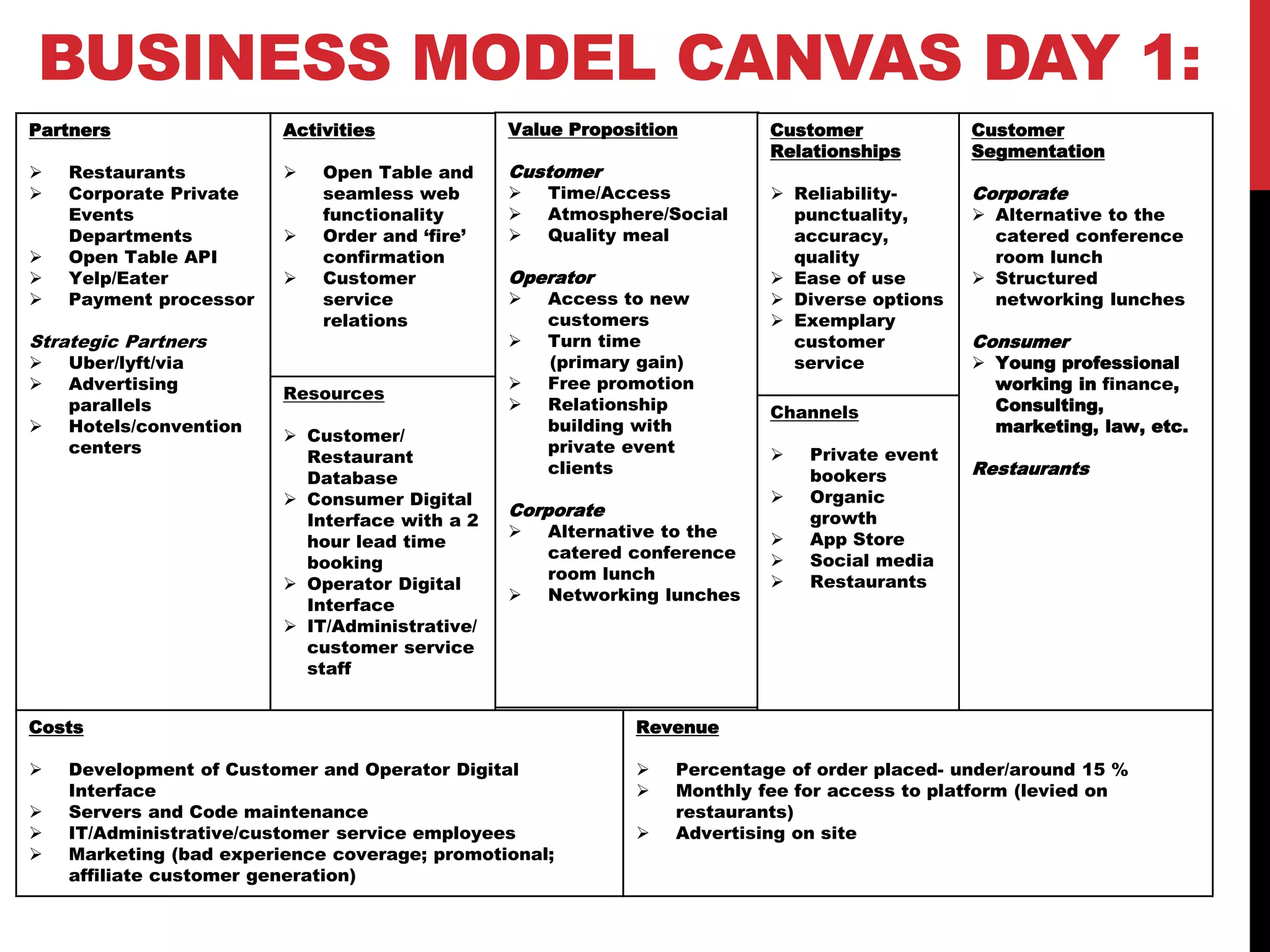

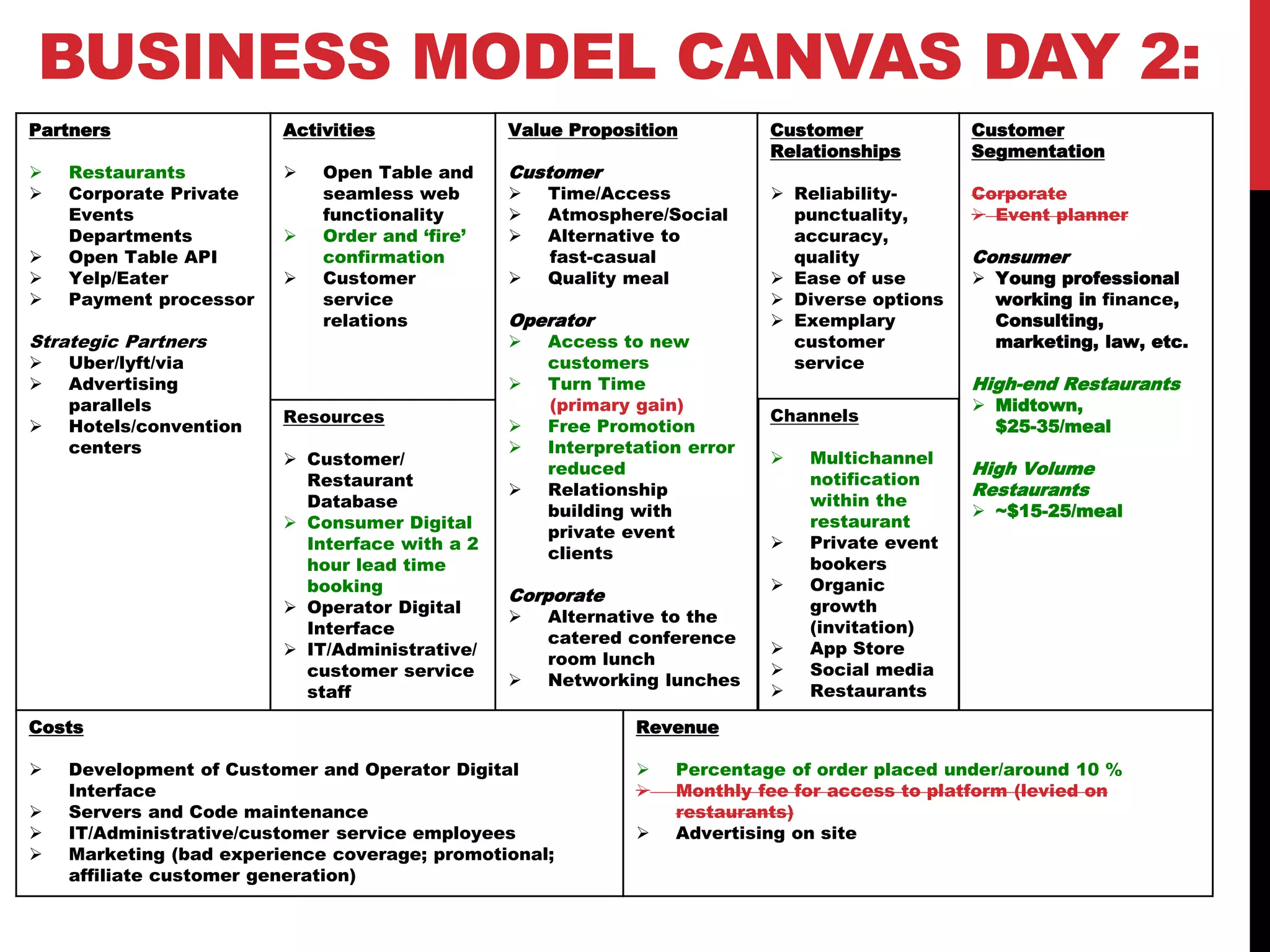

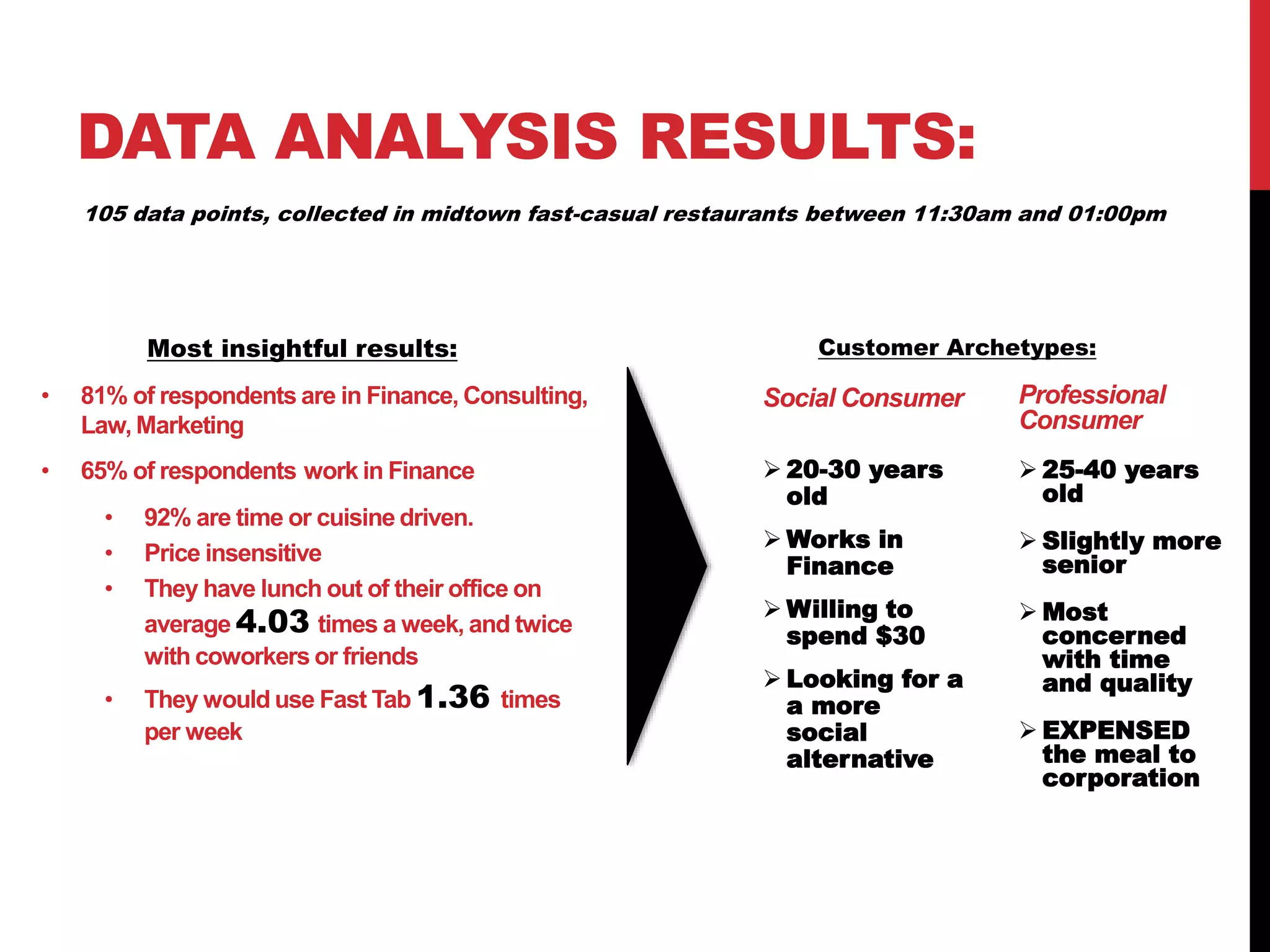

