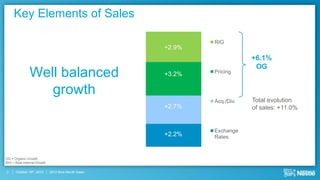

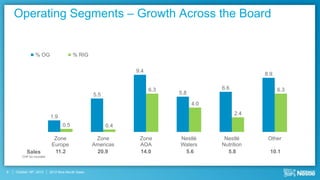

Sales for the first nine months of 2012 were up 11% to CHF 67.6 billion compared to the same period last year. Organic growth was 6.1% driven by pricing increases of 3.2% and real internal growth of 2.9%. The company saw continued growth in both developed and emerging markets and confirmed its full year outlook of 5-6% organic growth along with improved margins and earnings per share.