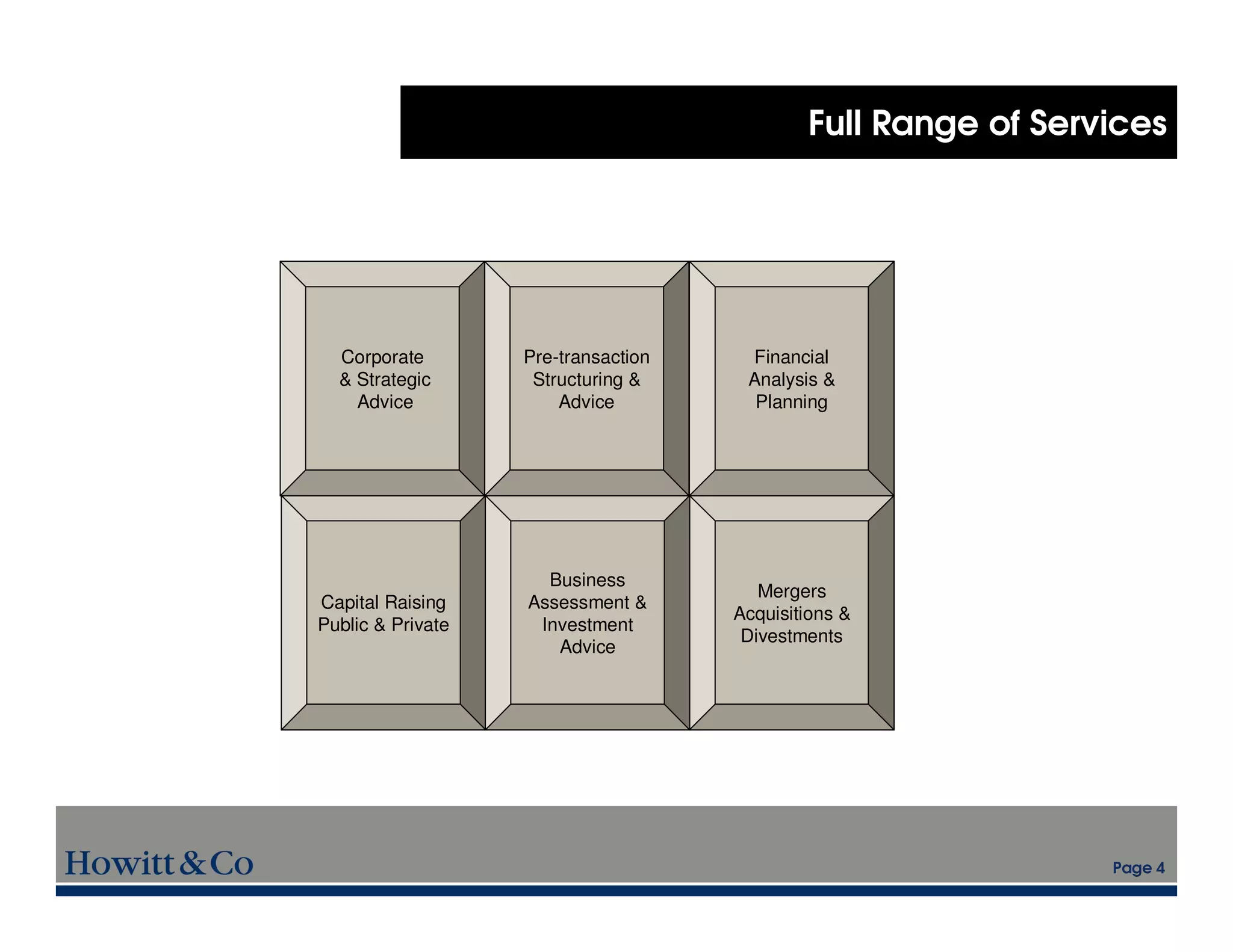

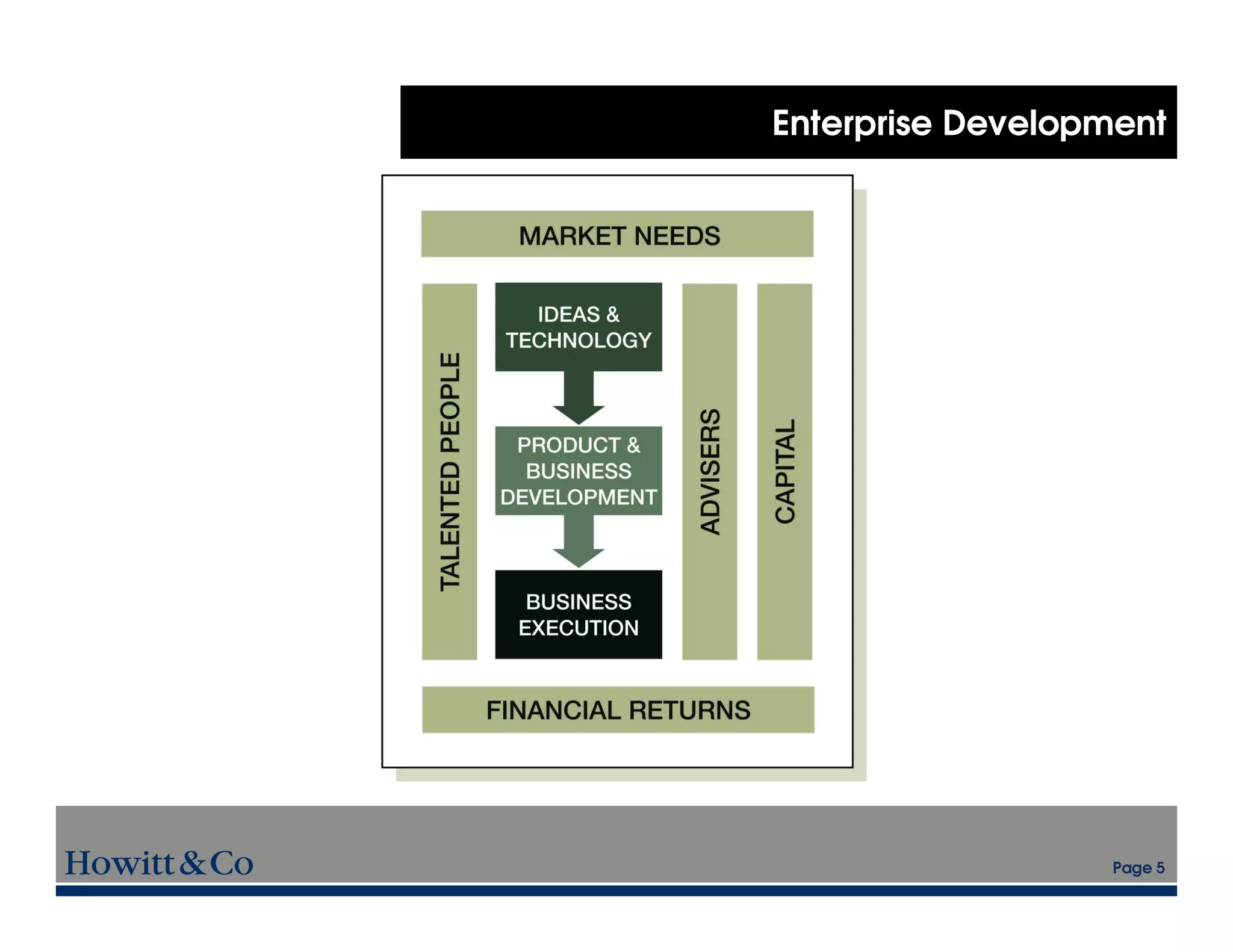

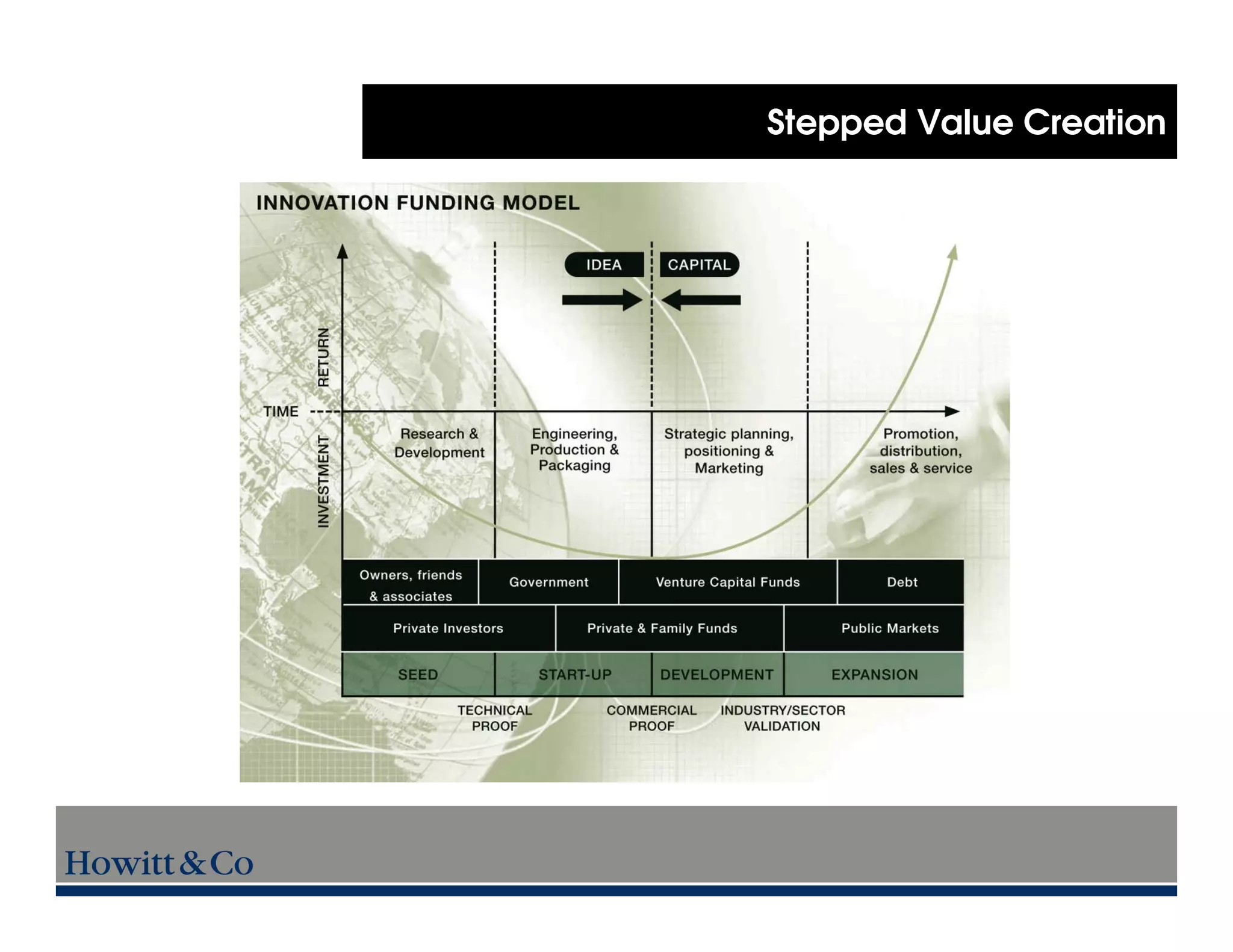

