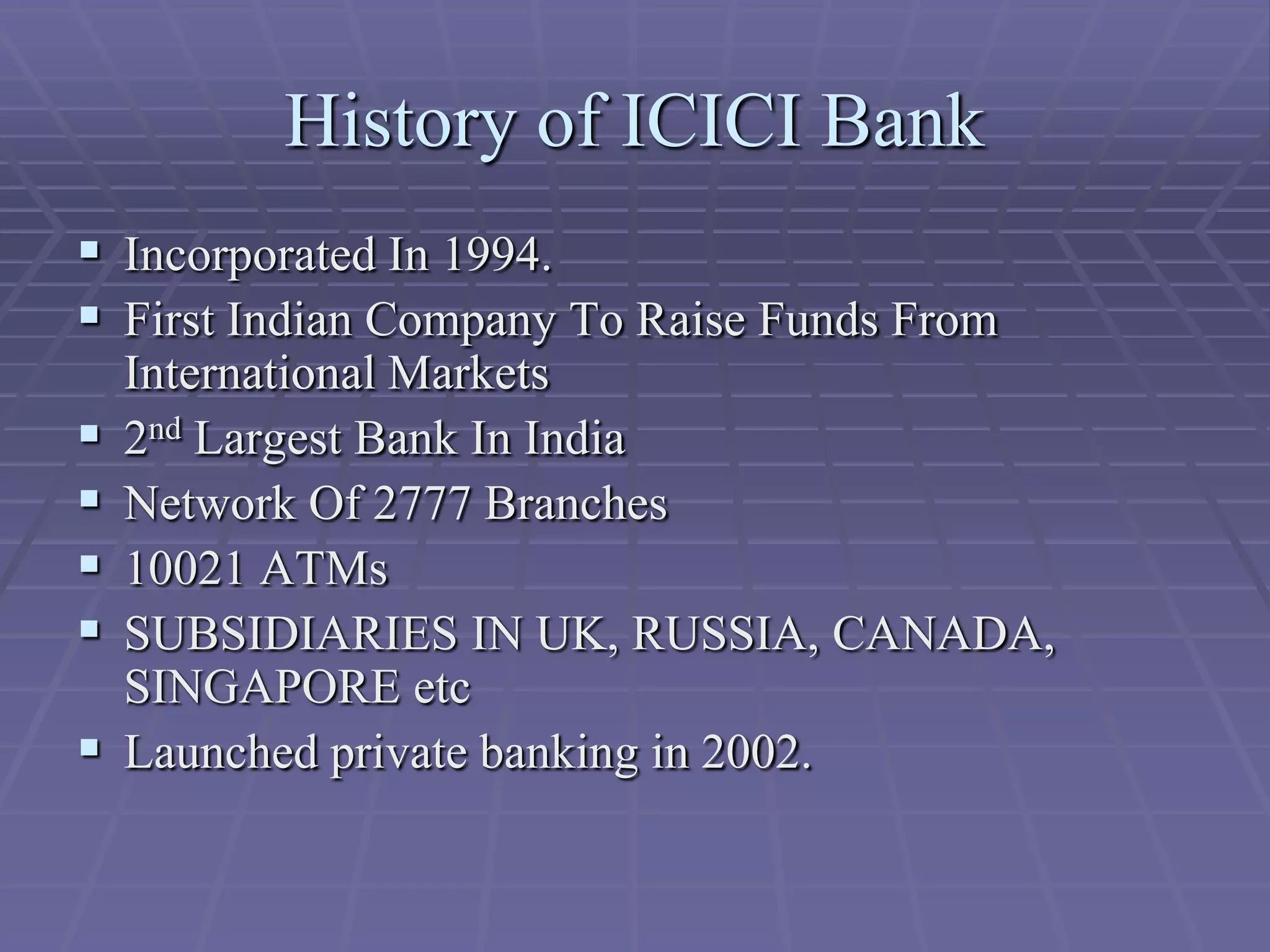

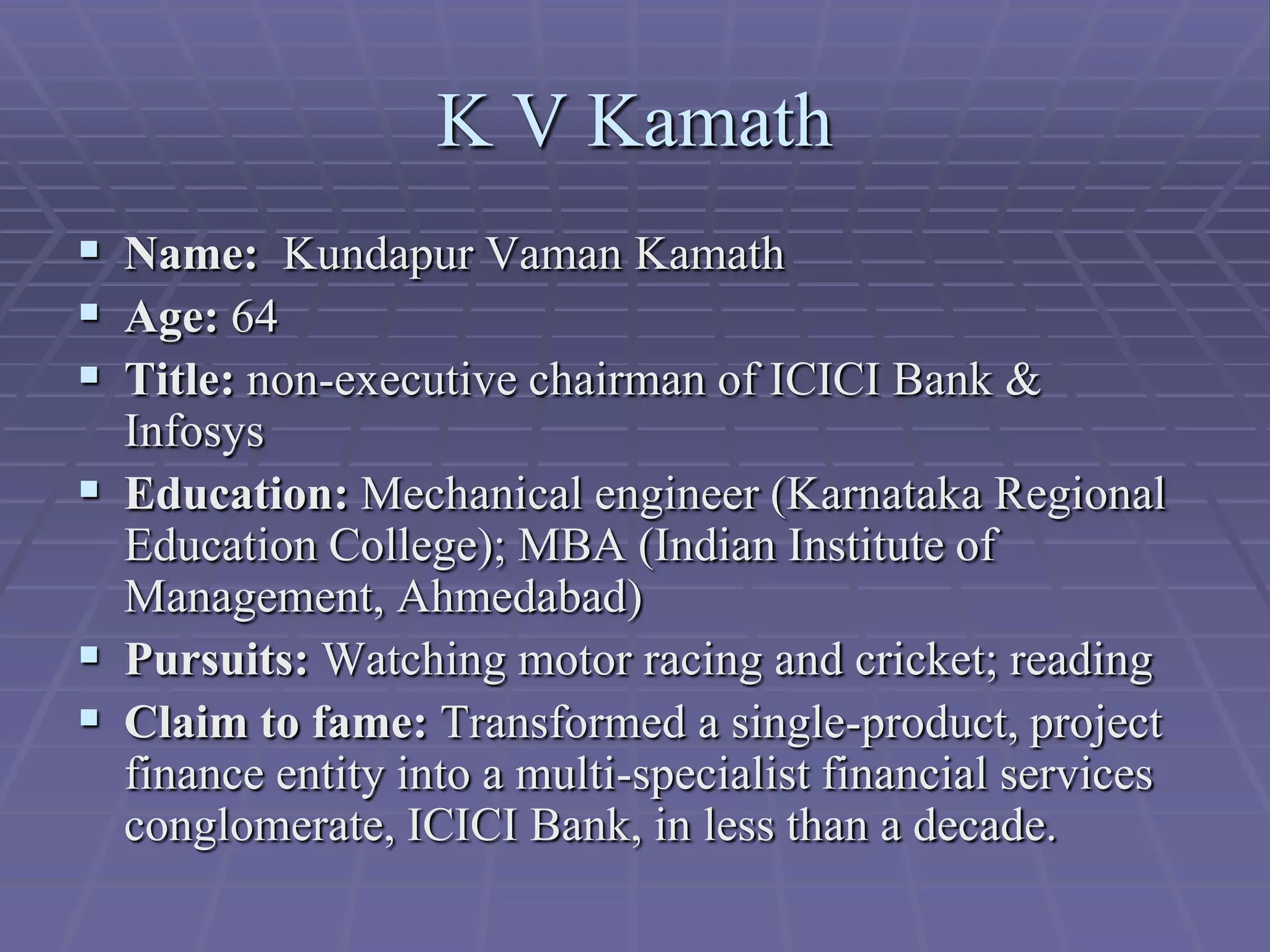

K V Kamath is a renowned Indian banker who served as the CEO of ICICI Bank from 1996 to 2009. During his tenure, he transformed ICICI from a development financial institution into a retail banking giant through strategic acquisitions and a focus on consumer banking. Some of his major achievements include leading ICICI's initial public offering in India, expanding its branch network across the country, and making it the second largest bank. He is currently the non-executive chairman of Infosys.