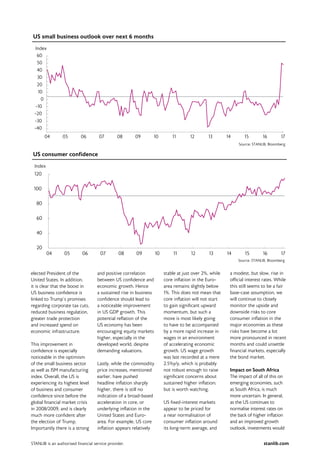

The document discusses the shift from deflation risk to inflation concerns in developed markets, particularly focusing on the economic changes following the election of Donald Trump. It notes that rising consumer inflation in the US and Europe has led to increased business and consumer confidence, pushing equity markets higher while affecting bond yields. The impact on emerging economies like South Africa is uncertain, with factors such as fluctuating currency valuations and individual country economic conditions playing a significant role in investment prospects.