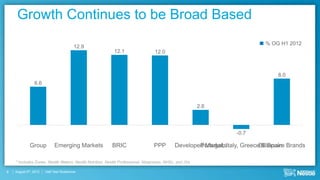

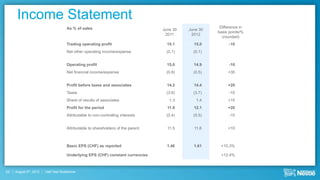

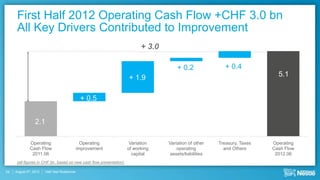

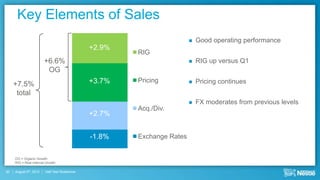

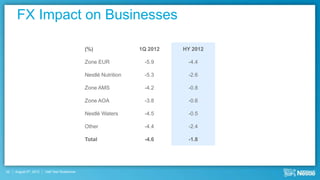

The document summarizes Nestlé's financial results for the first half of 2012. Key highlights include consistent performance and steady momentum with organic growth of 6.6% and operating profit margin of 15.0%. All three regions (Europe, Americas, Asia/Oceania/Africa) saw continued growth. Major product categories like coffee, chocolate, ice cream, and pet care contributed strongly. Nestlé reconfirmed its guidance to deliver on its business model.