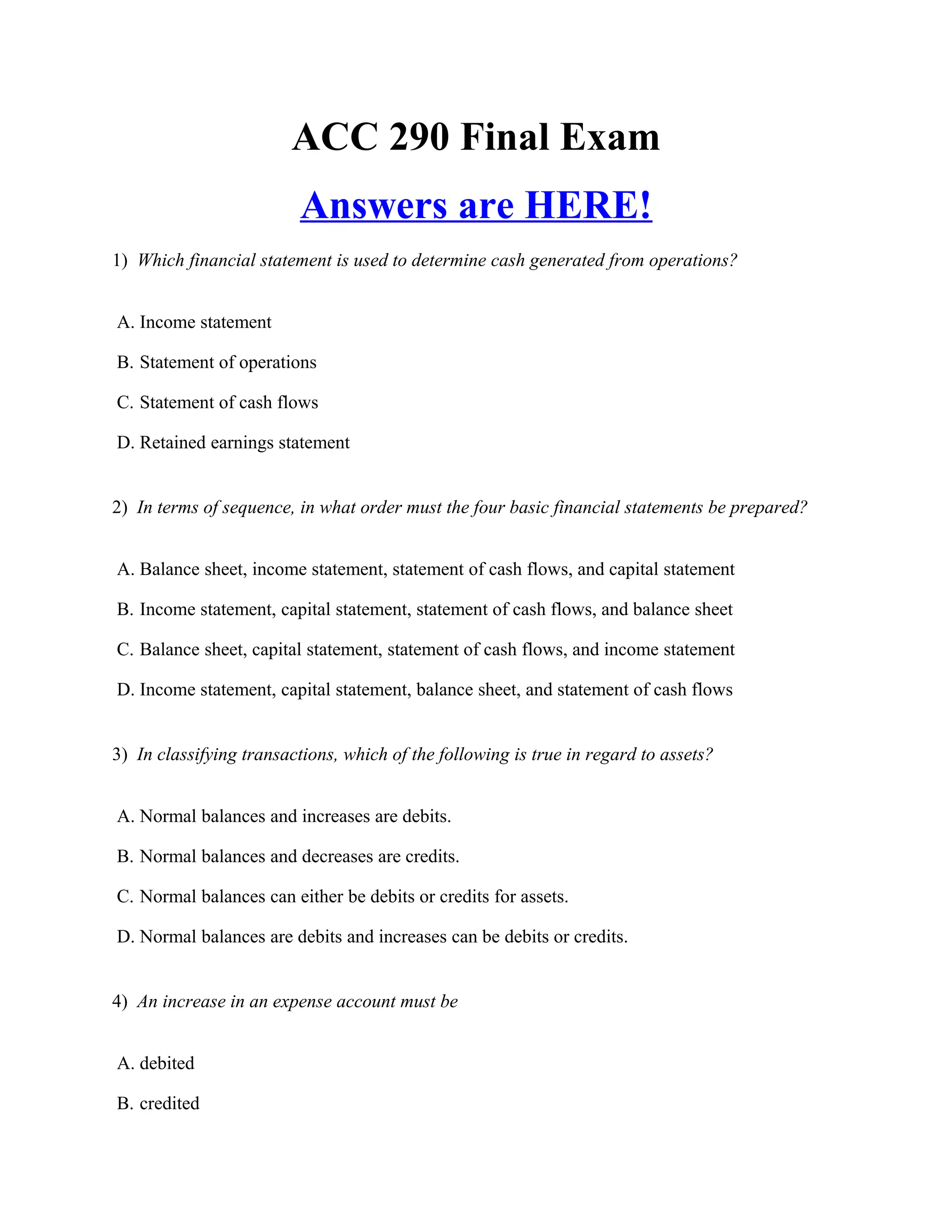

The document provides sample questions and multiple choice answers for an ACC 290 Final Exam. It includes 19 questions testing concepts like:

1) Which financial statement is used to determine cash generated from operations.

2) The typical order for preparing the four basic financial statements.

3) Normal balances and classifications of transactions for assets.

The questions cover accounting concepts like financial statements, journal entries, adjusting entries, trial balances, closing entries and calculating cost of goods sold.