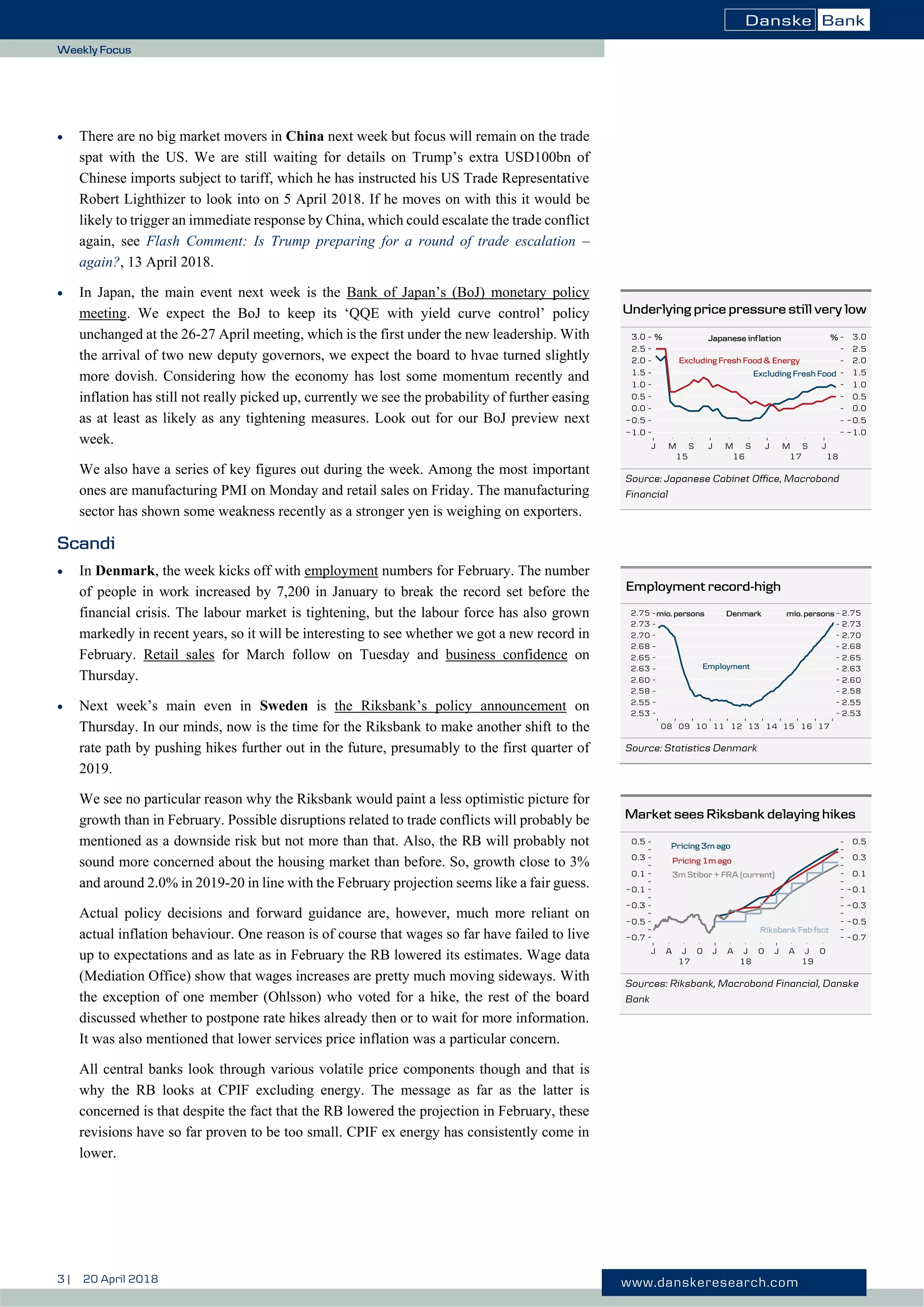

1) The document provides an analysis of upcoming economic data and events that could impact markets the following week, including US and Eurozone GDP growth estimates, PMI reports, and central bank meetings from the ECB, Riksbank, and BoJ.

