This document provides a summary of GAIL (India) Limited, including its vision, mission, objectives, and key business areas. It discusses GAIL's natural gas marketing and transmission activities through its extensive pipeline network. It also summarizes GAIL's involvement in other businesses like petrochemicals, liquefied natural gas, city gas distribution, power generation, and exploration and production. The document reviews GAIL's approach and methodology for analyzing its existing marketing practices and strategies. It provides an overview of GAIL's customers, contracts, and competition in the Indian natural gas market.

![specifications including specifying the buyer and seller, the price, the amount of

natural gas to be sold (usually expressed in a volume per day), the receipt and delivery

point, the tenure of the contract (usually expressed in number of days, beginning on

a specified day), and other terms and conditions. The special terms and conditions

usually outline such things as the payment dates, quality specifications for the natural

gas to be sold, and any other specifications agreed to by both parties.

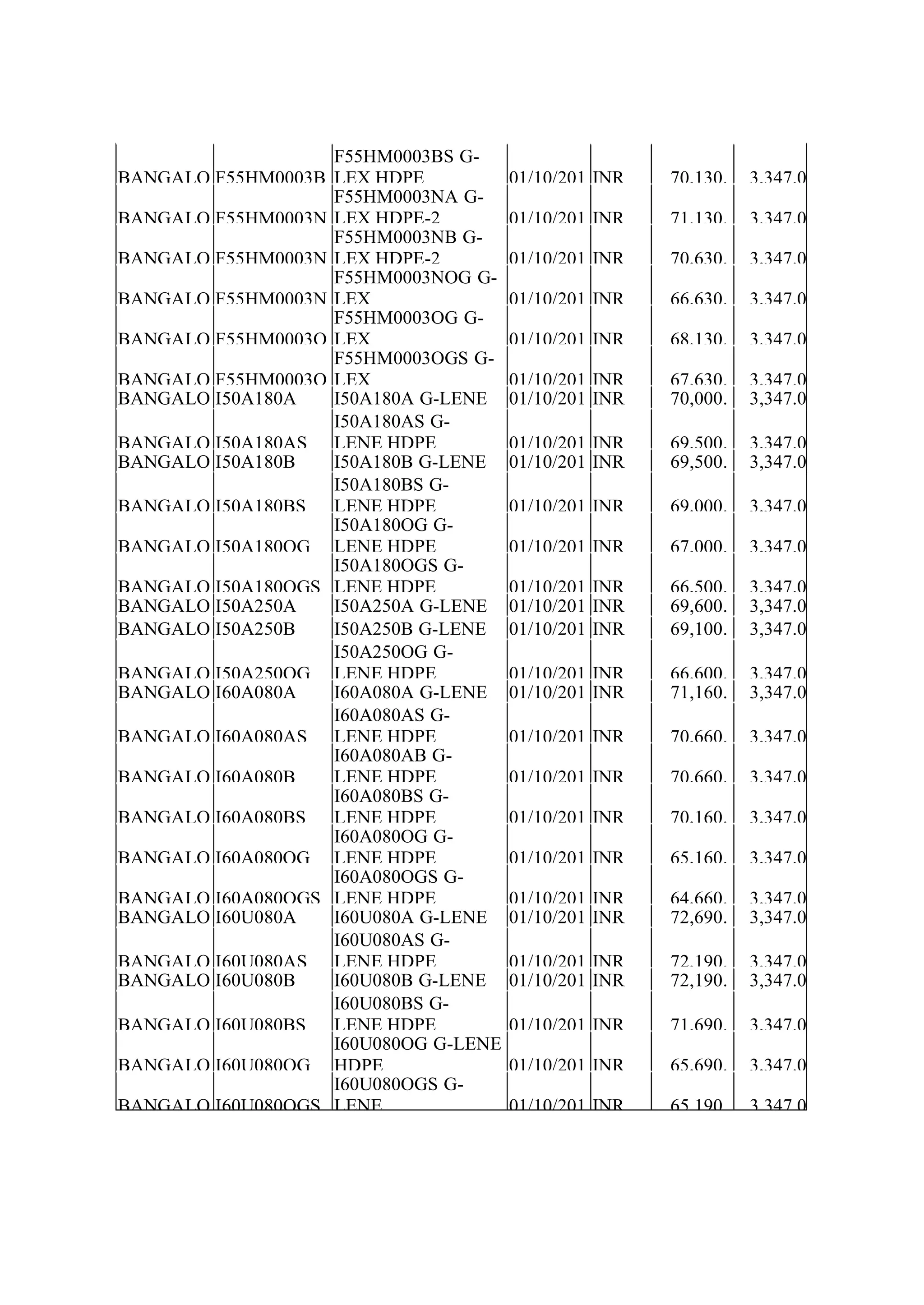

At GAIL, there are three different types of contracts for the Gas to be marketed:

