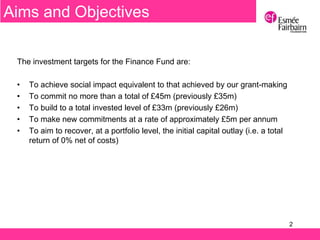

The document outlines the targets and objectives of the Finance Fund, including committing up to £45 million total and building to a total invested level of £33 million. It analyzes the current portfolio, which includes 92 total investments across debt, equity, funds, land purchases, and other categories. Key aspects of the current climate are discussed such as uncertainty, rising demand and reducing resources, resilience, and the need for redesign and innovation.