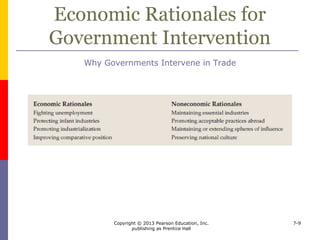

This document is a chapter from a textbook about governmental influence on trade. It discusses how governments intervene in trade to achieve economic and political goals, but must consider conflicting objectives and interest groups. It describes various rationales governments use to restrict or enhance trade, such as protecting domestic industries, managing unemployment, and furthering geopolitical influence. The chapter also outlines the major tools governments use to control trade, such as tariffs, quotas, subsidies, and standards. It notes both the uncertainties and opportunities these policies can create for businesses.