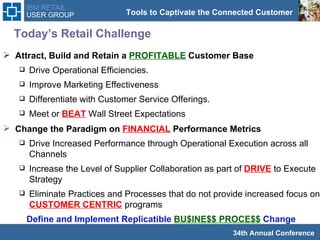

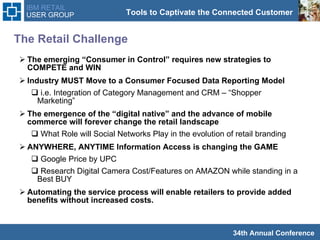

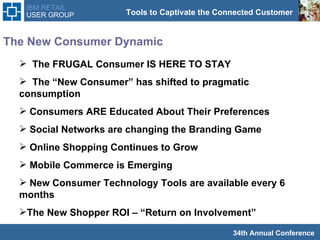

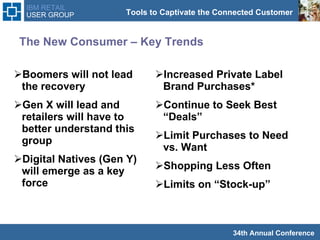

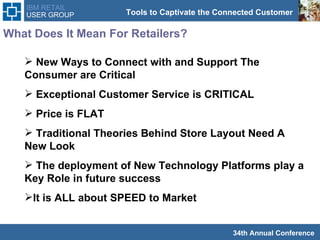

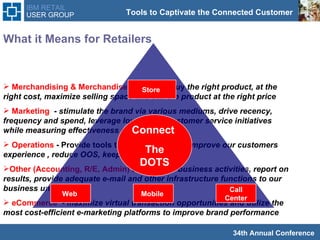

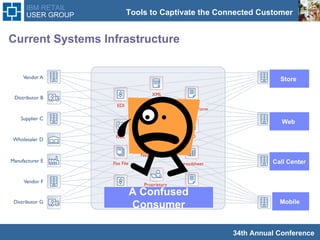

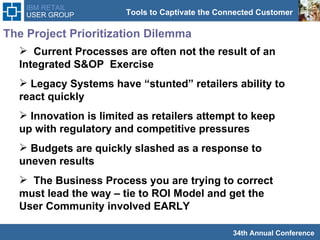

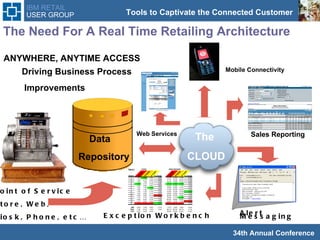

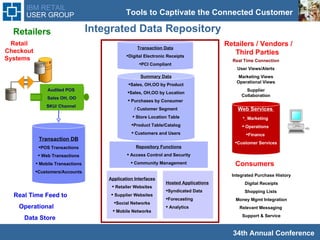

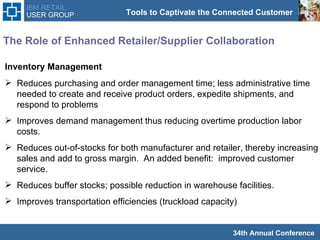

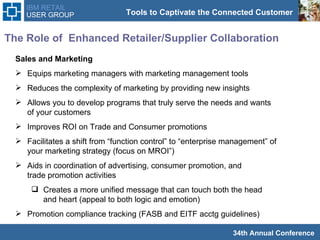

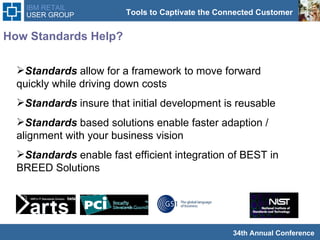

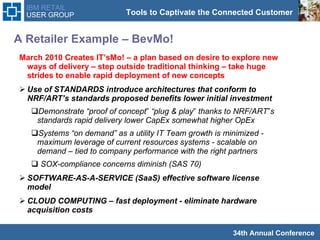

The document discusses the evolving retail landscape driven by consumer control, necessitating new strategies for retailers to attract and retain customers while improving operational efficiency. It emphasizes the importance of integrating technology, adopting real-time retailing, enhancing supplier collaboration, and leveraging consumer data to create effective marketing and operational strategies. The conclusion highlights the need for a flexible infrastructure that allows for rapid adaptation to changing consumer demands and technological advancements.

![How Standards Will Enable Retailers to Compete in a Consumer Controlled World Jim Nadler Principal [email_address]](https://image.slidesharecdn.com/2011presentationibmusersgroupv3-13088440328598-phpapp01-110623105028-phpapp01/75/2011-Presentation-Ibm-Users-Groupv3-1-2048.jpg)