1. APM Contract

2. R-LNG Contract

3. PMT Contract

PMT contract-Features

SALE AND PURCHASE OF GAS

• Sellers agree to deliver, on a Daily basis, to the Buyer one hundred percent (100%)

of the Deliverable Volume of Sales Gas at the Delivery Point and the Buyer,

provided the Gas is made available and tendered for delivery by the Sellers, agrees

to take and purchase, on a Daily basis, one hundred percent (100%) of the

Deliverable Volume of Sales Gas provided, however, that Sellers, at Sellers’ sole

discretion

• The Deliverable Volume on the date of execution of this Contract is 17.3

MMSCMD equivalent to [617,857 MMBTU/ Day] which Deliverable Volume

shall vary every Quarter based on the Delivery Profile. The use of MMSCMD in

this Clause 2.1(c) is for the purpose of reference only.

• Each of the Sellers shall, severally sell their respective Participating Interest

share of Sales Gas to the Buyer in the quantities set forth in this Contract and the

Buyer shall purchase from each Seller that Seller’s Participating Interest share of

Sales Gas and pay for such Sales Gas in accordance with the terms of this

Contract.

• During the Contract Period, if there is any Additional Gas from the Panna-

Mukta and Mid & South Tapti Fields that becomes available for sale then the

Sellers shall use reasonable endeavours to sell and deliver such Additional Gas

to the Buyer and the Buyer shall use reasonable endeavours to purchase and

receive the same, at the Delivery Point at the Sales Gas Price.

• On any Day, the Buyer may nominate for delivery at the Delivery Point a quantity

of Sales Gas up to the Deliverable Volume.

• In the event that the Sellers are compelled to shutdown the Sellers’ Facilities

or curtail production for reasons arising out of the Buyer’s inability to take Sales](https://image.slidesharecdn.com/242266287-case-study-on-guil-150913073942-lva1-app6892/75/242266287-case-study-on-guil-24-2048.jpg)