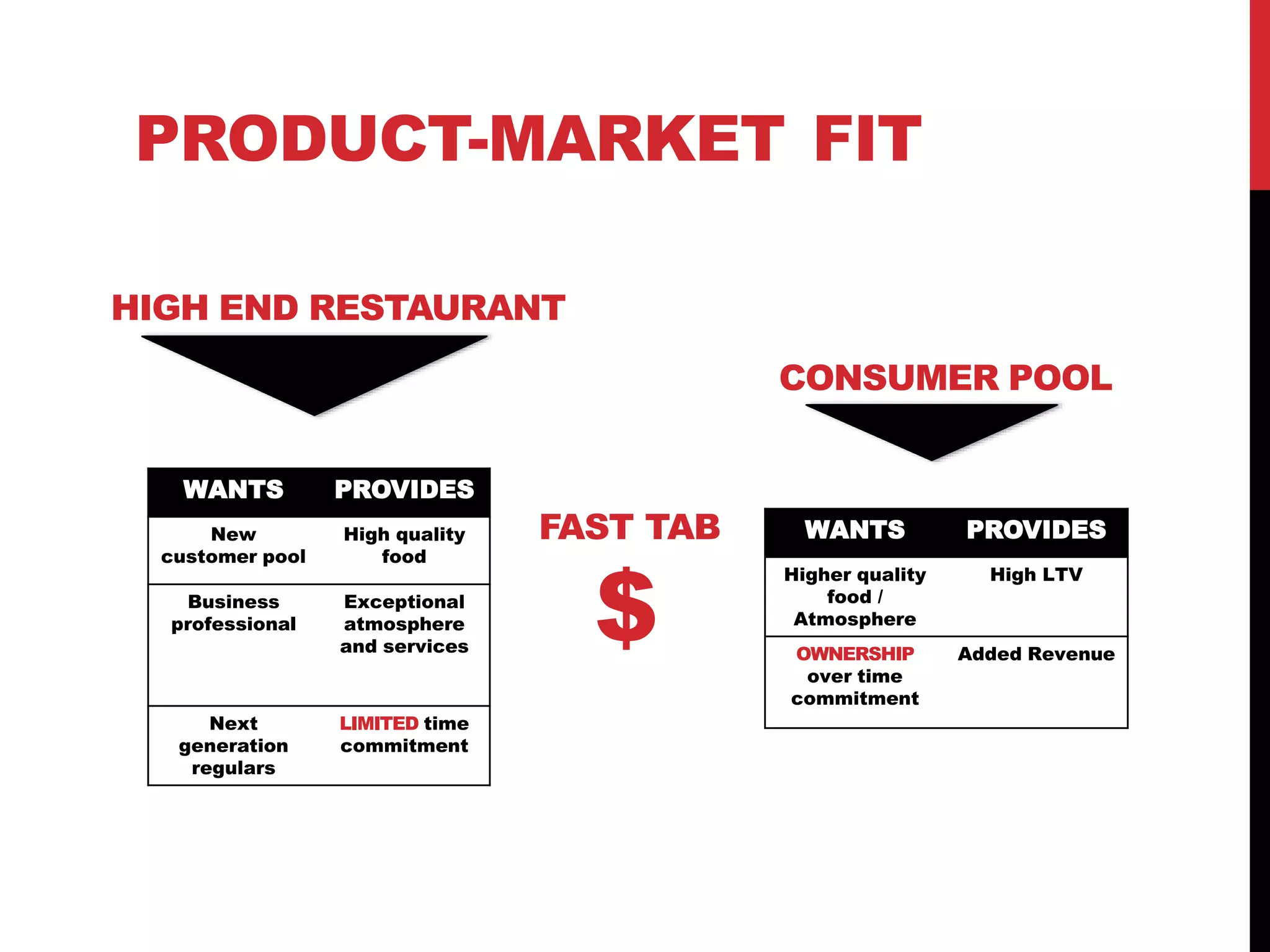

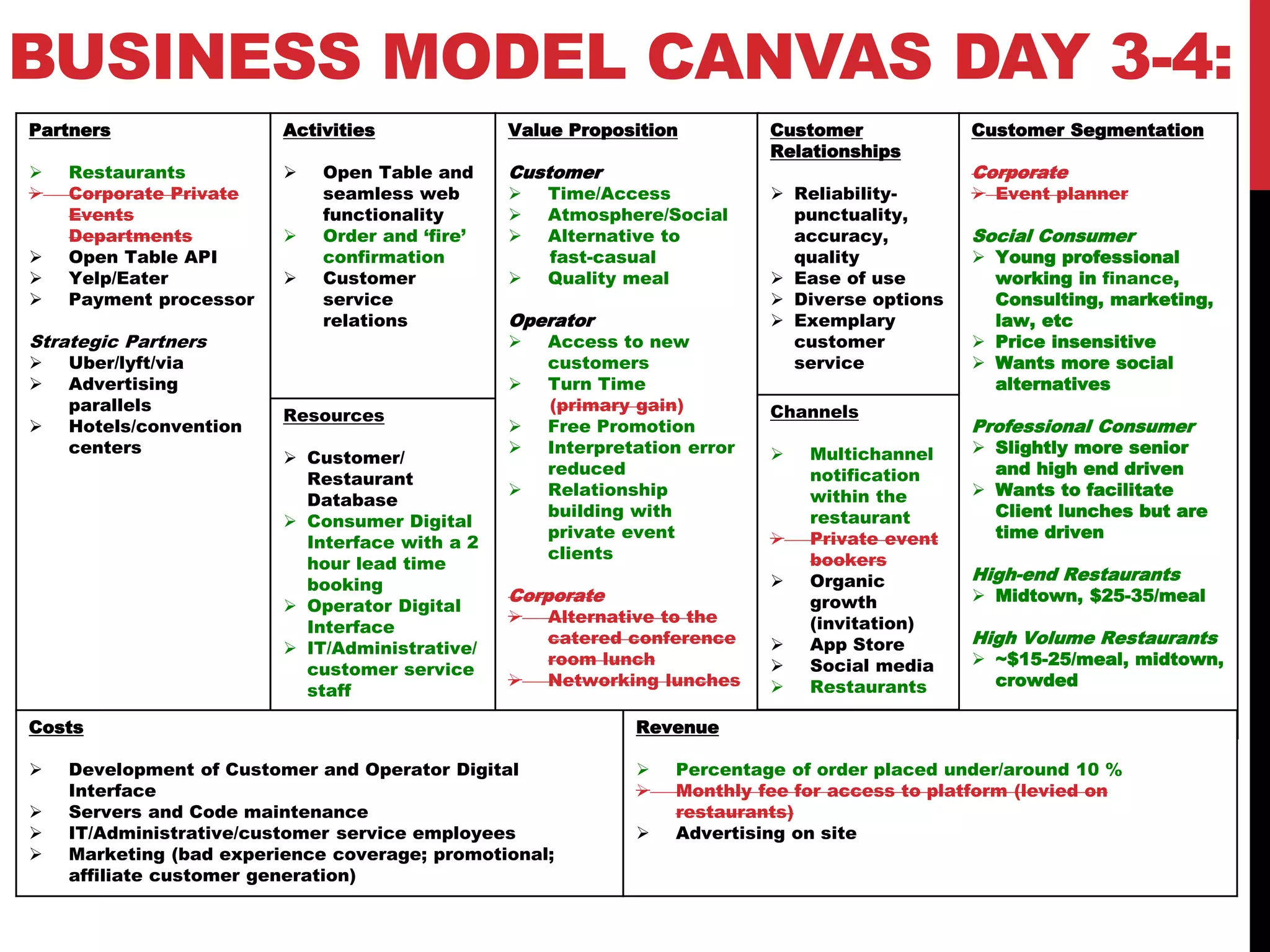

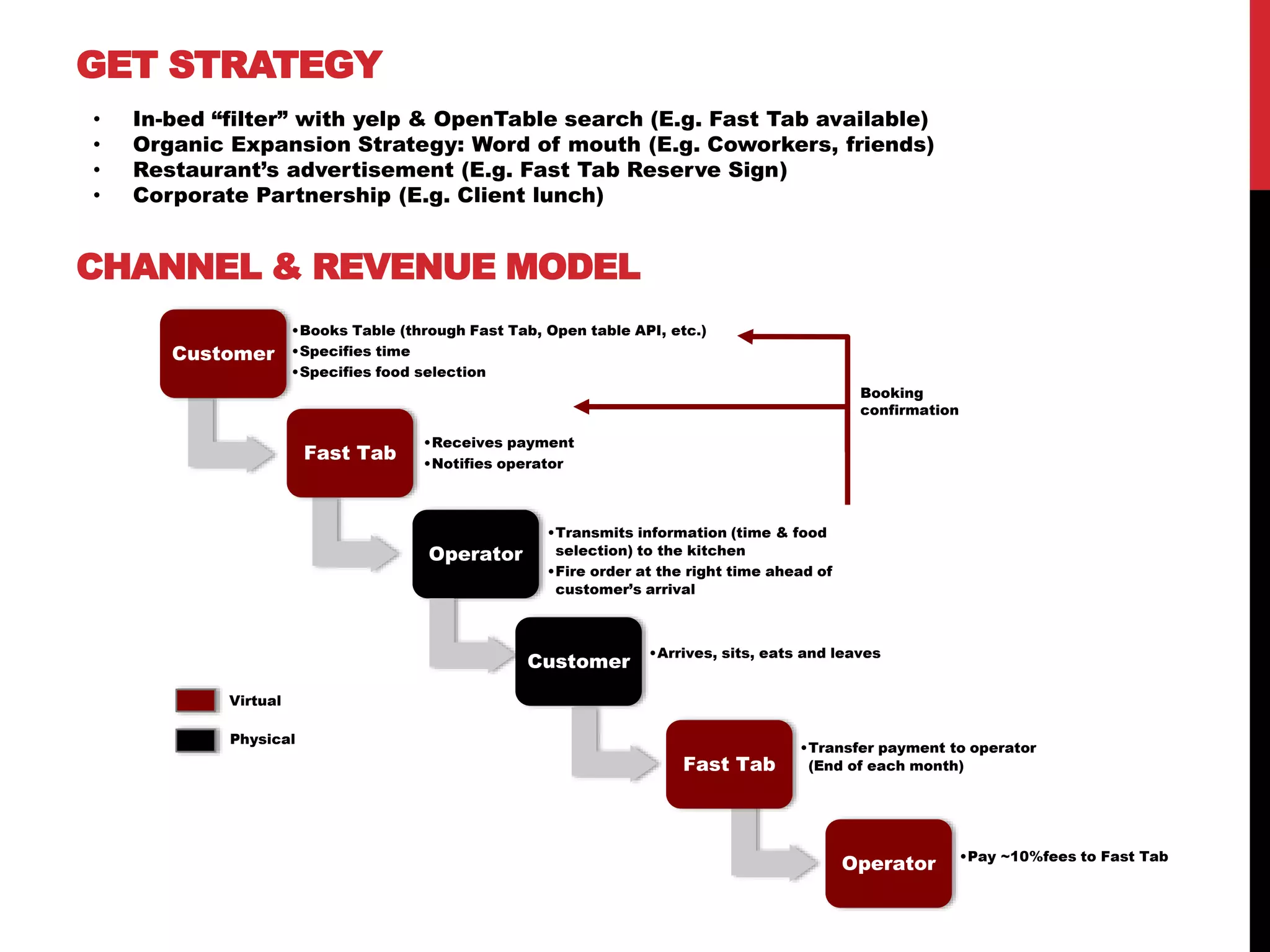

