To summarize:

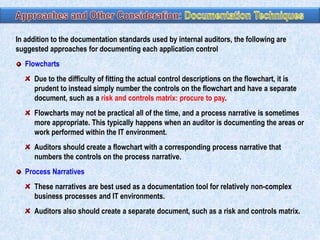

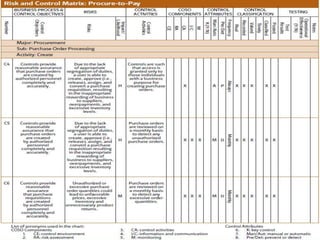

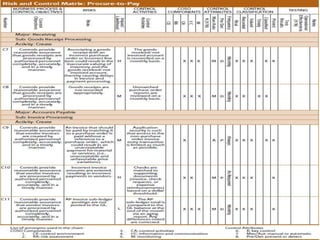

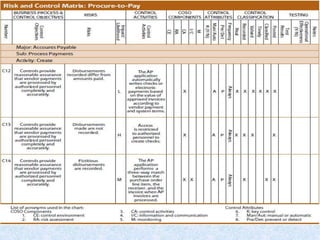

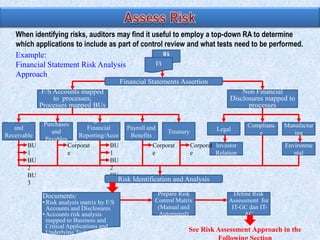

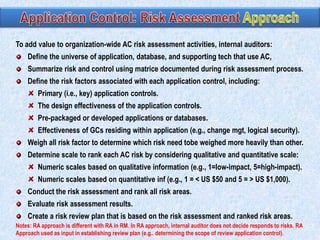

1) Auditors conduct a top-down risk assessment (RA) to determine which applications and controls to review. They document risks and controls in matrices mapped to processes, accounts, and disclosures.

2) The RA involves weighting risk factors, ranking risks, and prioritizing applications for review based on composite risk scores. Applications above a threshold score are included in the review scope.

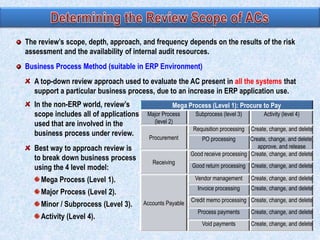

3) The review scope, approach, and frequency are based on the RA results and resource availability. A business process method breaks processes into levels to structure the control review.

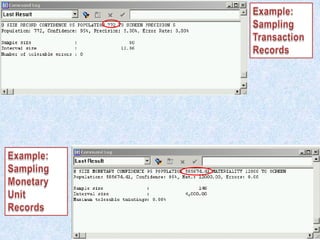

![Composite scores = ∑ (risk factor weight x risk scale) and adding the totals.

The composite score of 375 = [(20 x 5) + (10 x 1) + (10 x 5 ) +…].

For this example, the auditor may determine that the application control review will

include all applications with a score > 200.

Risk Factor Weighting

20

10

10

10

10

10

Applica- Application

Design

PreApp supports Frequency of Complexity

tion

contains

effective- packaded more than one

change

of change

primary ness of the

or

critical business

controls App control developed

process

15

Financial

impact

15

100

Effective- Composite

ness of the

scores

ITGCs

App A

5

1

5

5

3

3

5

2

375

App B

1

1

2

1

1

1

4

2

170

App C

5

2

2

1

5

5

5

2

245

App D

5

3

5

1

5

5

5

2

395

App E

5

1

1

1

1

1

3

2

225](https://image.slidesharecdn.com/05-140215091550-phpapp01/85/05-2-auditing-procedure-application-controls-4-320.jpg)