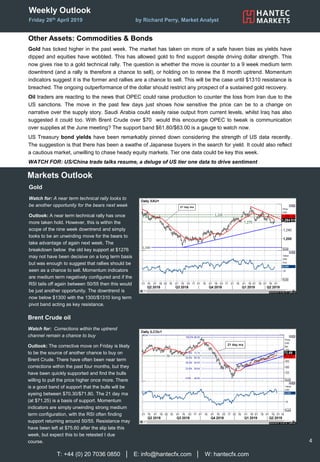

This document presents a weekly outlook on financial markets, focusing on economic data and its implications for the dollar and other currencies. It discusses key events affecting U.S. economic performance, including anticipated employment data and Federal Reserve interest rates, while noting that the strength of the dollar may continue due to relative U.S. economic outperformance. Additionally, it addresses equity markets, commodities, and provides a risk warning related to trading in forex and CFDs.