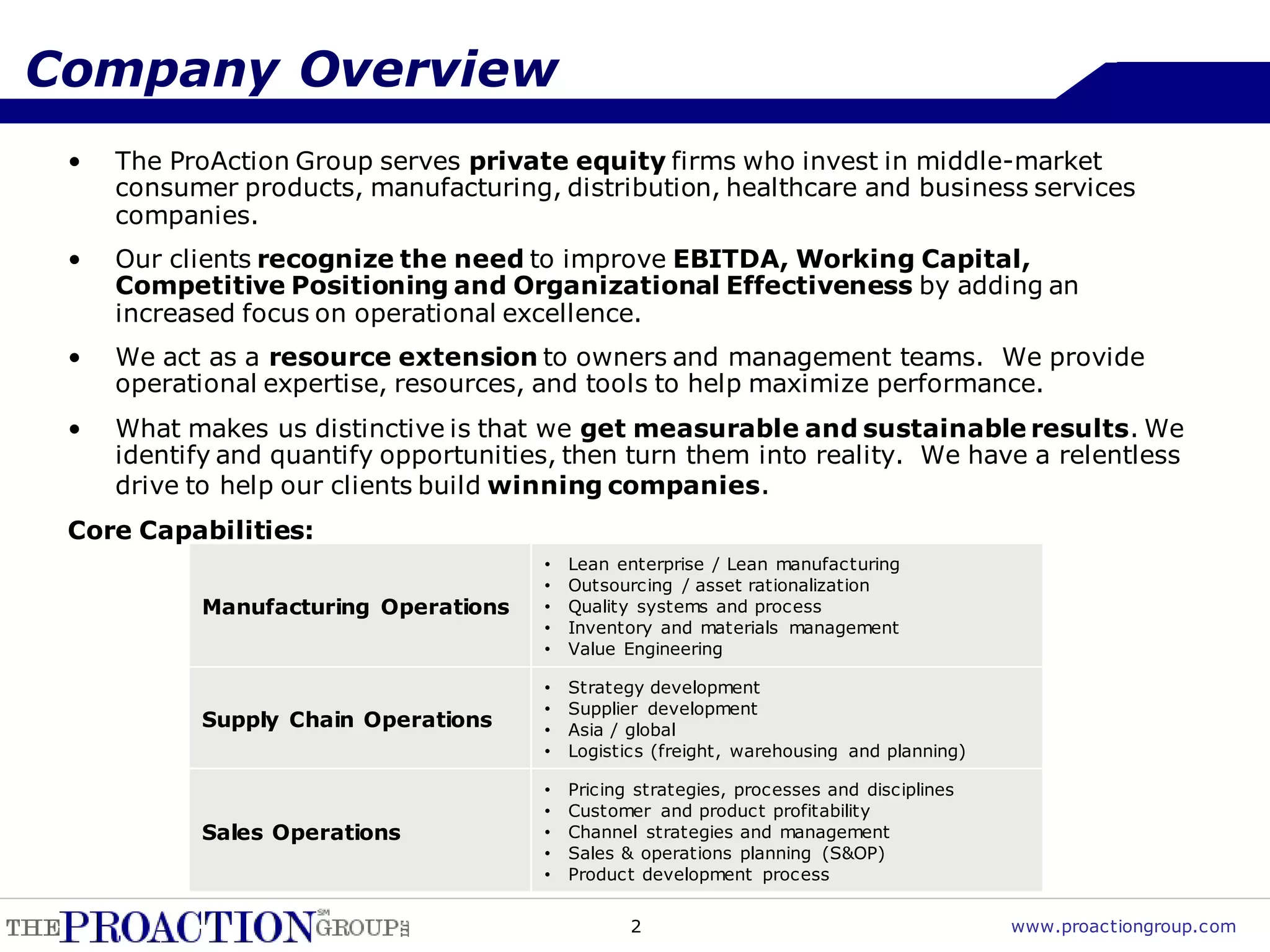

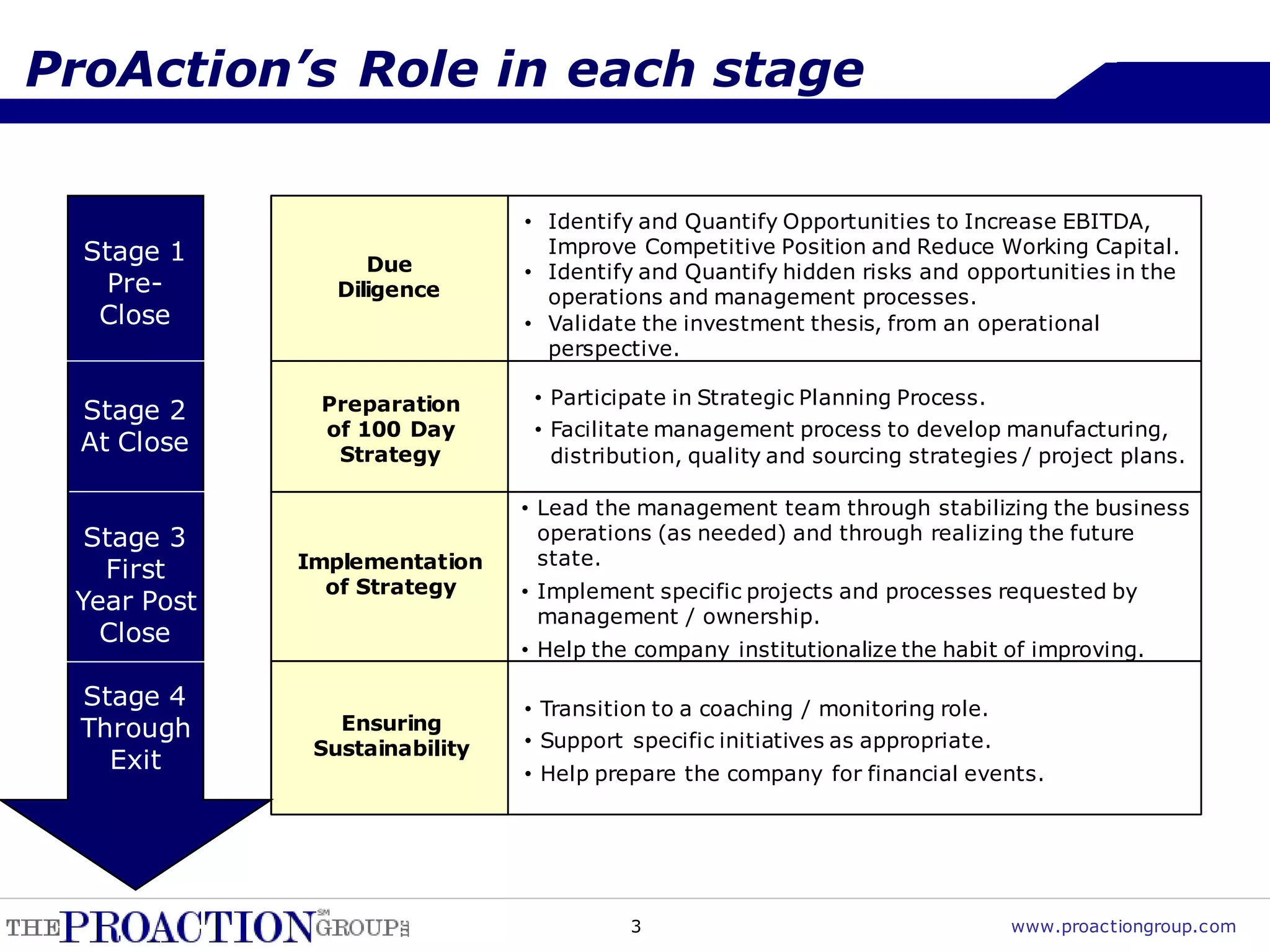

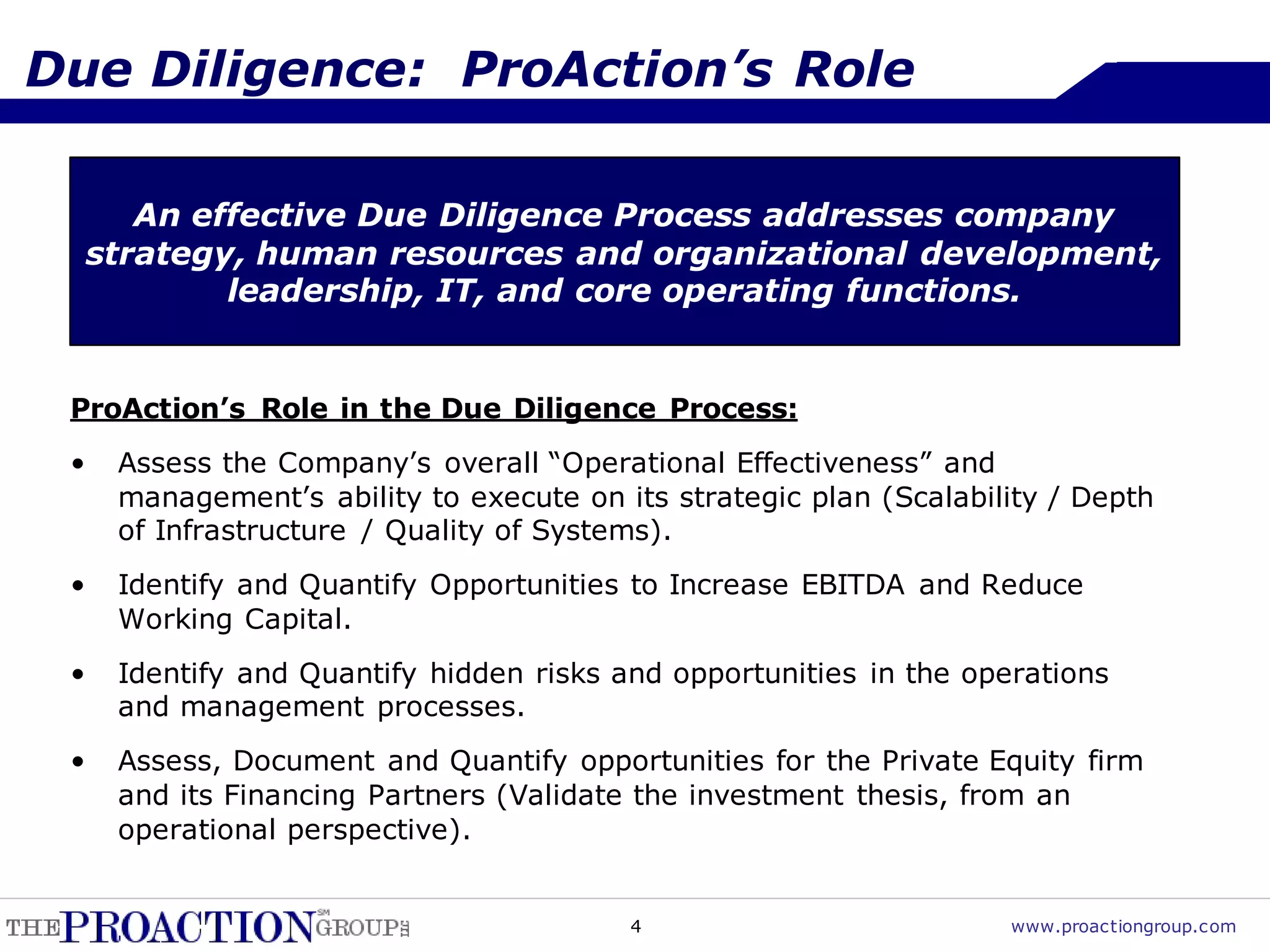

