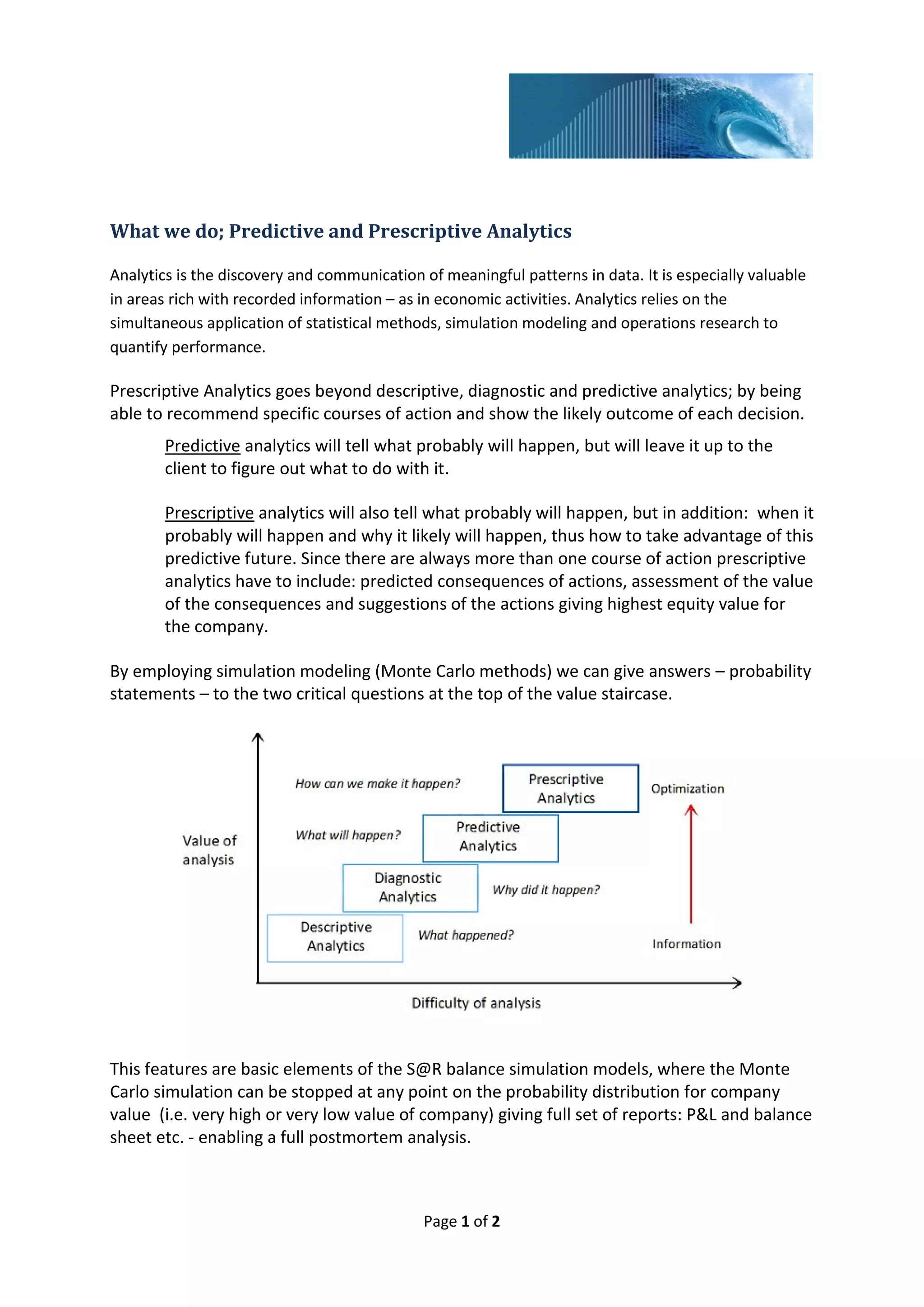

The document discusses predictive and prescriptive analytics, emphasizing their importance in identifying patterns within data, particularly in economic contexts. It explains how prescriptive analytics goes further than predictive analytics by recommending specific actions and assessing their probable outcomes. Additionally, it highlights the use of simulation modeling to evaluate various courses of action and improve business performance through informed decision-making.