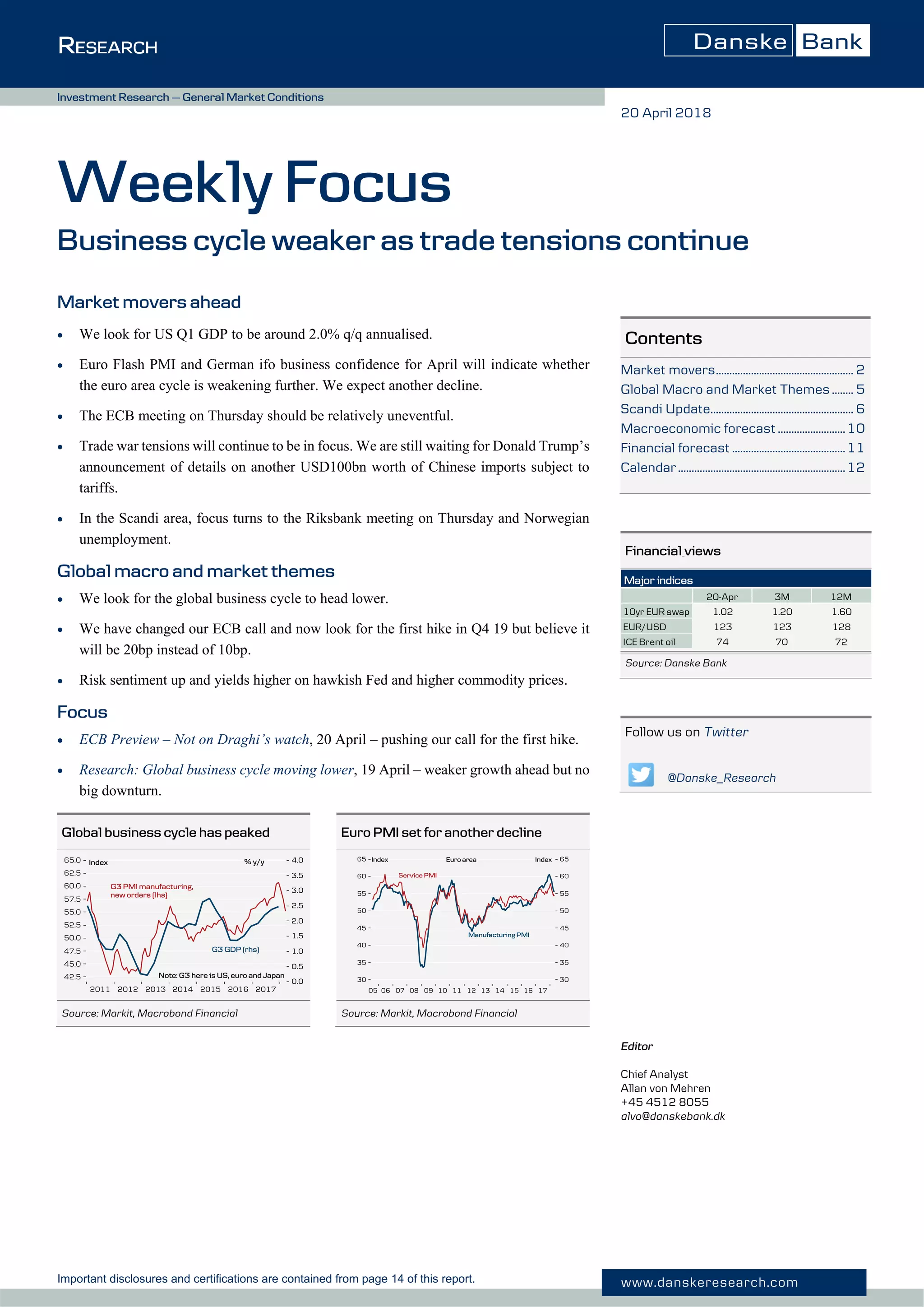

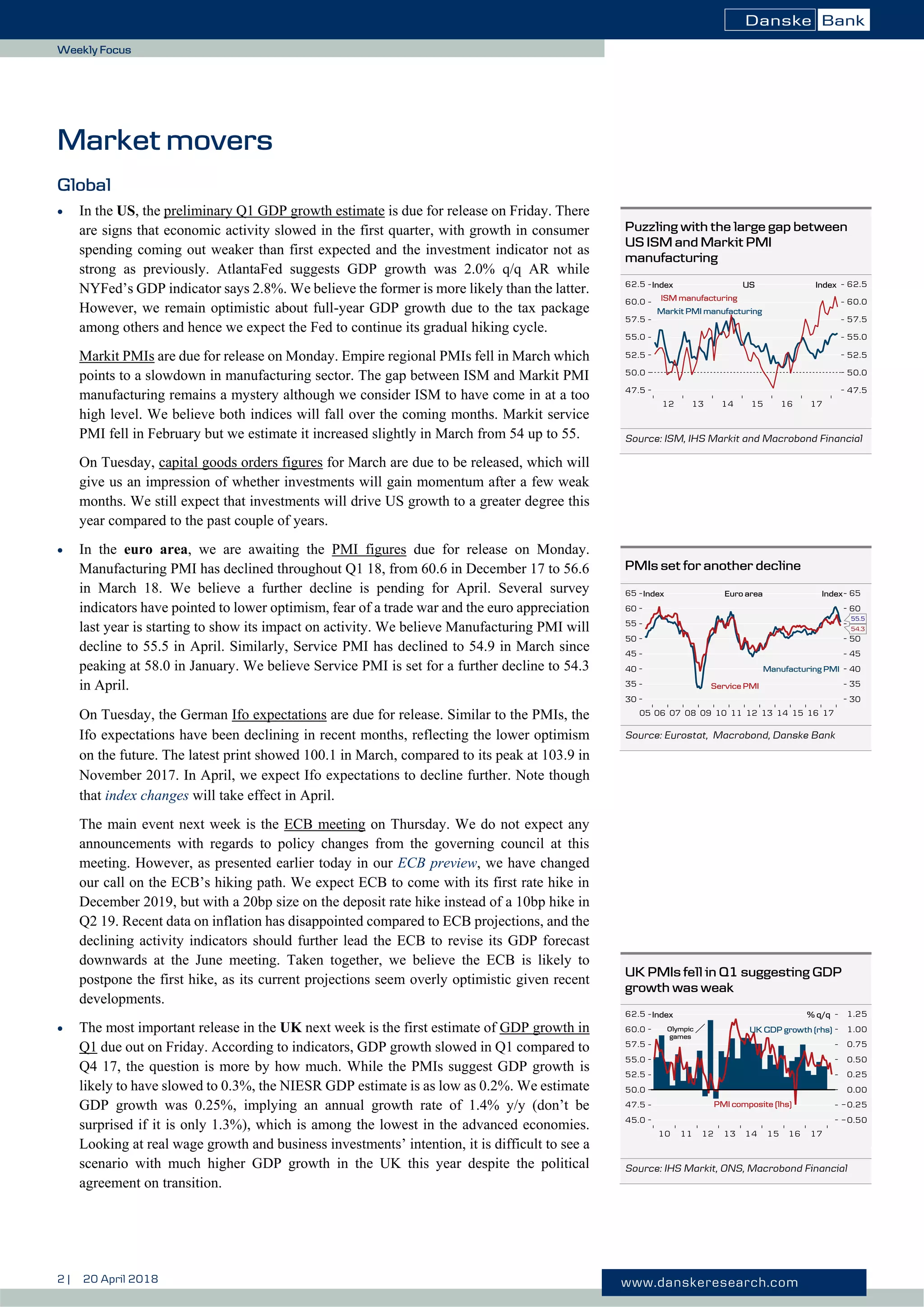

2) It is expected that the global business cycle will continue to weaken as trade tensions persist between the US and China. Eurozone PMIs are forecasted to decline further.

