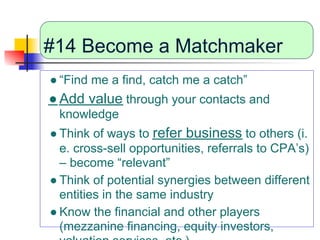

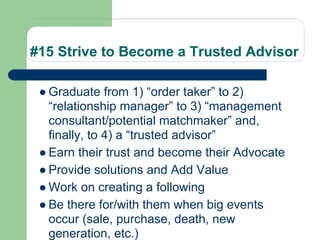

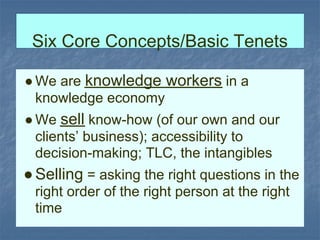

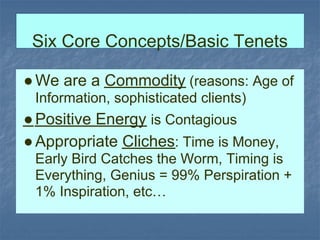

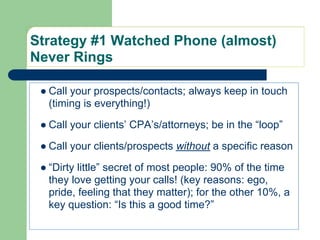

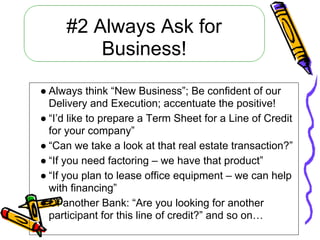

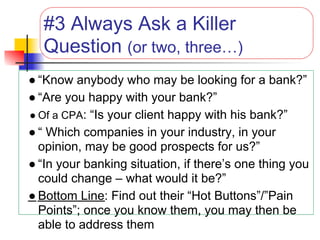

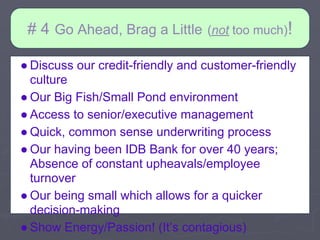

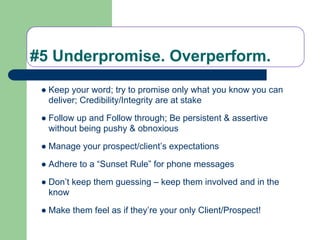

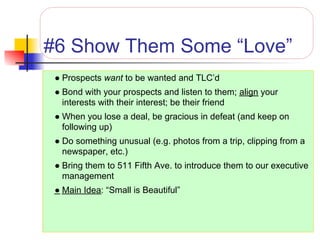

The document outlines 15 strategies and 6 core concepts for being an effective salesperson. The strategies include: calling prospects regularly to stay top of mind; always asking for business; asking probing questions; promoting your strengths while managing expectations; developing personal relationships; staying organized; and becoming a trusted advisor by providing value-added solutions. The core concepts emphasize treating clients well, having a positive attitude, and properly framing sales conversations through effective questioning.

![# 13 Learn, Develop and Hone Your

Negotiating Skills

● Turn customer objections into customer objectives [e.g. lack of

branches may be turned into a positive development (“stay with

existing branch!”);]

● Anticipate objections and be prepared for them (e.g. “yes, we’re a

foreign bank – just like HSBC”); always think of our “Value Proposition”

● Work on asking the right questions in the right sequence at the right

time

● Use sharp/clever similes, metaphors, analogies (loan covenants are

merely “road signs” to help us navigate the road or “we’re like airplanes

– safety first”; “cheapest shirt/doctor” analogy for pricing objections; no

PG’s are like a “mirage in the desert”, etc.)

● Try to resolve most conflicts/objections without involving senior

management

● Read some good books on negotiating](https://image.slidesharecdn.com/15-sales-techniques-to-improve-the-sales-process1763/85/15-sales-techniques-to-improve-the-sales-process-16-320.jpg)