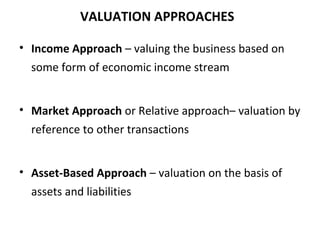

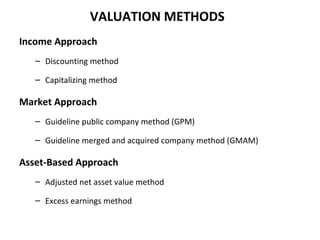

The document discusses various approaches, methods, and procedures used in business valuation. It describes the hierarchy of valuation approaches (income, market, asset-based), methods that fall under each approach (e.g. DCF method under income approach), and specific calculations and procedures involved in methods. Key valuation methods like DCF, relative valuation using multiples, adjusted net asset value method, and excess earnings method are explained in detail with steps and considerations.

![DCF METHOD“TEN CIRCLES OF HELL by DAMODARAN

,

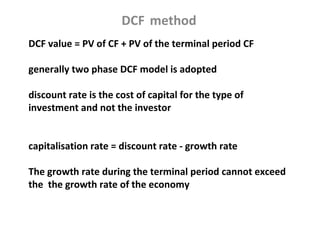

Discount rate. “I think we spend far too much time talking about cost of equity,

cost of capital, cost of debt—and not enough on cash flows.” Analysts

“outsource” so many of the elements of the calculation (to Ibbotson’s data,

Bloomberg data, Duff & Phelps, etc.), “that it’s frightening.”

Growth rate revisited. To grow a business, owners have to put money back

into the business, and that’s a cost of growth analysts may overlook. Instead,

the focus should be on the quality of the business’ growth.

Debt ratio revisited. “We spend a lot of time trying to get the discount rate

right,” “But given your own assumptions about the company, you should expect

the discount rate to change [over time].” Instead, “the discussion should be

about the discount rates.”](https://image.slidesharecdn.com/valuation-130103012446-phpapp02/85/Valuation-12-320.jpg)

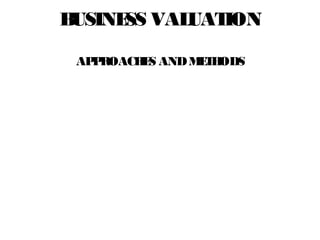

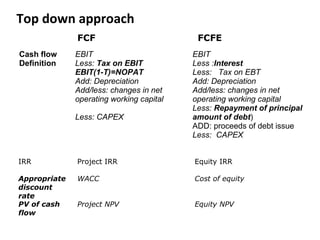

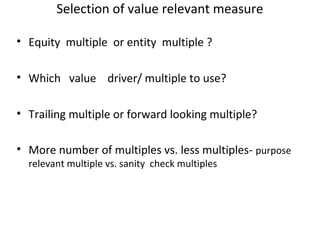

![Equity multiple

Price Earning Ratio – most commonly used multiples

• Make sure definition is consistent & uniform

PER = MPS / EPS

• Variant of PER

Current PER = Current MPS / Current EPS

Some analyst may use average price over last 6m or a year

• Trailing PER = Current MPS / EPS based on last 4 quarters.

[or, LTM: Last twelve months]

• Forward PER = Current MPS / expected EPS during next F/Y

• EPS may further be based on fully diluted basis or primary basis

• EPS may include or exclude extraordinary items](https://image.slidesharecdn.com/valuation-130103012446-phpapp02/85/Valuation-29-320.jpg)

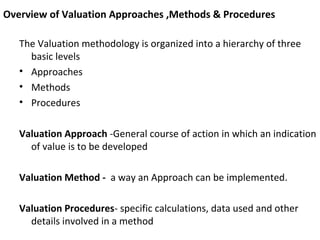

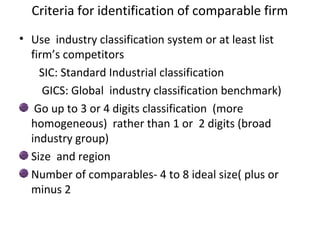

![Equity multiple

P/B ratio = market value of equity / book value of equity

• Book value is computed from the Financial Statement

• Price of book ratio near to 4 is highly priced stock [mean P/B ratio

of all listed firm in USA during 2006 was 2.4]

Price to Sales ratio

(Revenue multiple) = market value of equity

Revenue

• The larger the revenue multiple better it is.

• Generally there is no sectoral Revenue multiple.](https://image.slidesharecdn.com/valuation-130103012446-phpapp02/85/Valuation-32-320.jpg)