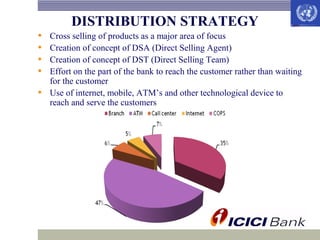

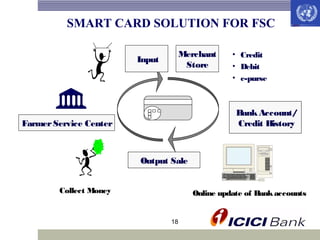

Industrial Credit & Investment Corporation of India (ICICI) presented on their principles of management. ICICI is India's second largest bank with over 4 trillion rupees in total assets. The presentation covered ICICI's history, awards, vision, management style, strategy for future challenges, and plans to enable India's economy through digital initiatives by 2015. ICICI aims to be a truly universal bank and sustain double digit growth through product innovation, technology usage, and focus on retail banking, SMEs, and financial inclusion.

![MANAGERIAL PERSON OF THE ICICI

K.V.KAMATH

The Chairman of Infosys Technologies, the second-largest IT services

company in India, and Non-Executive Chairman of ICICI Bank,

India's largest private bank. Mr. Kamath served as ICICI Bank's

Managing Director and CEO from May 1, 1996 until his retirement

from executive responsibilities on April 30, 2009.[1] Moreover, Mr.

Kamath is currently an independent Director of Houston-based oil

services company Schlumberger and Indian pharmaceutical Lupin.

KALPANA MORPARIA

Kalpana Morparia from ICICI', she surprised many when she moved

from ICICI Bank after thirty three long years to financial services firm

JPMorgan. Morparia now leads all the various businesses and services

of JP Morgan in India. The tough boss (though she believes otherwise)

who is a regular on all the woman power rankings, doesn't believe in

the glass ceiling, preferring to let her work talk for her.

8](https://image.slidesharecdn.com/icici-final-131124043125-phpapp02/85/ICICI-Bank-8-320.jpg)