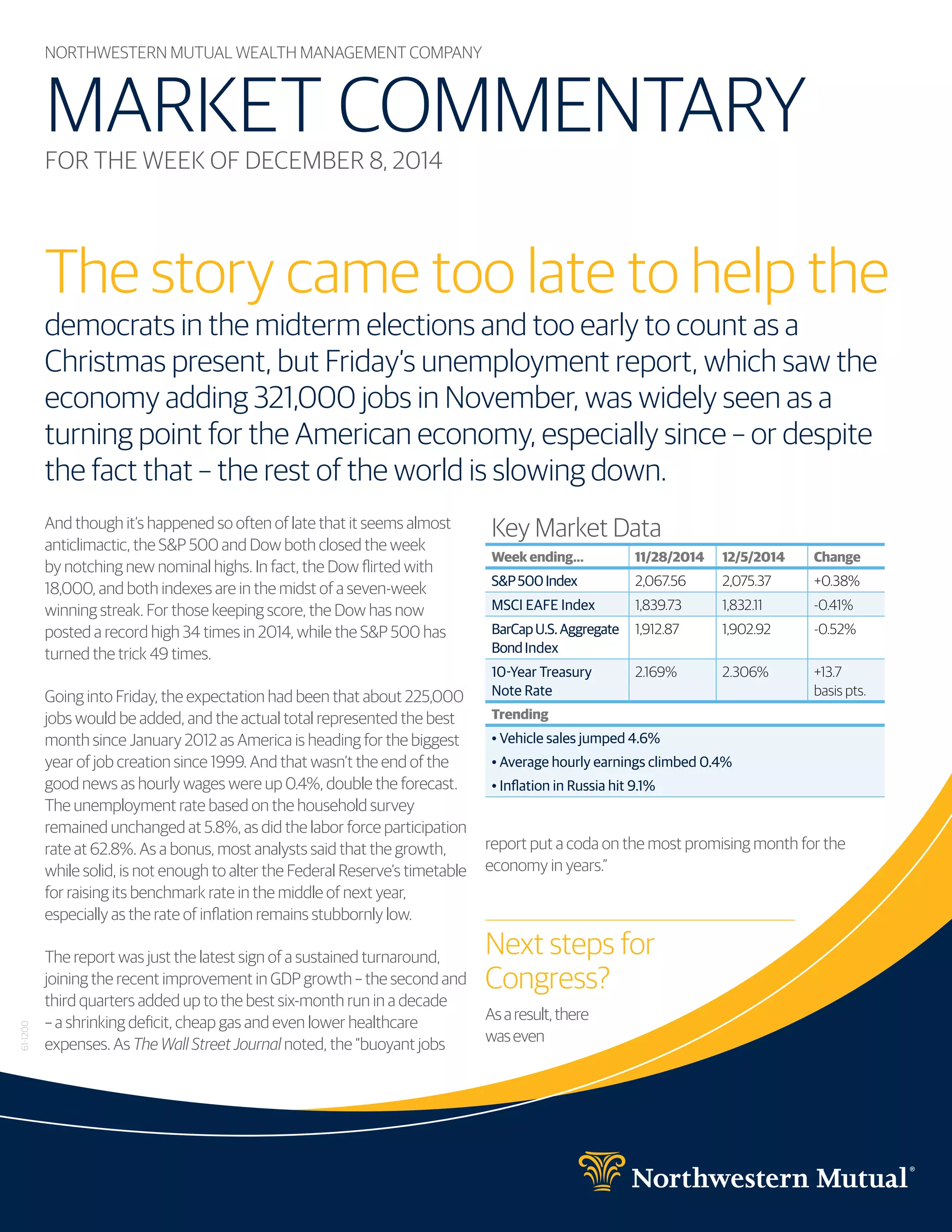

The document discusses positive economic news in the US including strong job growth and wage increases in November. It notes the S&P 500 and Dow Jones indexes reached new highs and the economy is strengthening, though inflation remains low. Congress faces funding decisions by the December 11th deadline and debates blocking part of President Obama's immigration order. In contrast, Russia's economy is weakening due to sanctions and low oil prices.