- Retailers face changing consumer behaviors as e-commerce and mobile commerce grow, requiring adaptation.

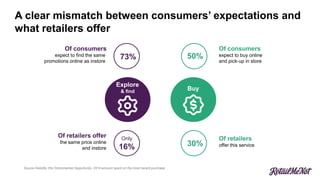

- Consumers now expect discounts, flexibility across channels, and personalized experiences. Mobile traffic and sales are rising rapidly while conversion rates decline.

- To succeed, retailers must listen to customers, optimize experiences for mobile and location, and personalize offers while maintaining transparency. Strategies should drive the right messages to consumers at the right time and place to increase sales.