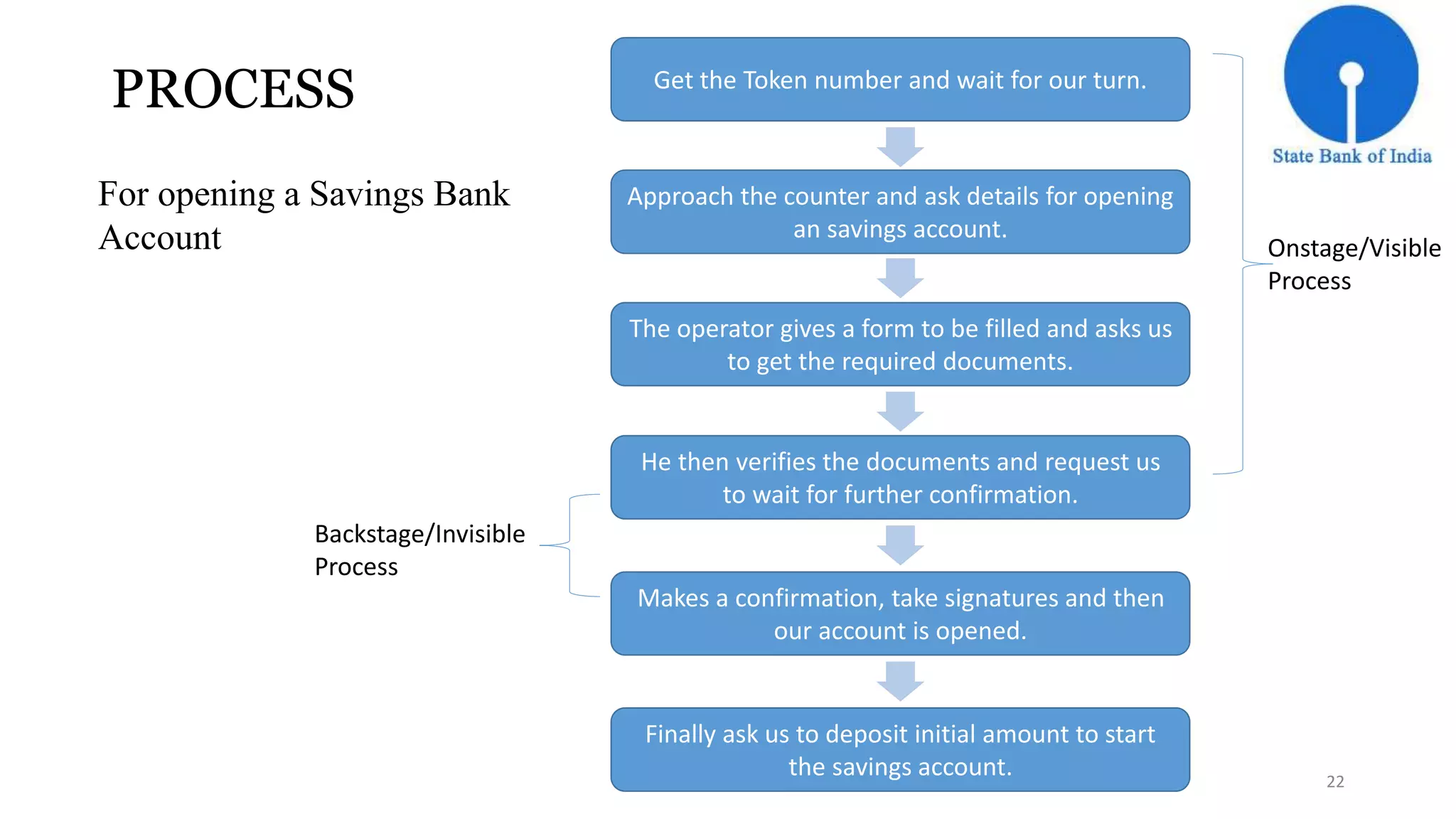

The document provides an overview of banking services in India. It discusses the history of banking in India from 1786 to the present in three phases. It defines banking as accepting deposits from the public that are repayable on demand. The banking sector contributes significantly to India's GDP and economy. Major players discussed are State Bank of India and ICICI Bank. SBI was established in 1806 and was nationalized in 1955. ICICI Bank was established in 1994 as a subsidiary of ICICI and transformed to a diversified financial institution.