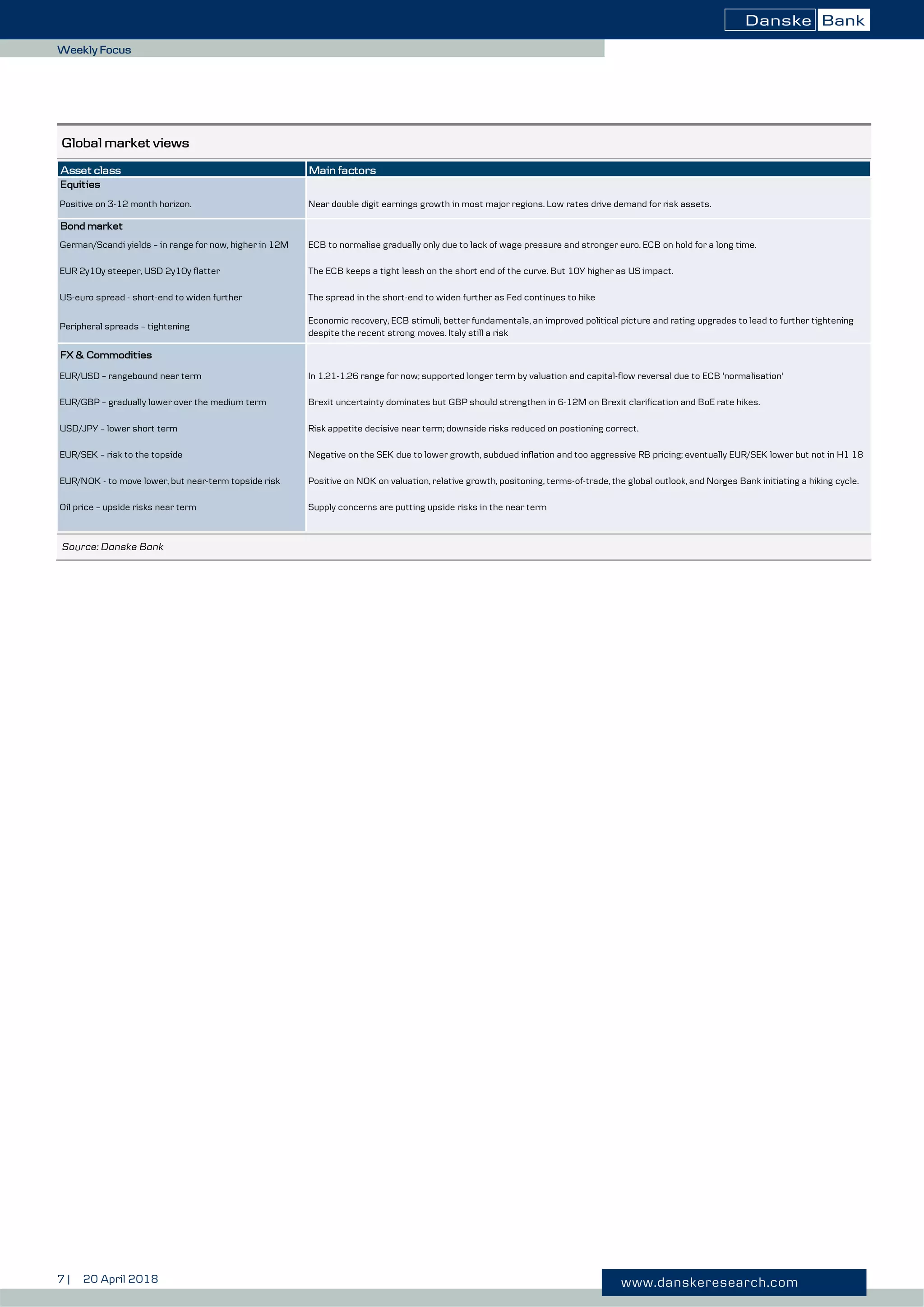

3) The main events covered are the ECB meeting on Thursday, where no policy changes are anticipated, and the Riksbank meeting on Thursday, where the bank may signal a delay in further rate hikes.