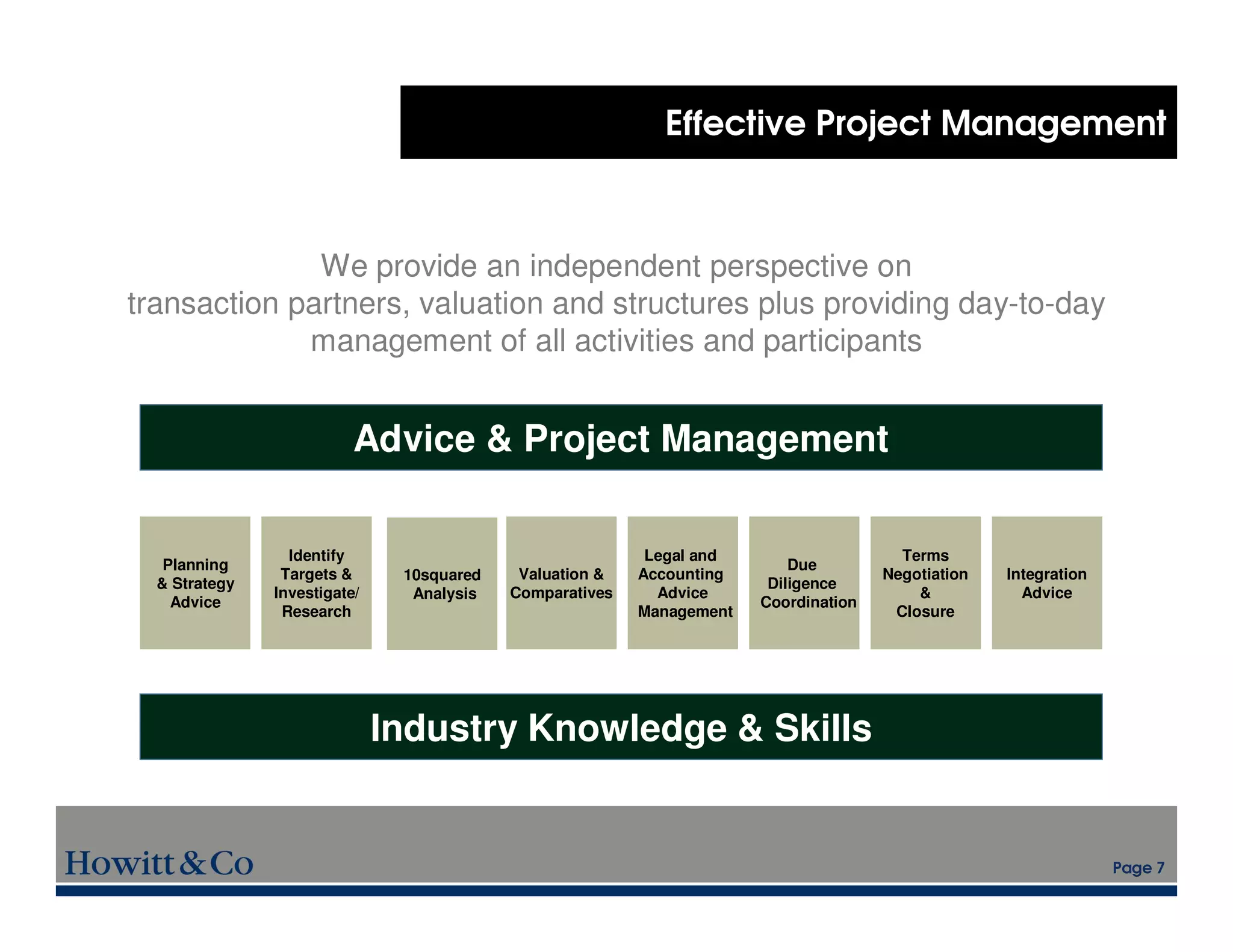

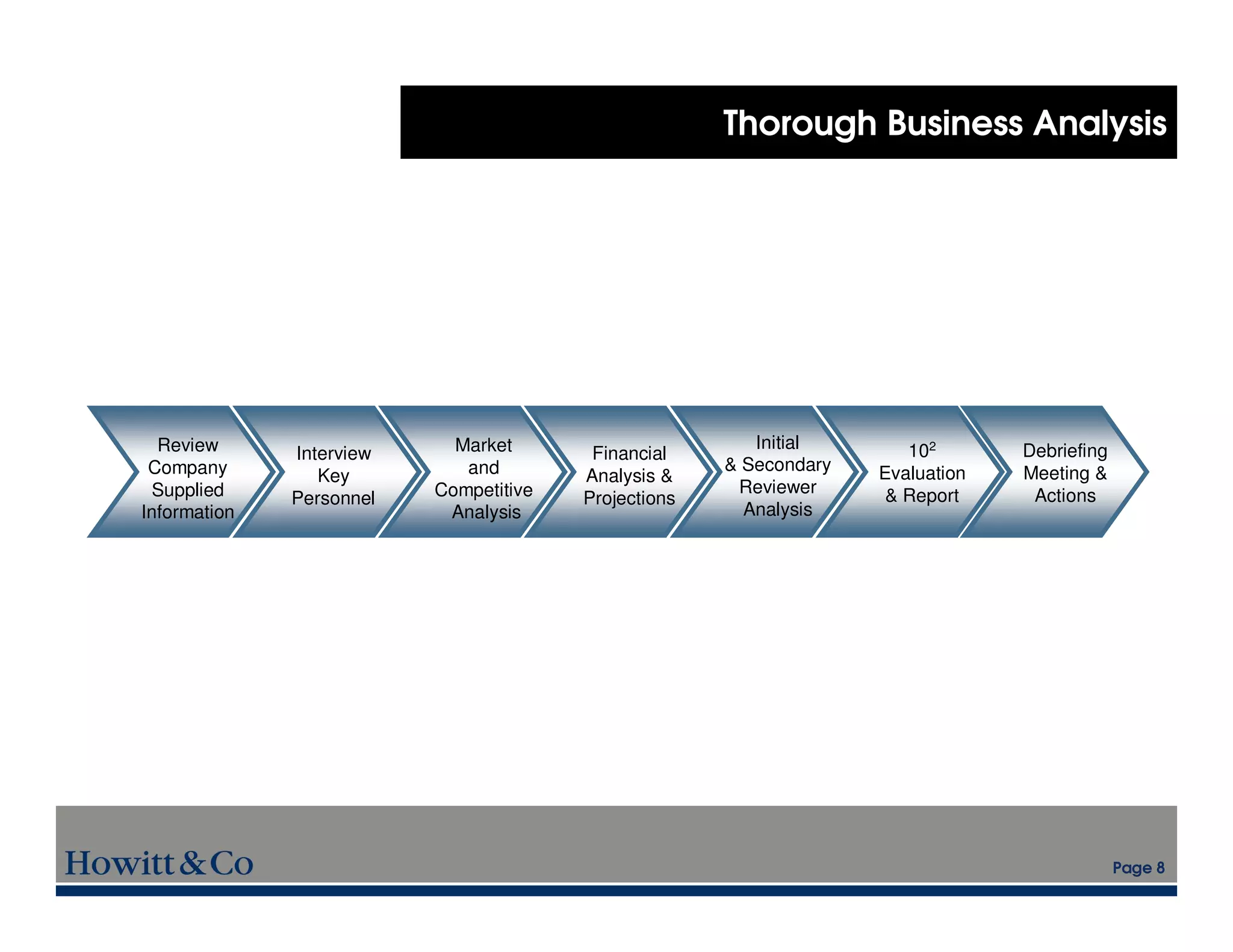

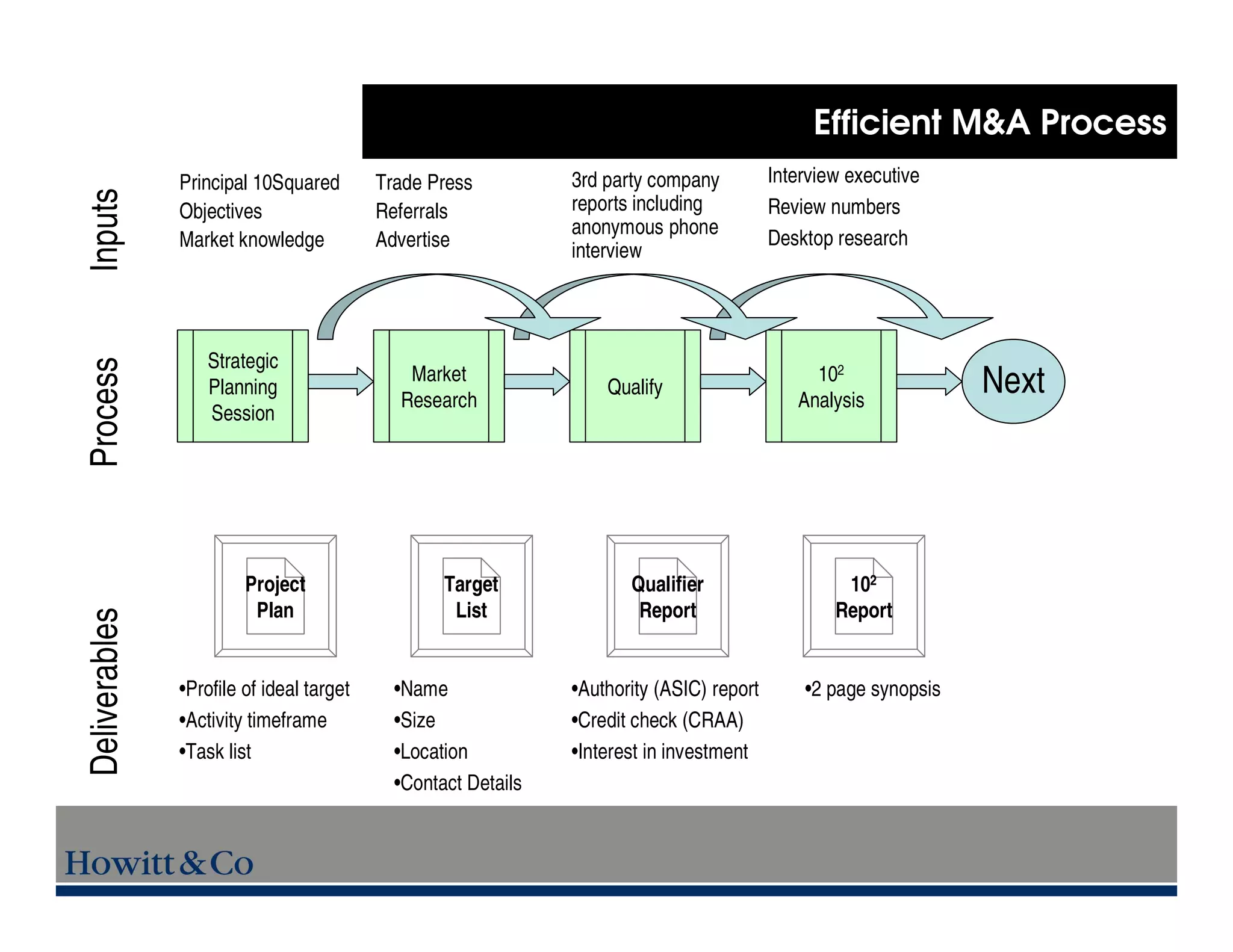

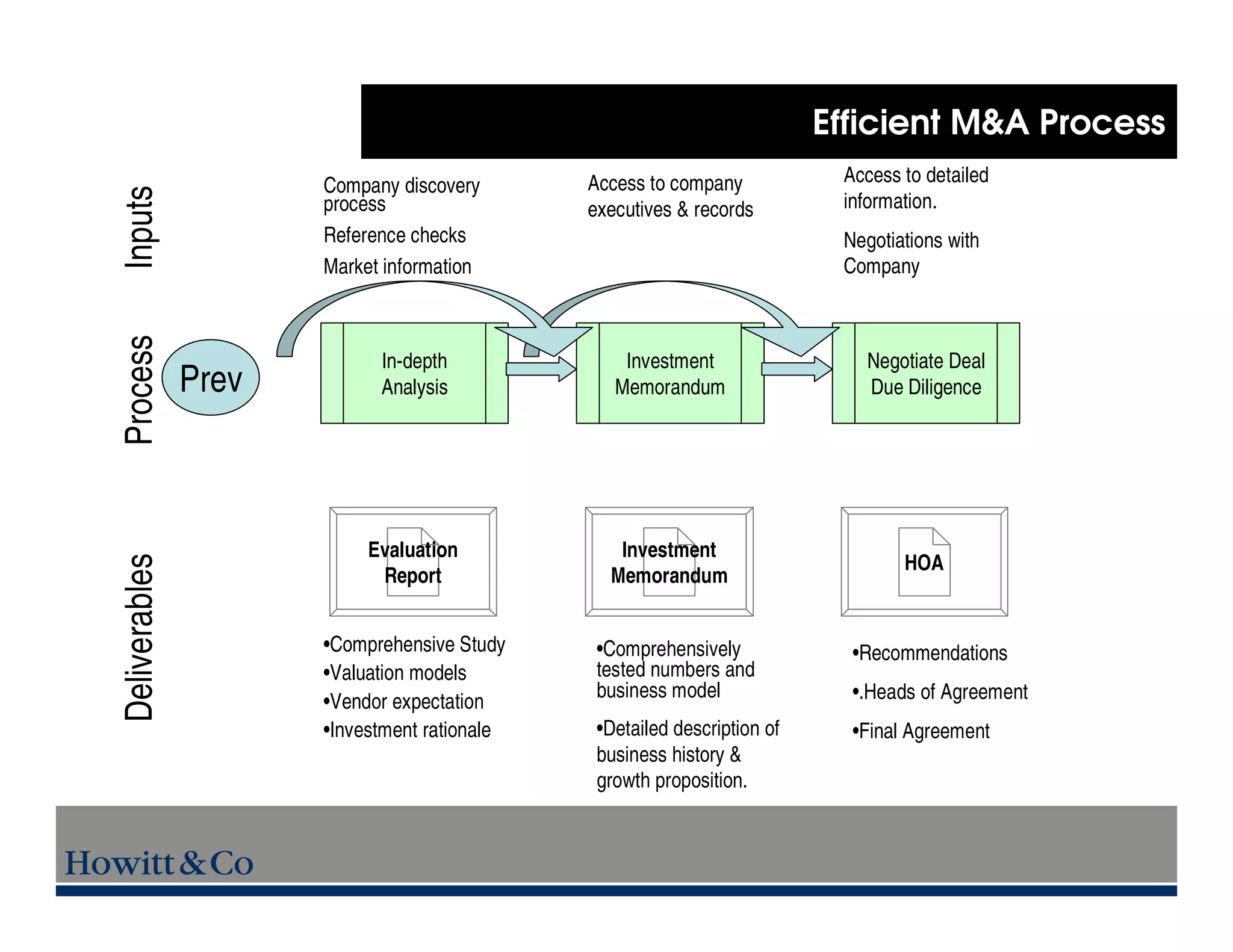

Howitt & Co provides corporate advisory and transaction services with over 50 successful mergers, acquisitions, and capital raising transactions concluded. The firm has extensive experience in corporate and strategic advice, financial analysis and planning, mergers and acquisitions, capital raising, and project management. Key services include business assessments, transaction structuring, capital raising, and integration advice. The principals have decades of experience in senior roles in finance, business, and property. Howitt & Co focuses on achieving the best outcomes for clients through independent advice and an established track record of delivering value.