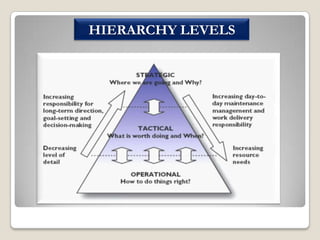

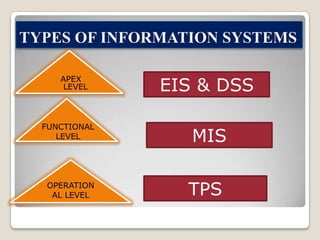

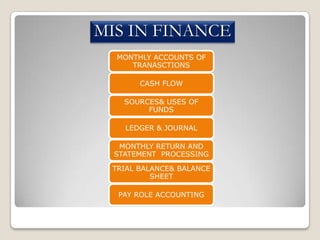

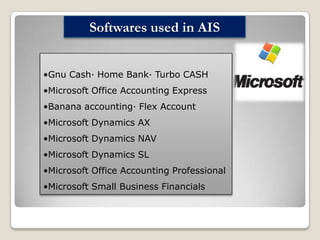

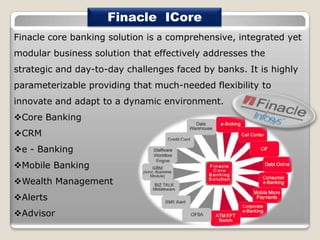

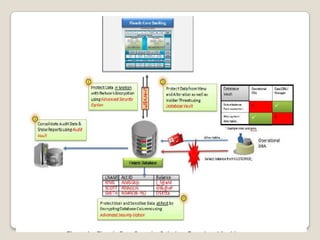

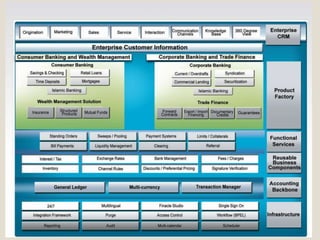

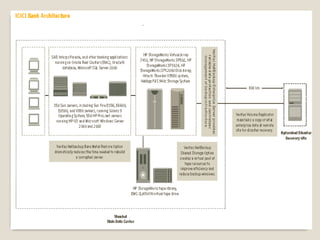

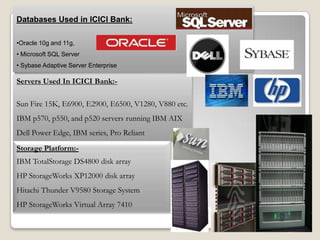

This document provides a summary of the management information system (MIS) used by ICICI Bank, one of the largest banks in India. It discusses the various software, databases, servers, and systems that make up ICICI Bank's MIS. This includes their core banking software Finacle ICore, loan origination system FinnOne, workflow management system Staffware, online trading platform ICICIdirect.com, ATM monitoring software ProView, and customer relationship management systems. The MIS provides the bank with critical information to control expenses, monitor cash flows, streamline operations, and analyze customer behavior.