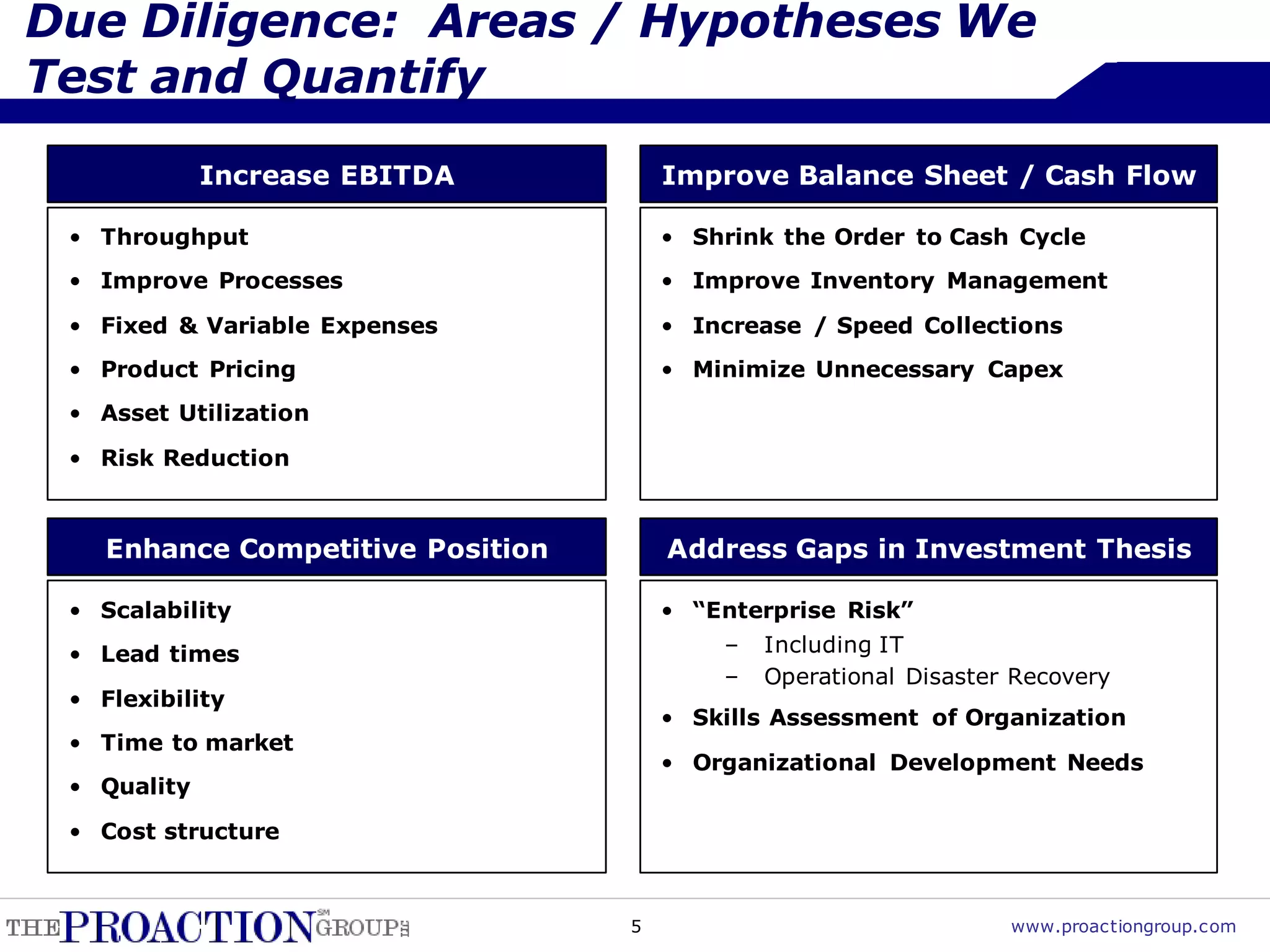

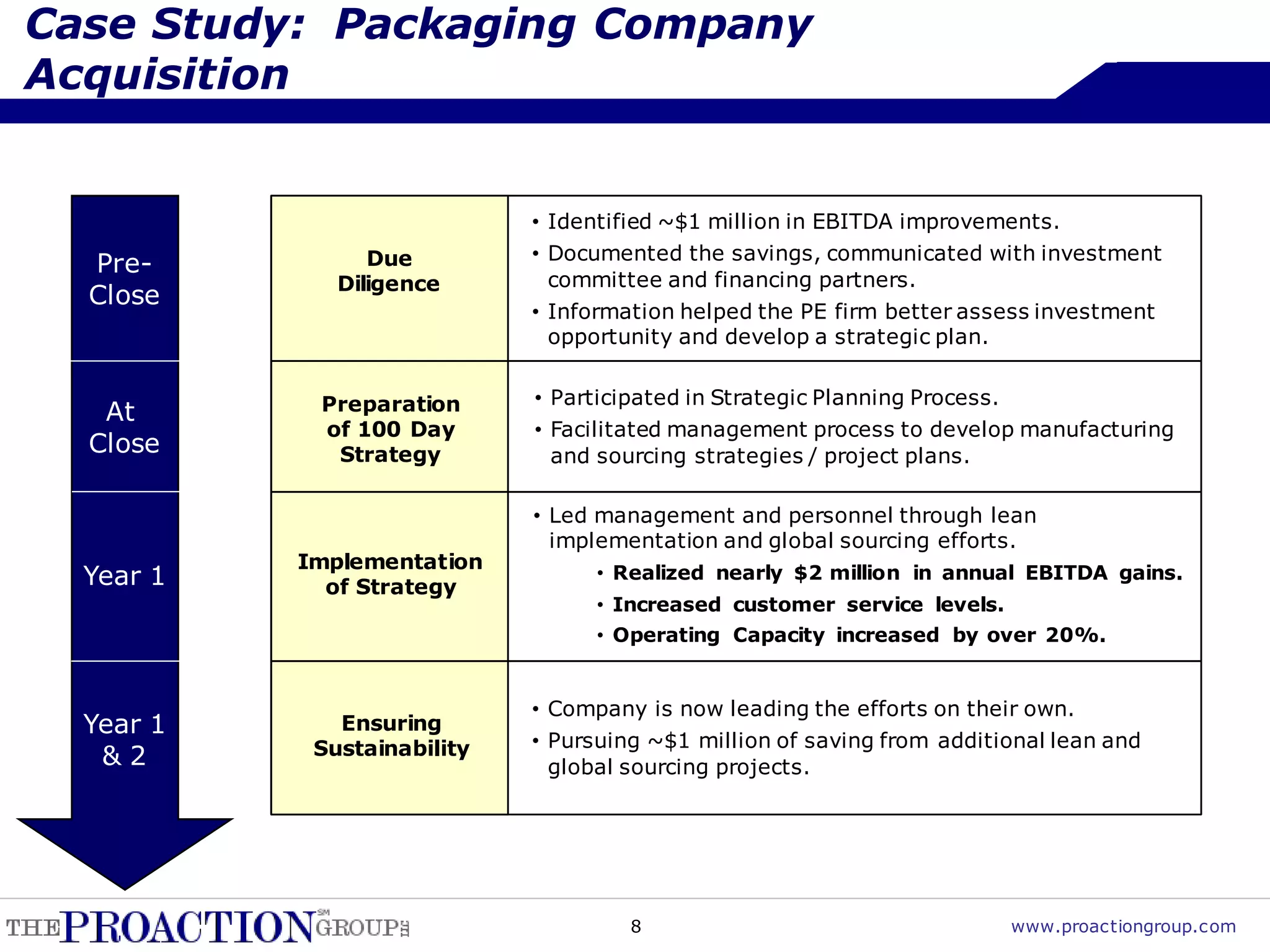

