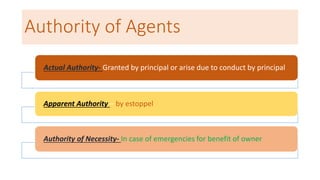

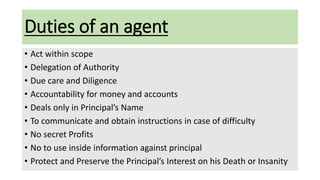

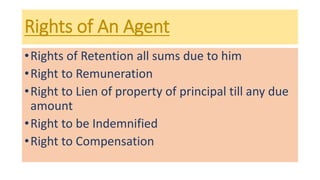

An insurance intermediary helps consumers purchase insurance policies. The main types are insurance agents, brokers, corporate agents, and bancassurance. Insurance agents work for insurance companies and sell only their products. Brokers can compare policies from multiple insurers. The primary difference is that agents represent insurers while brokers represent consumers. Agents have actual, apparent, and authority of necessity. Their duties include acting in the principal's interests, obtaining instructions, avoiding conflicts, and protecting the principal. Agents' rights include retaining sums due, receiving remuneration, and lien on the principal's property.