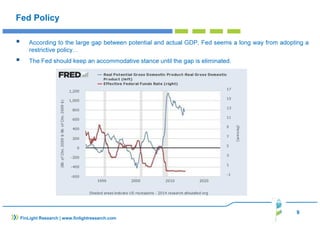

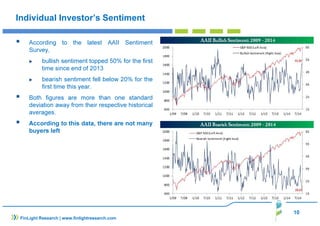

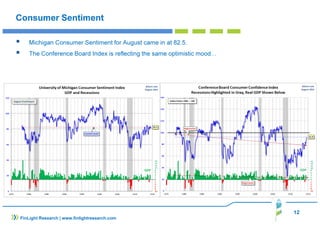

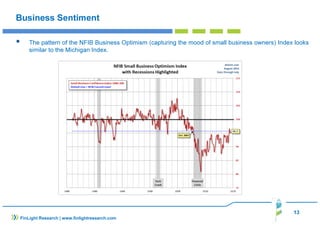

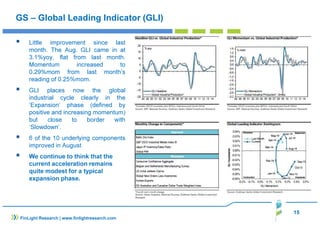

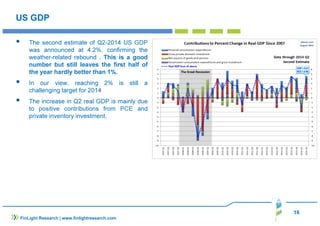

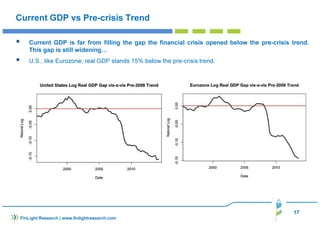

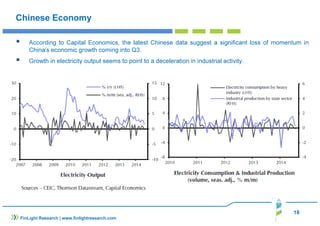

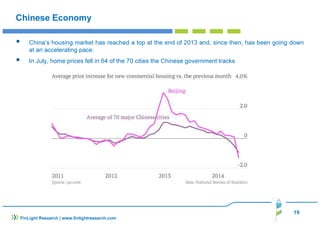

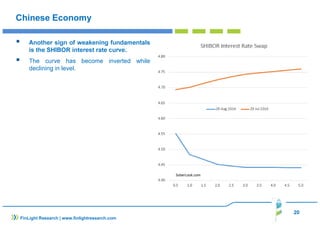

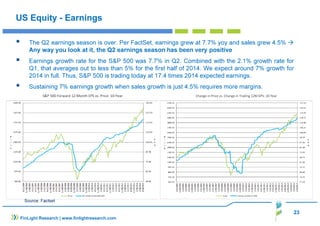

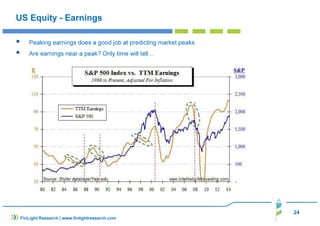

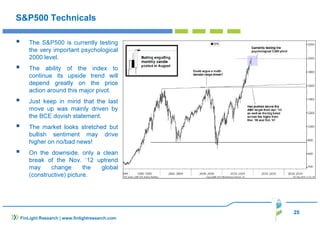

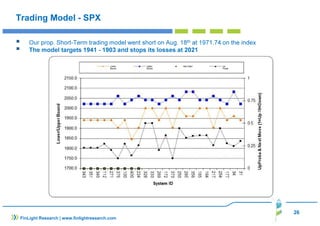

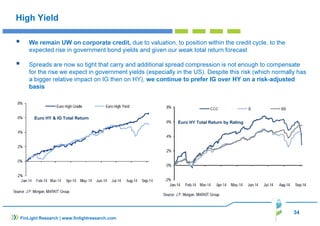

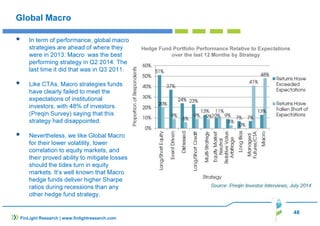

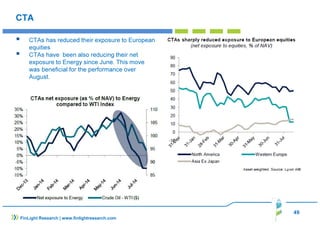

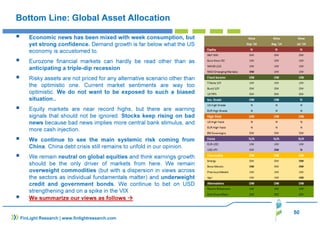

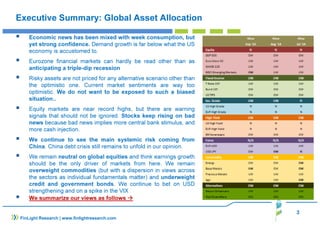

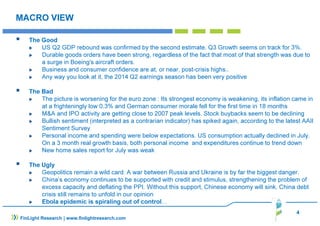

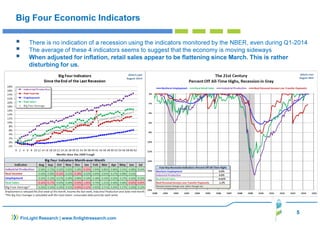

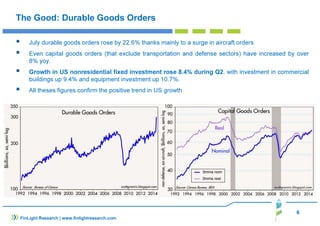

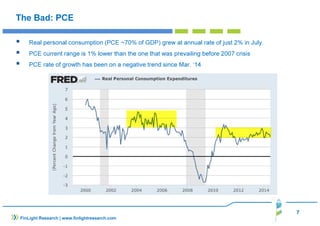