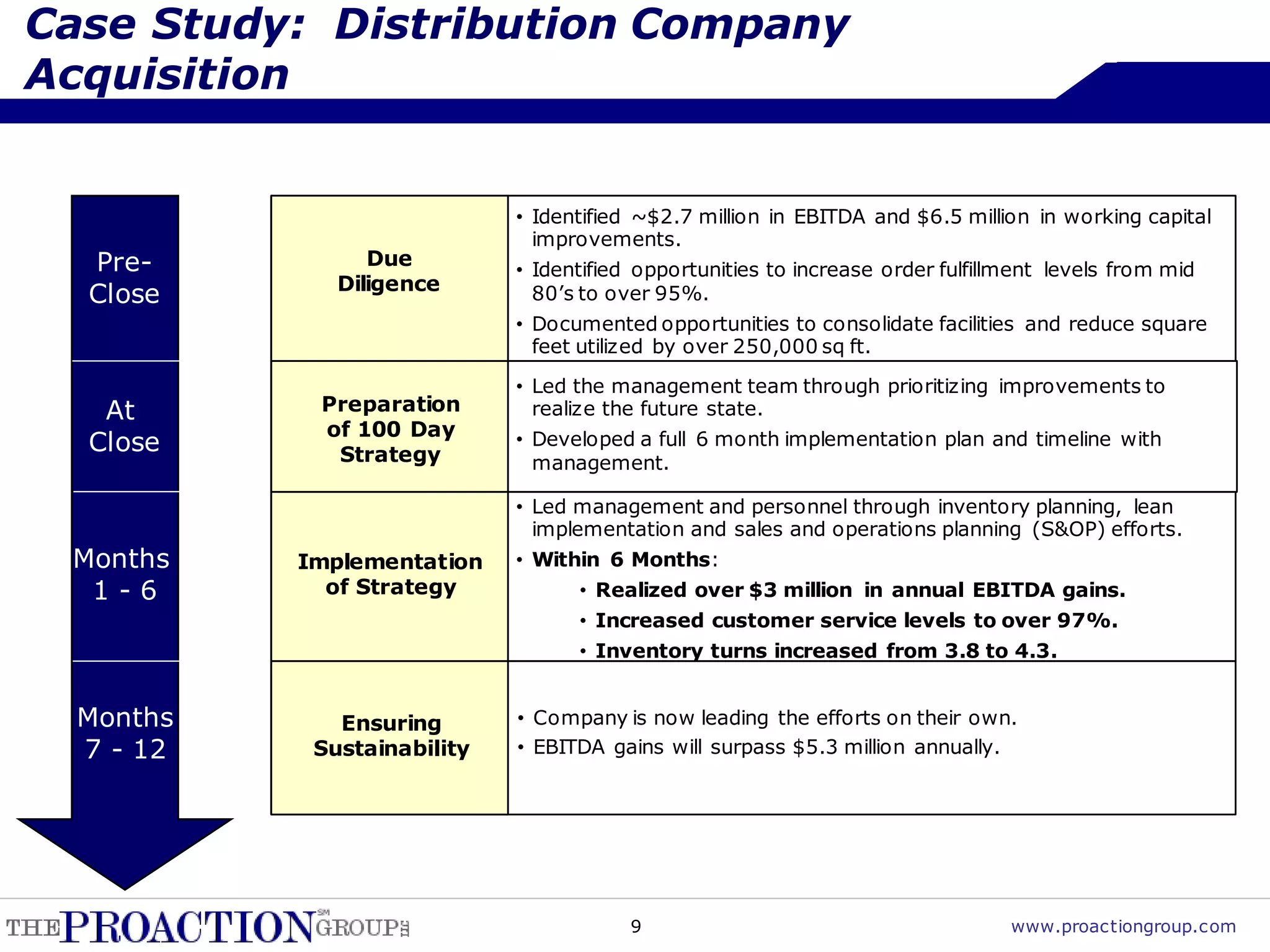

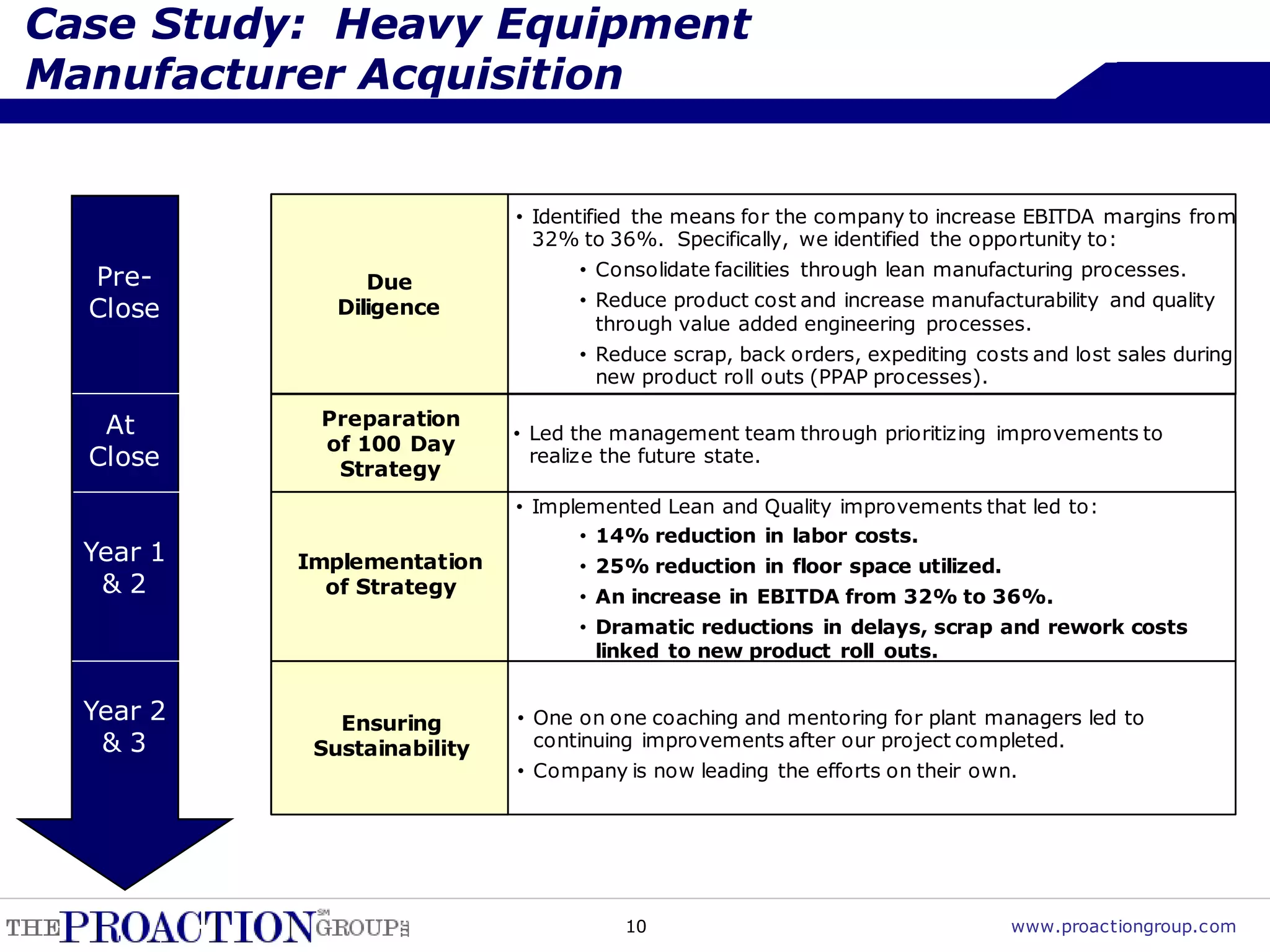

The Proaction Group assists private equity firms in improving operational efficiency and financial performance of middle-market companies. They provide expert resources for due diligence processes, focusing on increasing EBITDA and reducing working capital by identifying risks and opportunities in operations. Case studies demonstrate their successful strategies in enhancing value and achieving significant EBITDA gains through targeted initiatives and ongoing support.