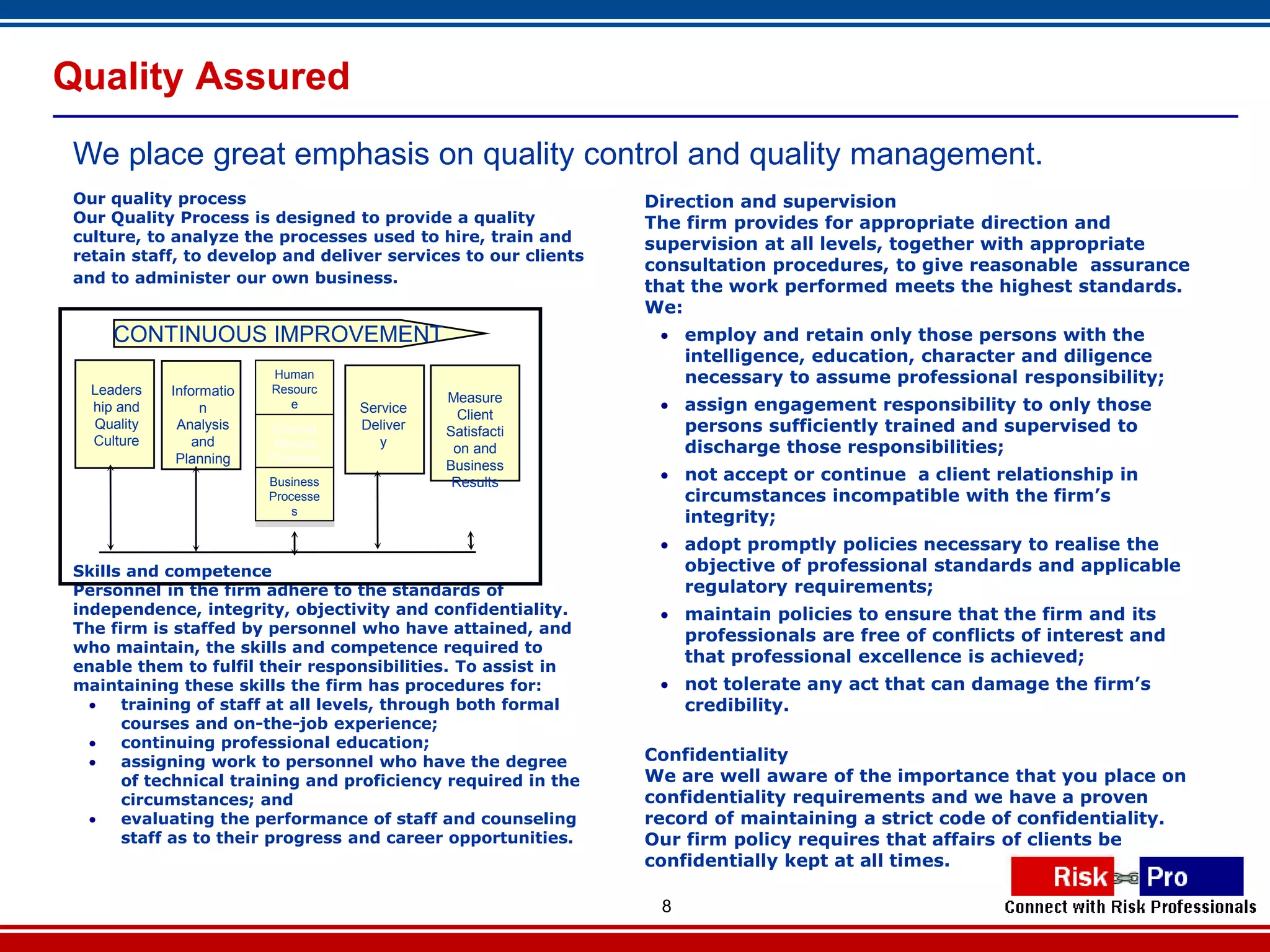

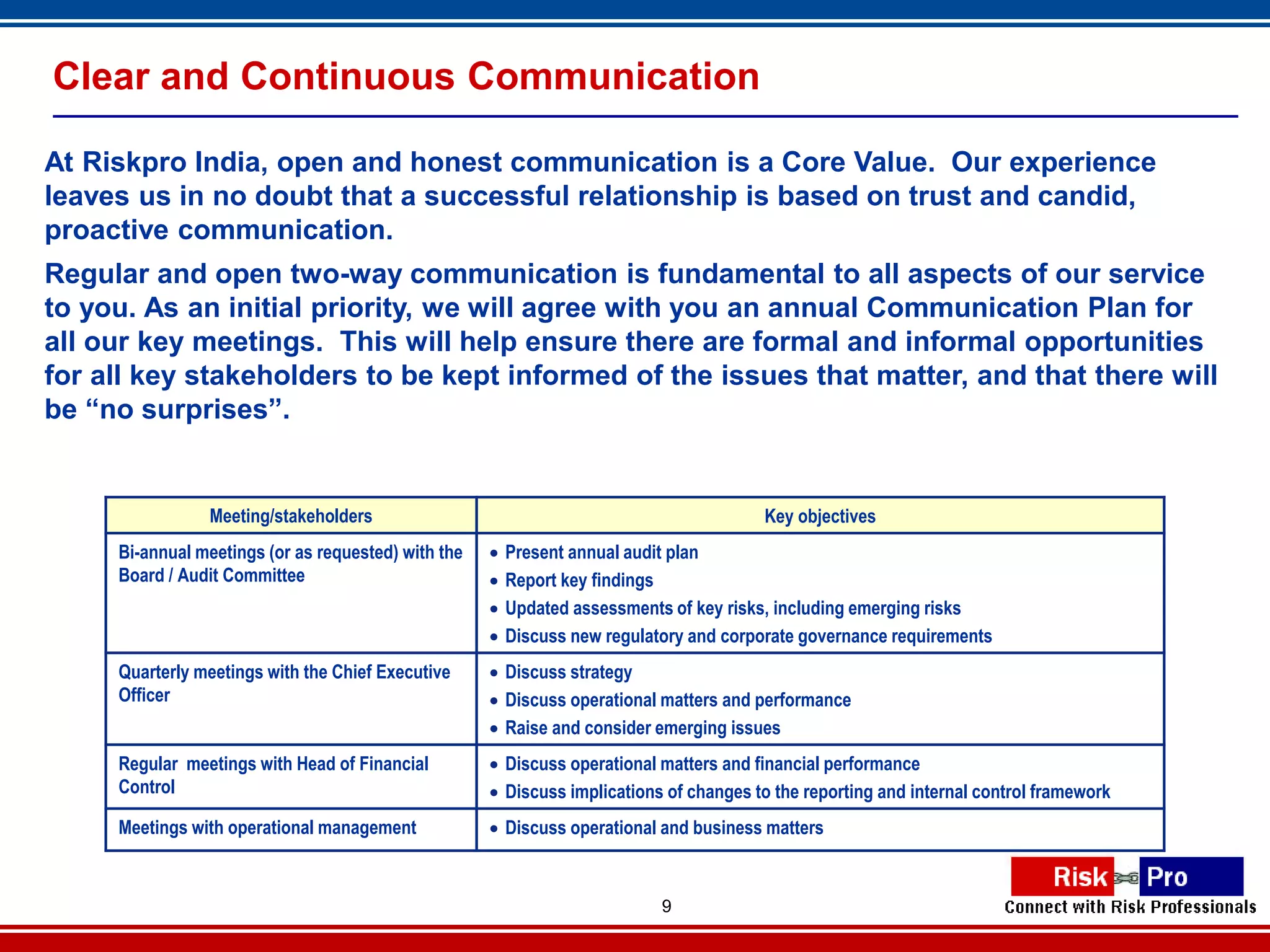

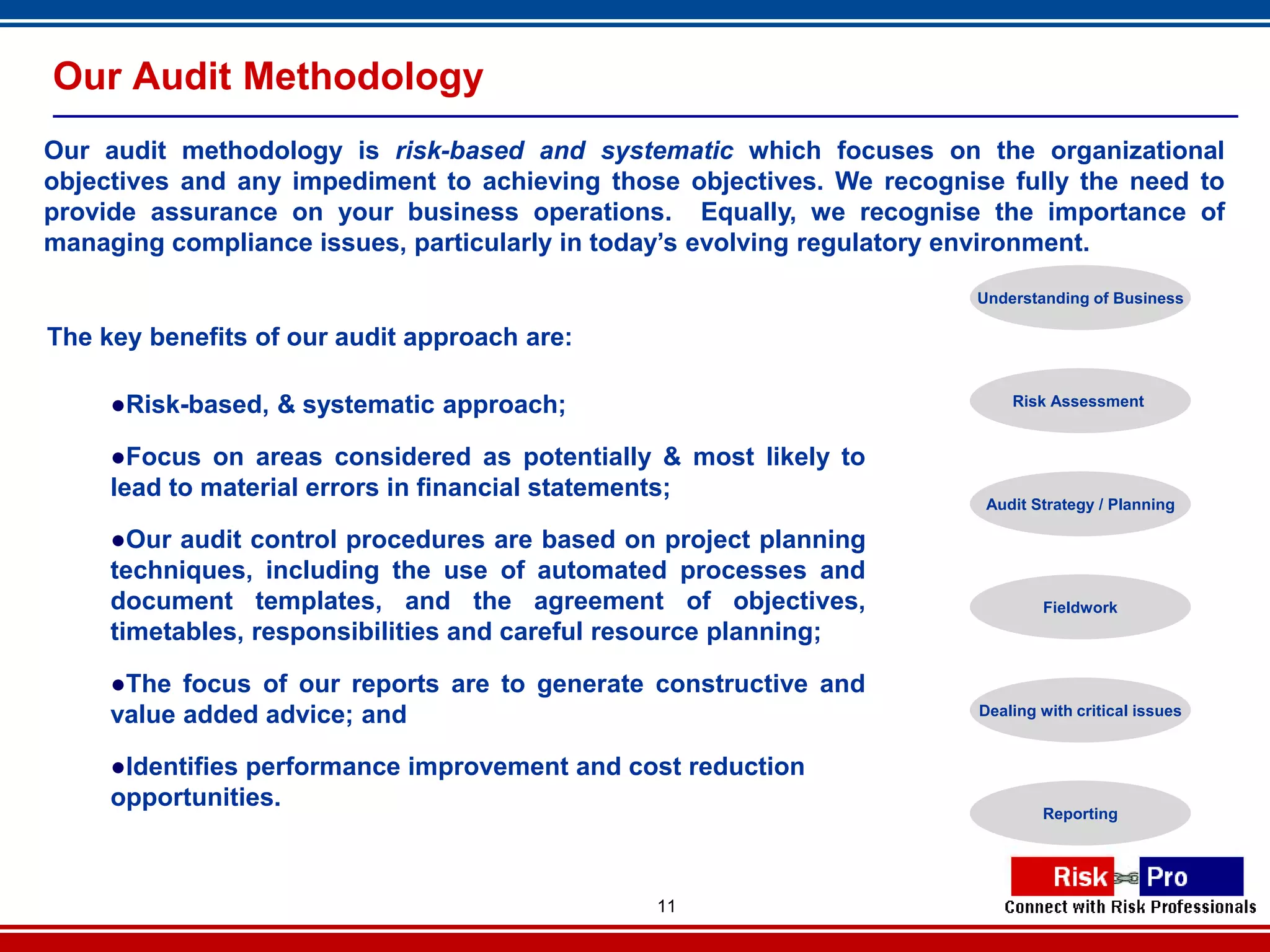