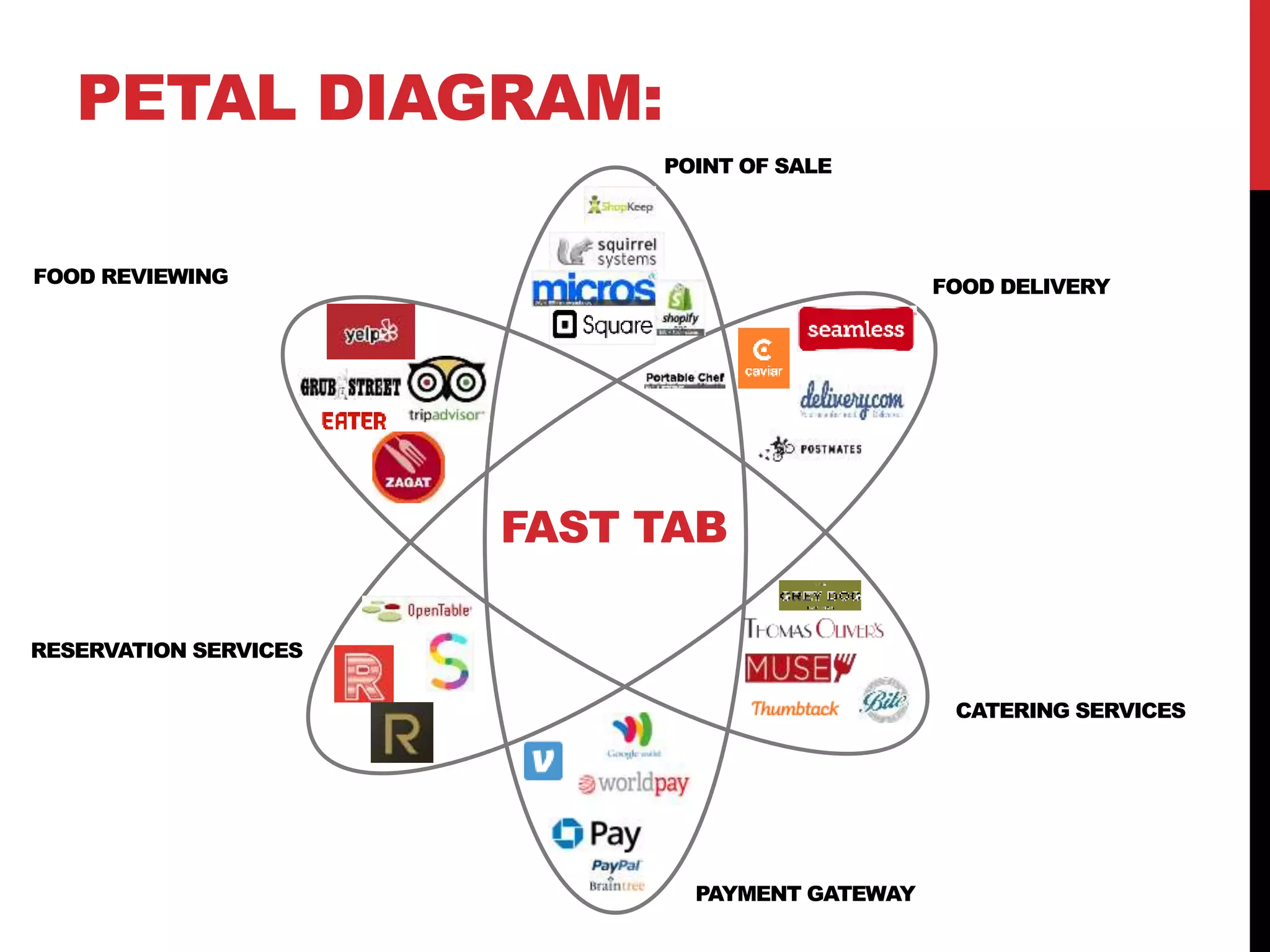

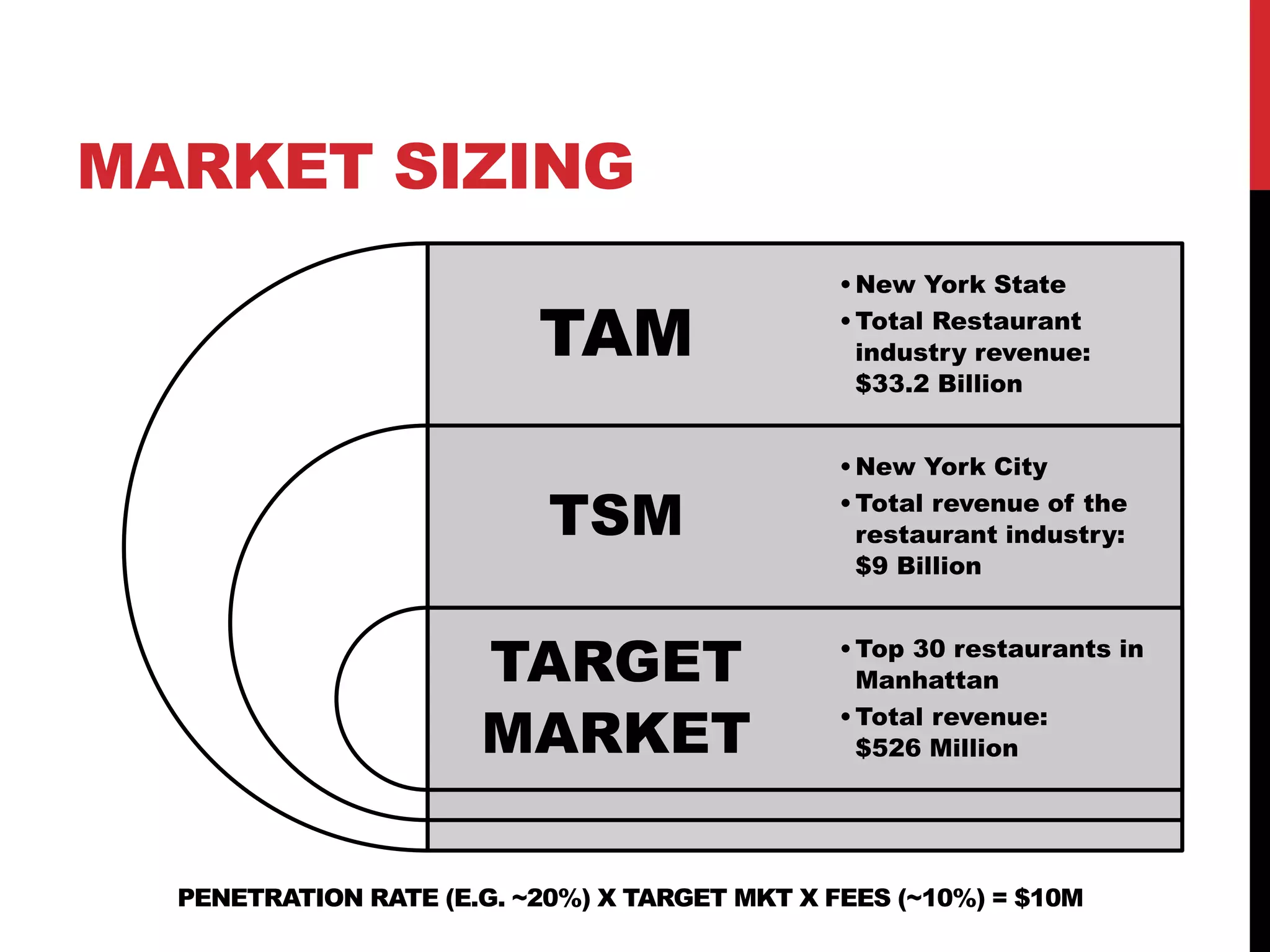

The document outlines a market analysis for a service called Fast Tab, focusing on the restaurant industry, with insights from 123 interviews, revealing a target demographic primarily comprised of young professionals in high-demand sectors. It highlights the value proposition for both customers and restaurants, emphasizing time-saving, quality meals, and reduced turnaround times as key selling points. Additionally, it details a business model dependent on commission fees and subscription charges for restaurants, alongside plans for market penetration and organic growth strategies.