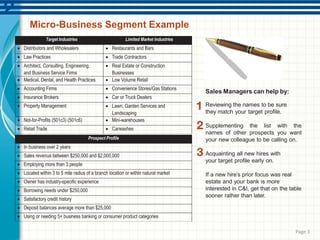

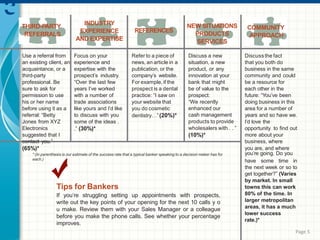

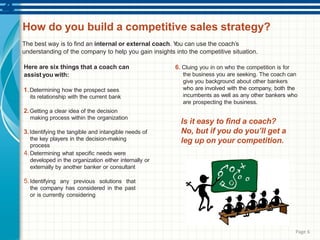

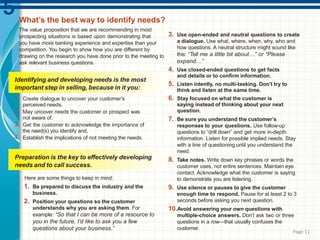

The document provides advice on prospecting and following up with prospects. It recommends developing a target profile that focuses sales efforts on the best prospects in desired industries. There is no magic list - sales managers should review prospect lists to ensure they match the target profile. When following up after an initial meeting, the banker should review notes to identify needs, develop questions about the needs, and have a clear reason for a second meeting. The best way to identify needs is to ask open-ended questions and listen for implied needs in order to understand the prospect's situation and determine how the banker can help meet their needs.