The document discusses global economic trends as of September 2014, highlighting mixed economic signals with strong consumer confidence but weak demand growth, particularly in the Eurozone. It points out risks in equity markets being driven by overly optimistic sentiment, especially concerning China’s debt crisis and geopolitical tensions. The analysis leads to a cautious investment strategy, advising underweight positions in credit and government bonds while favoring commodities and emerging market equities.

![8

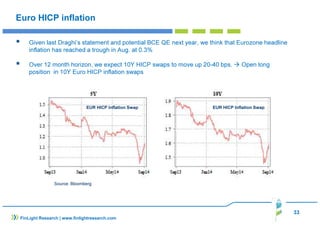

Eurozone Deflation Risk

Deflationary forces are proving more

persistent than previously thought,

according to ECB President Draghi, who

also said “within its mandate [the ECB] will

use all the available instruments needed to

ensure price stability over the medium

term”.

In the Eurozone, short and medium-term

inflation are plunging. 5Y5Y inflation swaps

(one of the measures used by the ECB to

gauge medium-term inflation expectations)

has already slided below 2%

FinLight Research | www.finlightresearch.com](https://image.slidesharecdn.com/marketperspectives-sep2014-140907104916-phpapp01/85/Finlight-Research-Market-Perspectives-Sep-2014-8-320.jpg)