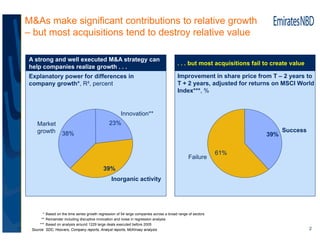

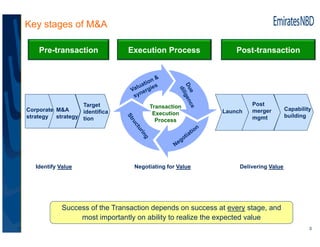

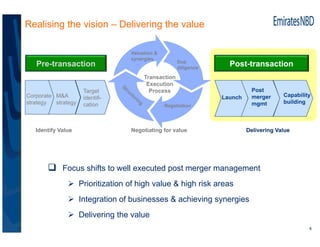

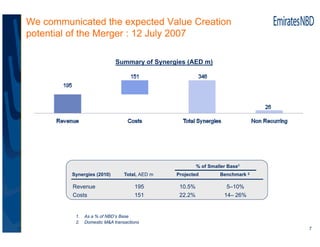

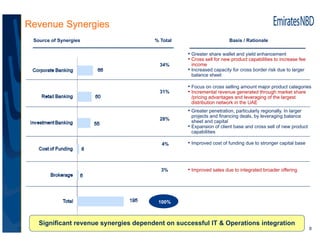

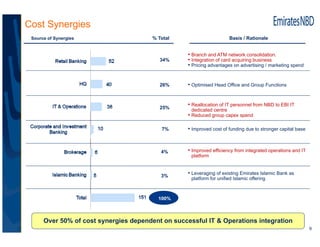

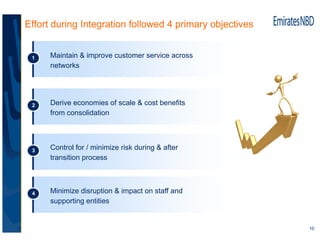

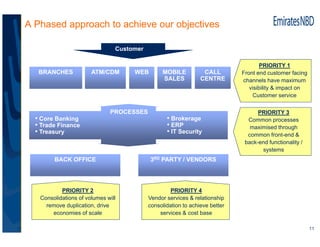

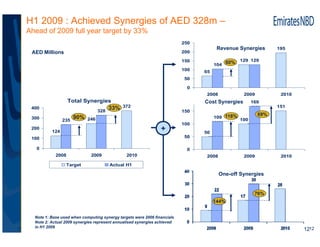

This document discusses business consolidation and mergers and acquisitions (M&As). It notes that while M&As can help drive growth, most acquisitions destroy shareholder value by failing to create expected synergies. To create value, companies must focus on executing successful post-merger integration. Emirates NBD achieved cost and revenue synergies exceeding targets in its acquisition of National Bank of Dubai by maintaining a phased approach prioritizing customers, processes, back office consolidation, and third-party relationships. Communication, planning, and dedicating integration resources are keys to delivering the expected value from a consolidation.