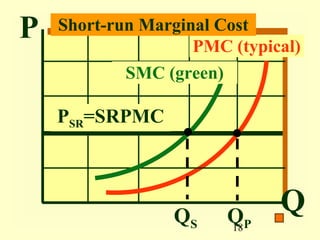

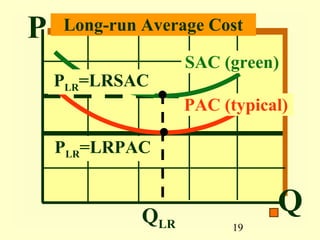

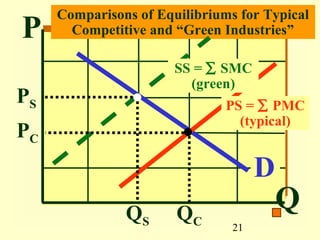

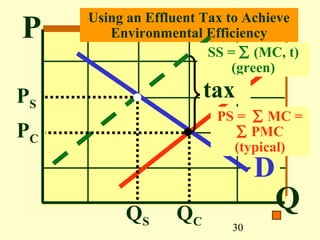

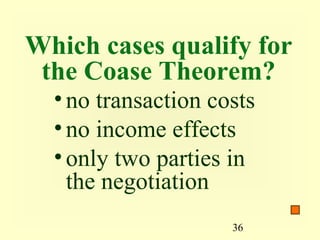

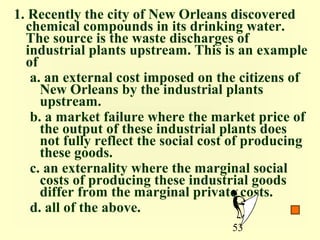

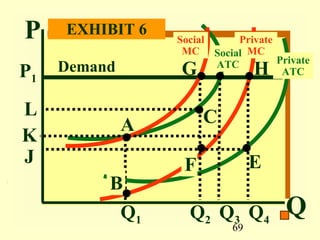

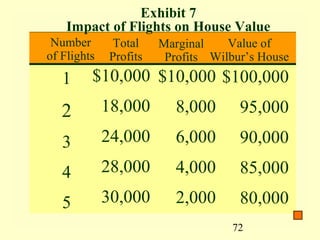

Externalities like pollution are costs not considered by buyers and sellers. This leads markets to produce inefficiently high pollution. Government intervention can correct market failures, but may also fail if it does not use incentive-based policies like effluent taxes and emissions trading rather than command-and-control regulations. The Coase Theorem finds private bargaining can achieve efficiency if property rights and low transaction costs allow negotiations, though obstacles often remain.