Normal balance refers to the typical debit or credit classification of accounts in a double-entry accounting system. Asset and expense accounts typically have debit normal balances, while equity, liability, and revenue accounts typically have credit normal balances. This classification determines whether increases to an account are recorded as debits or credits.

![Income from operations 170,000

Other Expenses and Revenue:

Plus Rent Revenue 20,000

Minus Interest Expense 10,000

NET INCOME: 180,000

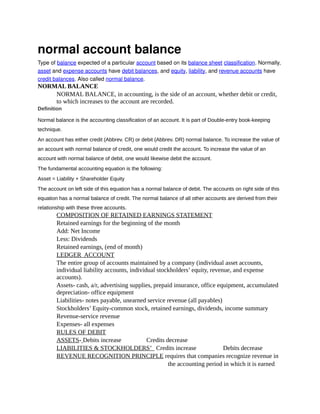

. Sales (Revenue) minus Sales returns (Contra Revenue) gives you the net sales of our

merchandise. Then take net sales and subtract cost of merch, or what we paid to buy our

merchandise. This gives you our gross profit that we made from selling our merchandise. Then

add up administrative expenses and selling expenses and subtract from Gross profit to find

income from operations, or income from what we are in business to do, which is sell

merchandise or a product. Finally, add in other revenue to income from operations and subtract

other expenses and there you have net income!

ACCOUNTING INFORMATION SYSTEMS AND ITS COMPONENTS

An accounting information system (AIS) is a system of collection, storage and processing of

financial and accounting data that is used by decision makers. An accounting information system

is generally a computer-based method for tracking accounting activity in conjunction with

information technology resources. The resulting statistical reports can be used internally by

management or externally by other interested parties including investors, creditors and tax

authorities.

Accounting information systems are composed of six main components:[1]

1. People: users who operate on the systems

2. Procedures and instructions: processes involved in collecting, managing and storing the

data

3. Data: data that is related to the organization and its business processes

4. Software: application that processes the data

5. Information technology infrastructure: the actual physical devices and systems that

allows the AIS to operate and perform its functions

6. Internal controls and security measures: what is implemented to safeguard the data](https://image.slidesharecdn.com/studyguide4midtermexam-121125120908-phpapp02/85/Study-guide-4-midterm-exam-7-320.jpg)