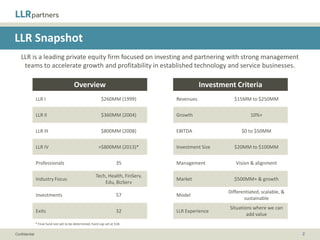

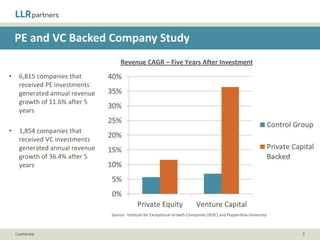

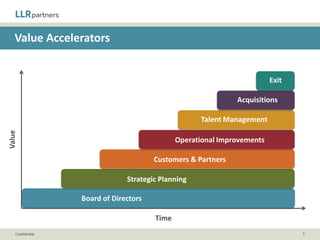

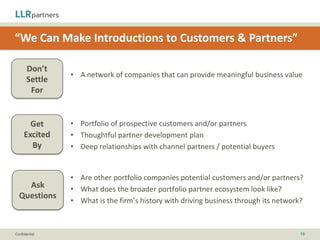

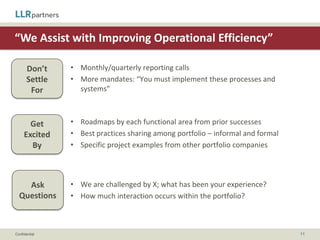

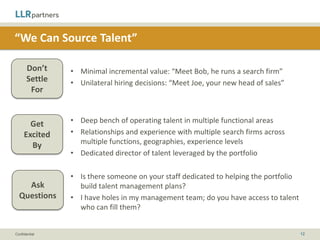

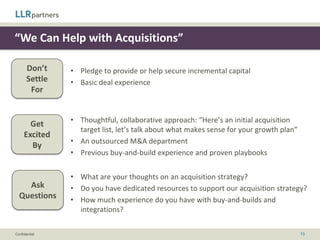

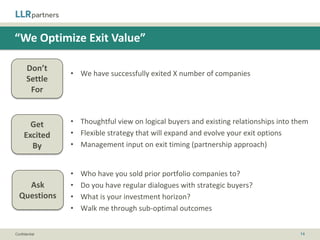

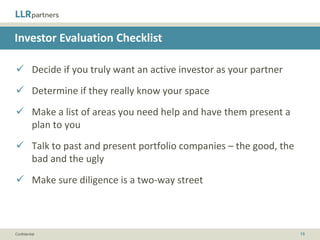

LLR Partners is a private equity firm focused on investing in established technology and service businesses with revenues between $15mm to $250mm and EBITDA of $0 to $50mm. The firm actively collaborates with portfolio companies to implement strategic initiatives, improve operational efficiency, and assist with acquisitions, emphasizing a hands-on approach and adding value through deep industry relationships. Key strategies also include building effective boards, providing strategic insights, and optimizing exit value.