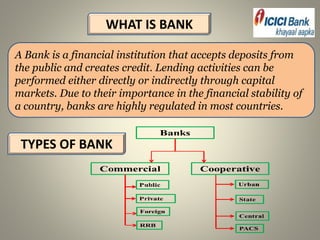

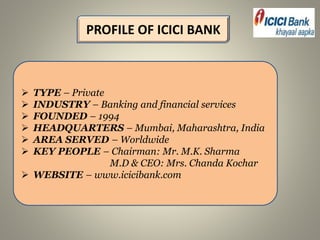

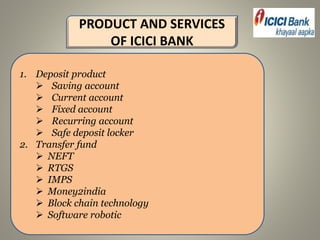

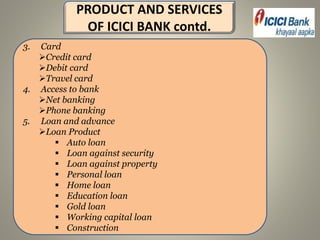

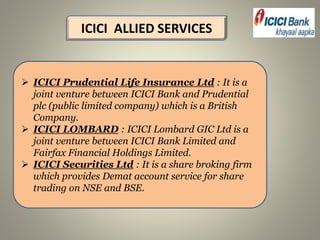

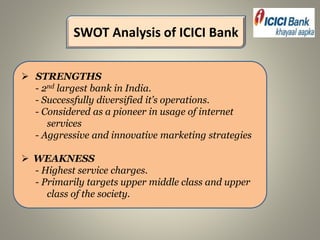

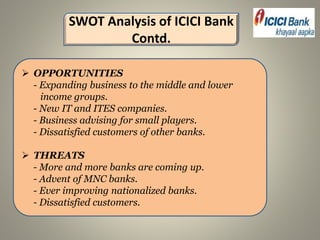

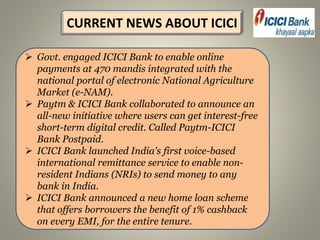

This document provides an overview of ICICI Bank, including its profile, products and services, allied services, SWOT analysis, recent news, and achievements. It begins with defining banks and describing types of banks in India, specifically public sector banks and private sector banks. It then focuses on providing details about ICICI Bank, the third largest bank in India, covering its founding, headquarters, key leadership, and operations across India and internationally.