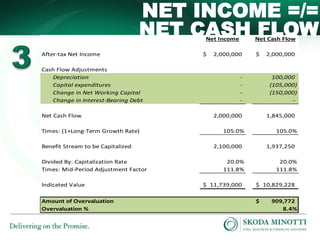

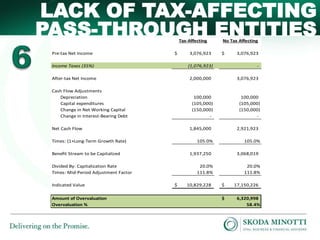

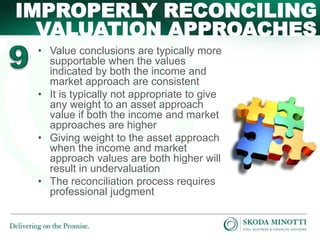

The document outlines 10 common errors observed in business valuations, emphasizing the importance of correctly distinguishing between equity value and enterprise value, accounting for normalizing adjustments, and employing appropriate tax considerations. It discusses three primary valuation approaches—asset, income, and market—while detailing pitfalls such as the misapplication of marketability discount studies. Participants are equipped to identify these errors and effectively cross-examine opposing experts on valuation issues.