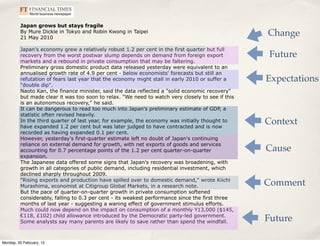

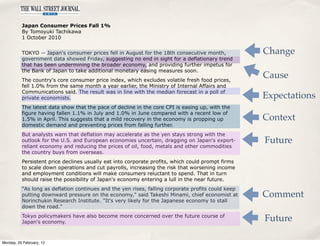

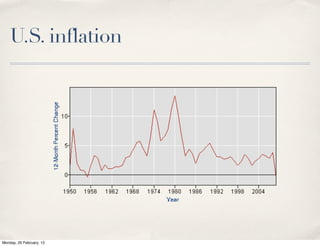

The document discusses key economic goals of governments which include full employment, steady annual growth in output without overheating, and stable prices with low inflation. It then provides guidance on writing about key economic indicators such as GDP, CPI, unemployment rates. It notes important details to focus on for each indicator and potential issues to be aware of.