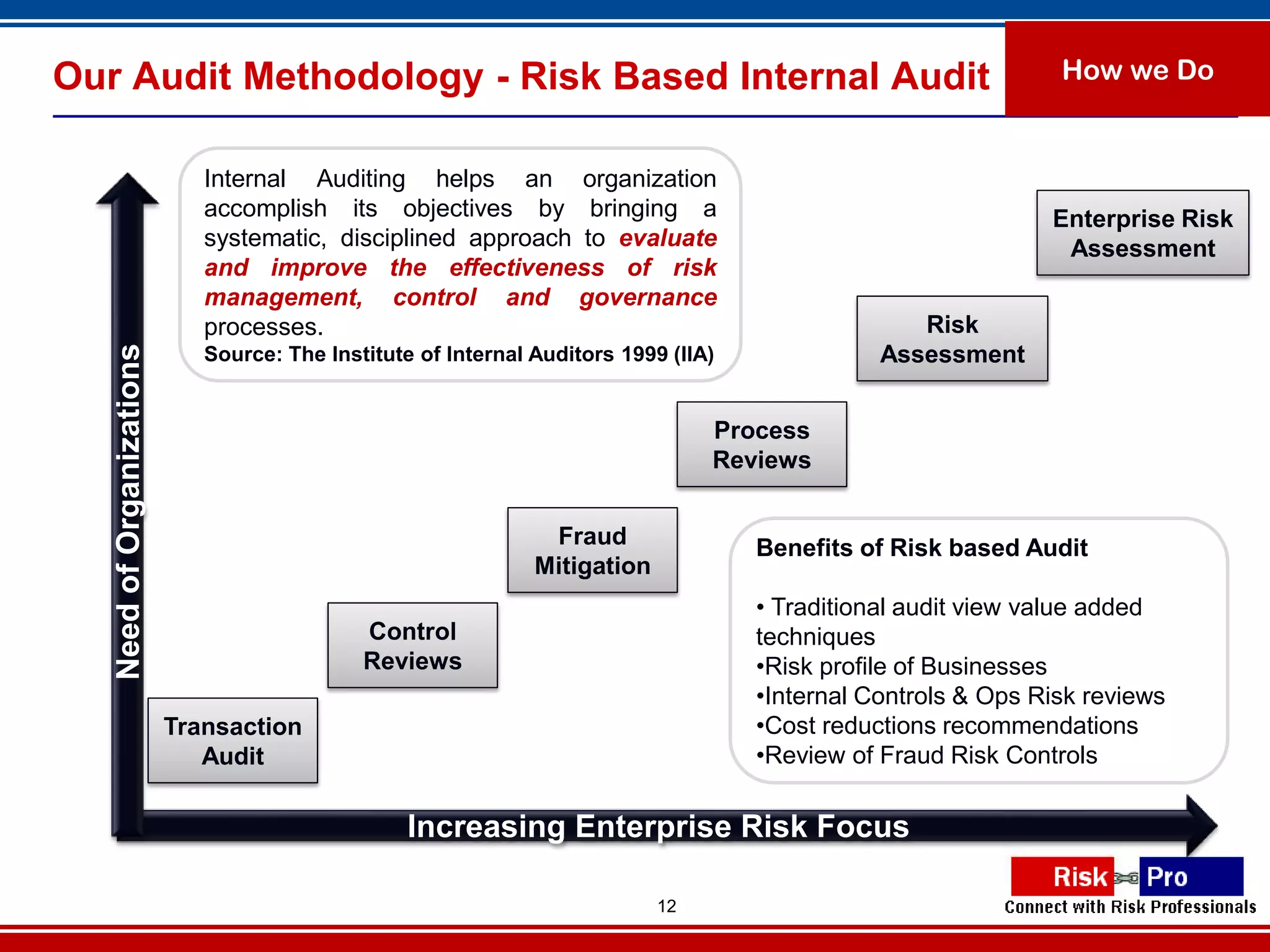

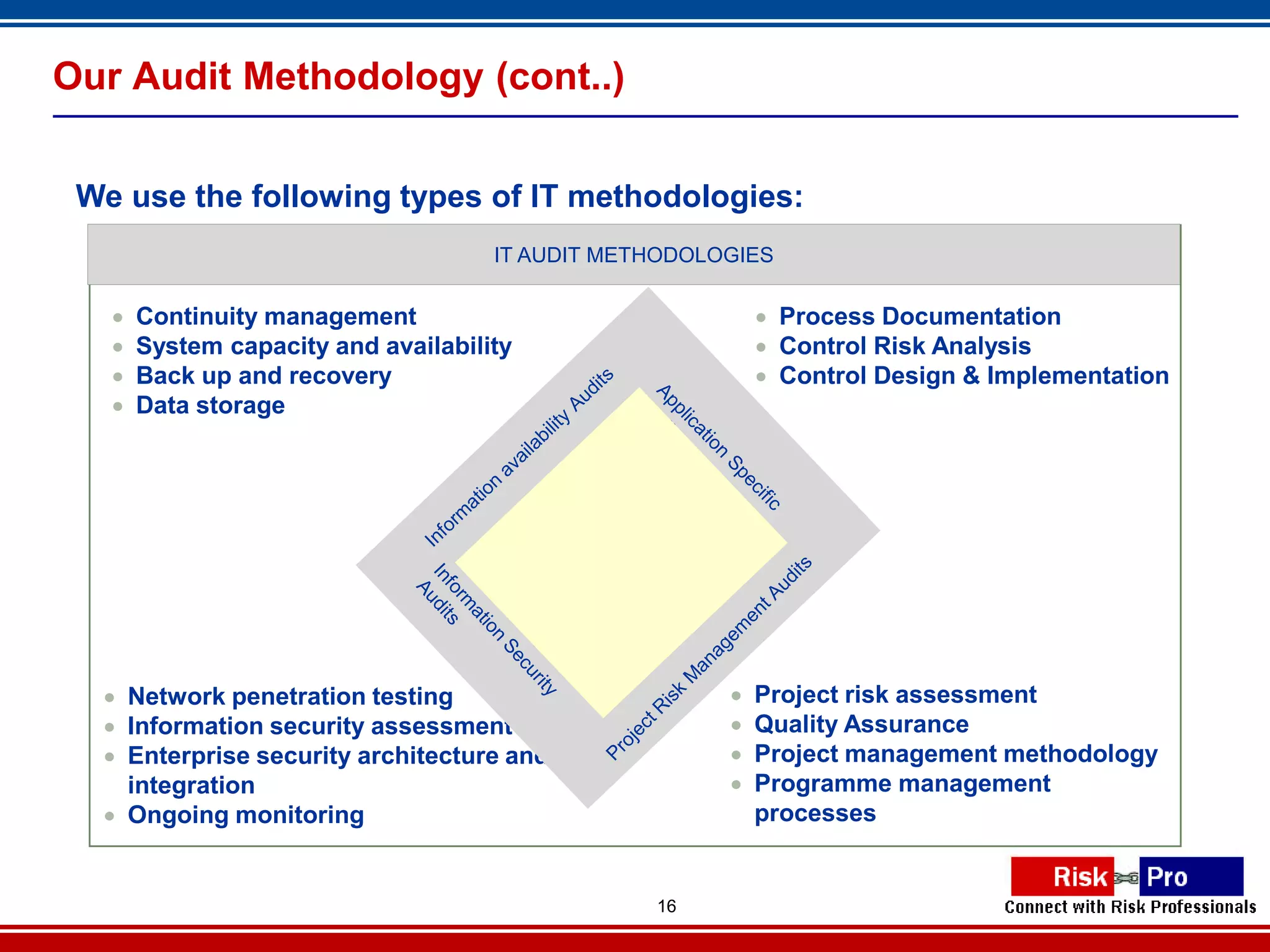

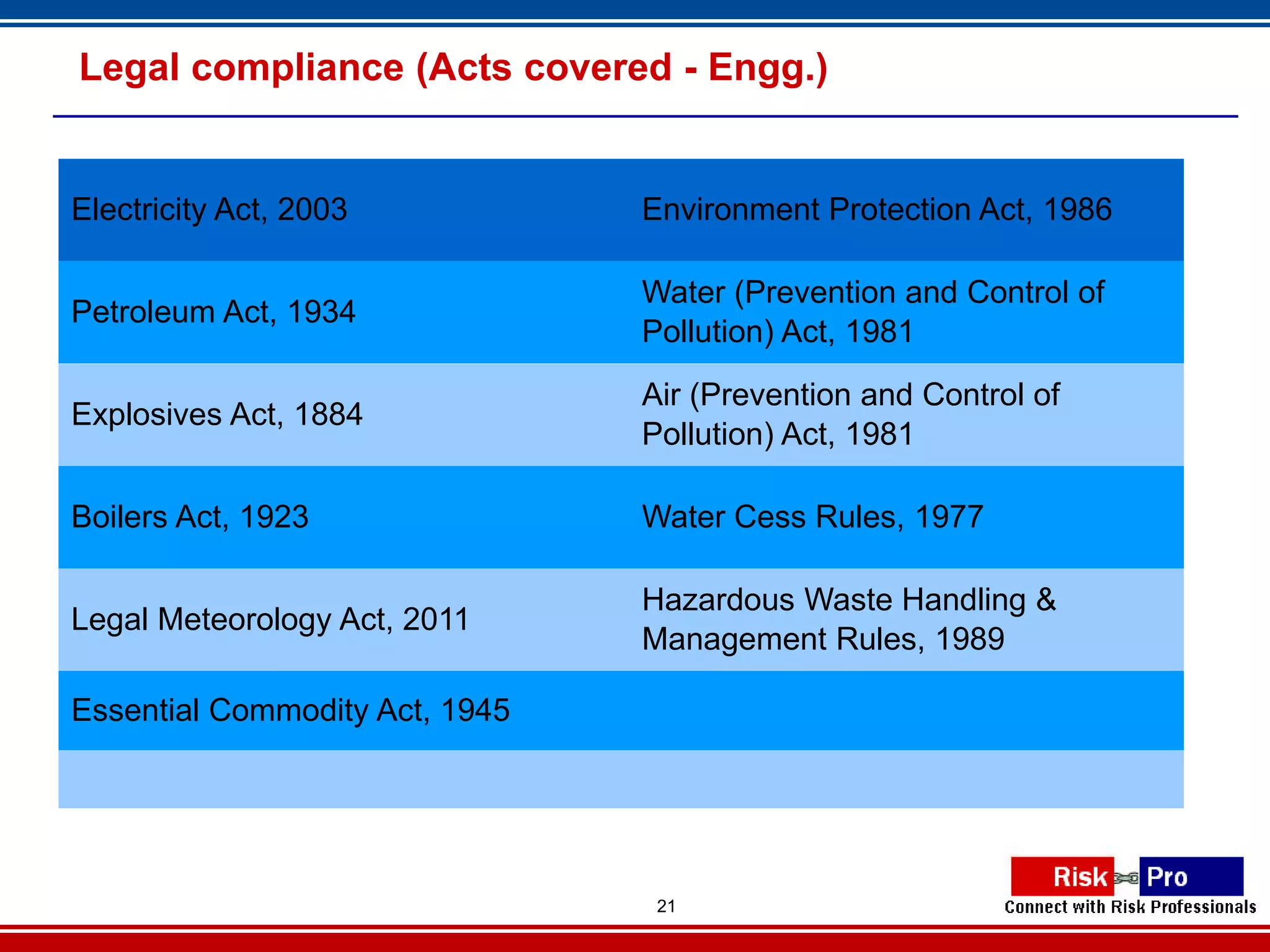

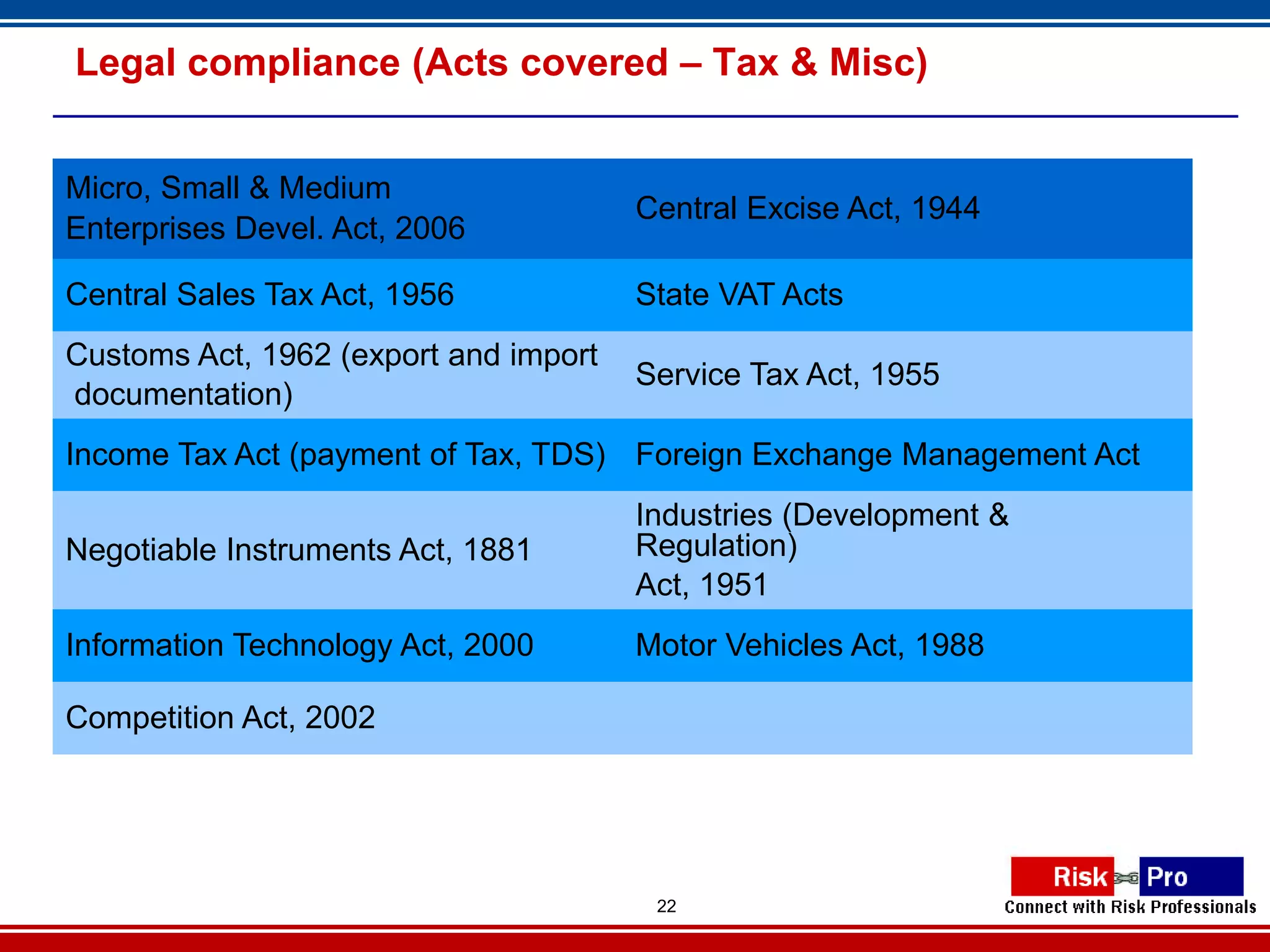

Mehrotra and Mehrotra is an audit firm based in India that uses a risk-based audit methodology. Their methodology focuses on understanding the client's business, assessing risks, developing an audit strategy and plan, performing audit fieldwork, dealing with critical issues, and reporting findings. They aim to provide assurance on operations and identify compliance issues. Their audits are tailored to each client and focus on high-risk areas. They also incorporate IT auditing and use technology to enhance their methodology. The firm ensures legal compliance with various Indian labor, environmental, and tax laws across different stages of the compliance audit process.