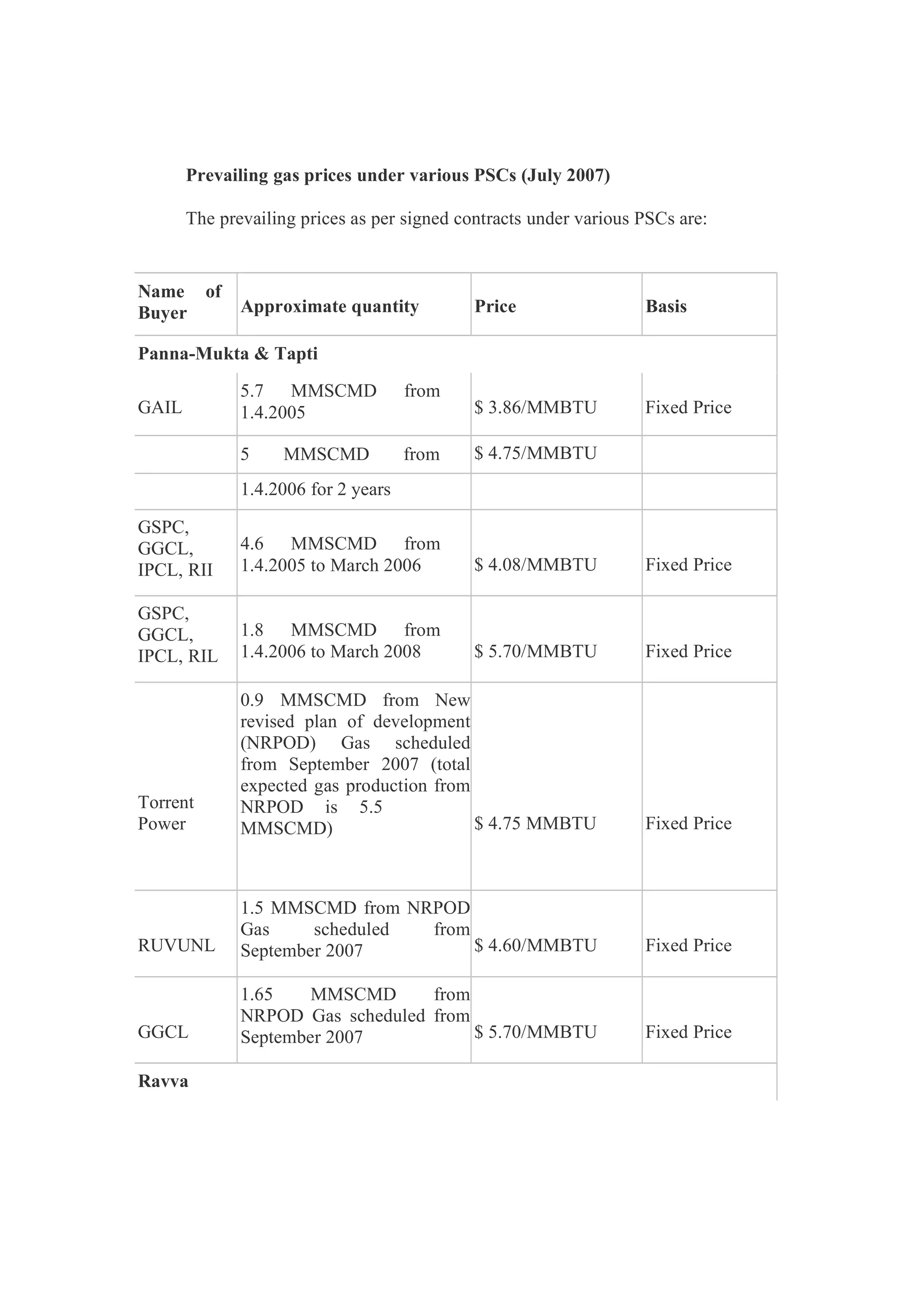

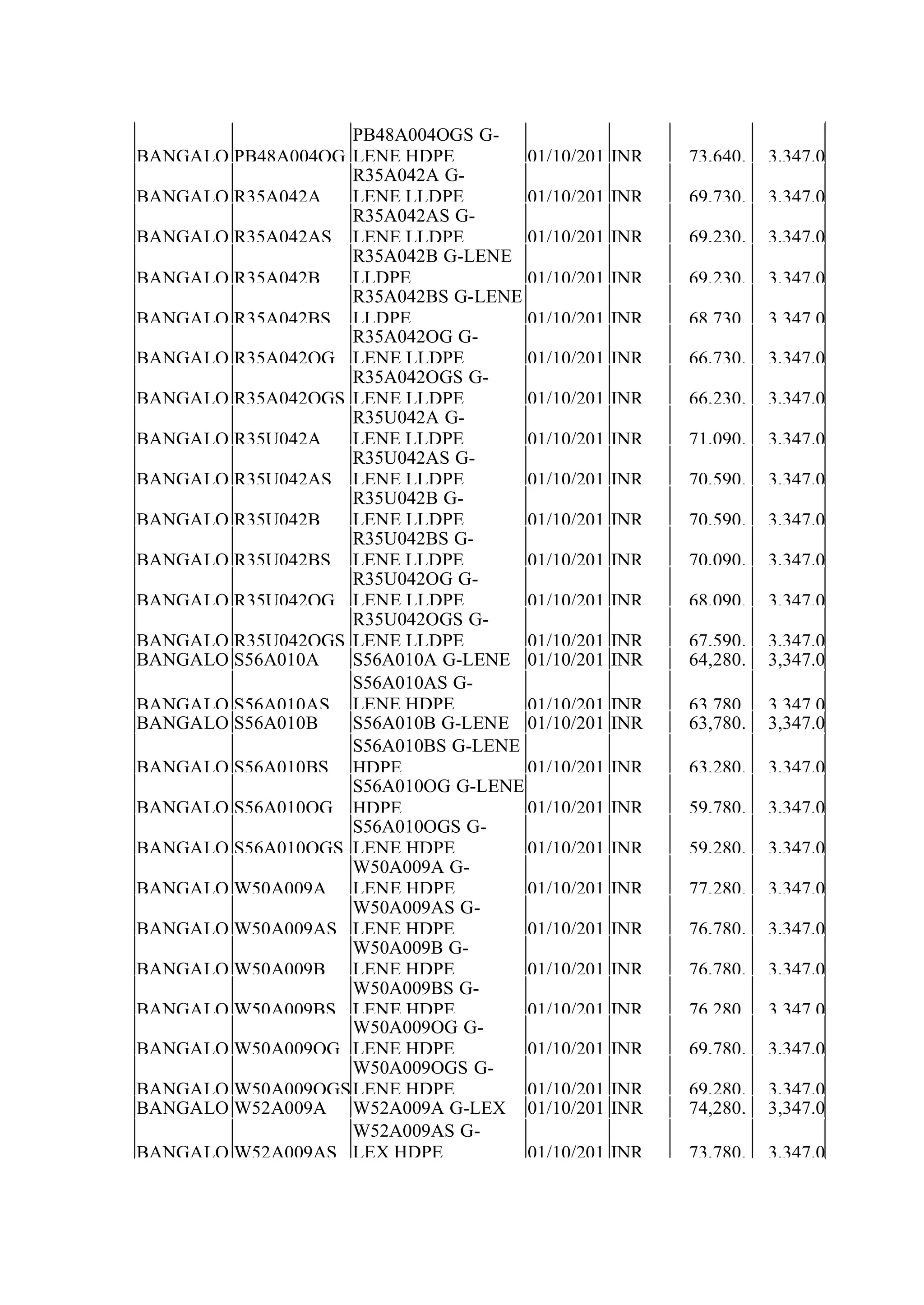

![2.3.2 It was decided that the price of gas supplied to small consumers and

transport sector (CNG) would be increased over the next 3 to 5 years to the

level of the market price. With effect from 06.06.2006, the APM gas price to

small consumers and CNG sector has been increased to Rs.4608 / MSCM.

2.3.3 It was decided that the gas price to the consumers other than those

stated in para 2.3.1, which were hitherto getting gas at APM price through

GAIL network, would be market determined.

Existing Producer Price & Consumer Price

Majority of Gas produced by ONGC, known as APM gas, is currently sold to

GAIL of the price regulated by the Government. This price at which ONGC sells

gas to GAIL is known as producer price. The price of this gas does not vary state

wise/offshore areas, instead varies for North East Consumers and General

Consumers (other than North East Consumers). The price at which GAIL sells

the gas procured from ONGC, is called consumer price.

3. Pricing of R-LNG

A contract was signed with Rasgas, Qatar for supply of 5 MMTPA LNG

(equivalent to about 18 MMSCMD] by Petronet LNG Limited and supplies

were commenced from April 2004. The price for LNG has been linked to

JCC crude oil under an agreed formula. However, the FOB price for the period

up to December 2008 has been agreed at a constant price of $2.53/MMBTU.

This price translates to RLNG price of $3.86/MMBTU ex-Dahej terminal.

In order to make the price of RLNG affordable, EGoM has decided in the

meeting held on 11.1.07 for pooling of prices of 5 MMTPA RLNG

presently being imported from Qatar with the price of new RLNG being

imported on term contract basis. This Ministry accordingly issued orders on

6.3.07, in consultation with Ministry of Law, in compliance with the decision of

EGoM. The pool price ex- Dahej of RLNG for various consumers would

be about US$

4.92/MMBTU.

4. Pricing of Gas under Pre-NELP Production Sharing Contracts - PMT

and Ravva JV Gas

4.1 Production Sharing Contracts were executed by GOI with Ravva consortium

and PMT consortium on October 28, 1994 and December

12, 1994 respectively. PSCs contain the following pricing provisions: (in

$/MMBTU)](https://image.slidesharecdn.com/242266287-case-study-on-guil-150913073942-lva1-app6892/75/242266287-case-study-on-guil-30-2048.jpg)