Key differences between nbfc and bank

•Download as DOCX, PDF•

0 likes•946 views

Key Differences Between NBFC and Bank

Report

Share

Report

Share

Recommended

More Related Content

What's hot

What's hot (20)

FINANCIAL SYSTEM- FORMAL AND INFORMAL - AND INTRODUCTION TO NBFC

FINANCIAL SYSTEM- FORMAL AND INFORMAL - AND INTRODUCTION TO NBFC

Similar to Key differences between nbfc and bank

Similar to Key differences between nbfc and bank (20)

Chapter3 privateandmultinationalbanks-160807125332

Chapter3 privateandmultinationalbanks-160807125332

Presentation on advances to agents/intermediaries based on consideration of d...

Presentation on advances to agents/intermediaries based on consideration of d...

NBFC Registration,NBFC License,NBFC License procedure

NBFC Registration,NBFC License,NBFC License procedure

Local Bank Financial Constraints and Firm Access To E-Fin.pptx

Local Bank Financial Constraints and Firm Access To E-Fin.pptx

Recently uploaded

""wsp;+971581248768 "/BUY%$ AbORTION PILLS ORIGNAL%In DUBAI ))%3 ((+971_58*124*8768((#Abortion Pills in Dubai#)Abu Dhabi#. #UAE# DUBAI #| SHARJAH#UAE💉💊+971581248768>> SAFE AND ORIGINAL ABORTION PILLS FOR SALE IN DUBAI AND ABUDHABI}}+971581248768

+971581248768 Mtp-Kit (500MG) Prices » Dubai [(+971581248768**)] Abortion Pills For Sale In Dubai, UAE, Mifepristone and Misoprostol Tablets Available In Dubai, UAE CONTACT DR.Maya Whatsapp +971581248768 We Have Abortion Pills / Cytotec Tablets /Mifegest Kit Available in Dubai, Sharjah, Abudhabi, Ajman, Alain, Fujairah, Ras Al Khaimah, Umm Al Quwain, UAE, Buy cytotec in Dubai +971581248768''''Abortion Pills near me DUBAI | ABU DHABI|UAE. Price of Misoprostol, Cytotec” +971581248768' Dr.DEEM ''BUY ABORTION PILLS MIFEGEST KIT, MISOPROTONE, CYTOTEC PILLS IN DUBAI, ABU DHABI,UAE'' Contact me now via What's App…… abortion Pills Cytotec also available Oman Qatar Doha Saudi Arabia Bahrain Above all, Cytotec Abortion Pills are Available In Dubai / UAE, you will be very happy to do abortion in Dubai we are providing cytotec 200mg abortion pill in Dubai, UAE. Medication abortion offers an alternative to Surgical Abortion for women in the early weeks of pregnancy. We only offer abortion pills from 1 week-6 Months. We then advise you to use surgery if its beyond 6 months. Our Abu Dhabi, Ajman, Al Ain, Dubai, Fujairah, Ras Al Khaimah (RAK), Sharjah, Umm Al Quwain (UAQ) United Arab Emirates Abortion Clinic provides the safest and most advanced techniques for providing non-surgical, medical and surgical abortion methods for early through late second trimester, including the Abortion By Pill Procedure (RU 486, Mifeprex, Mifepristone, early options French Abortion Pill), Tamoxifen, Methotrexate and Cytotec (Misoprostol). The Abu Dhabi, United Arab Emirates Abortion Clinic performs Same Day Abortion Procedure using medications that are taken on the first day of the office visit and will cause the abortion to occur generally within 4 to 6 hours (as early as 30 minutes) for patients who are 3 to 12 weeks pregnant. When Mifepristone and Misoprostol are used, 50% of patients complete in 4 to 6 hours; 75% to 80% in 12 hours; and 90% in 24 hours. We use a regimen that allows for completion without the need for surgery 99% of the time. All advanced second trimester and late term pregnancies at our Tampa clinic (17 to 24 weeks or greater) can be completed within 24 hours or less 99% of the time without the need surgery. The procedure is completed with minimal to no complications. Our Women's Health Center located in Abu Dhabi, United Arab Emirates, uses the latest medications for medical abortions (RU-486, Mifeprex, Mifegyne, Mifepristone, early options French abortion pill), Methotrexate and Cytotec (Misoprostol). The safety standards of our Abu Dhabi, United Arab Emirates Abortion Doctors remain unparalleled. They consistently maintain the lowest complication rates throughout the nation.Contact +971581248768 for 100% original and safe abortion pills available for...

Contact +971581248768 for 100% original and safe abortion pills available for...DUBAI (+971)581248768 BUY ABORTION PILLS IN ABU dhabi...Qatar

Falcon stands out as a top-tier P2P Invoice Discounting platform in India, bridging esteemed blue-chip companies and eager investors. Our goal is to transform the investment landscape in India by establishing a comprehensive destination for borrowers and investors with diverse profiles and needs, all while minimizing risk. What sets Falcon apart is the elimination of intermediaries such as commercial banks and depository institutions, allowing investors to enjoy higher yields.Falcon Invoice Discounting: The best investment platform in india for investors

Falcon Invoice Discounting: The best investment platform in india for investorsFalcon Invoice Discounting

Recently uploaded (20)

Goal Presentation_NEW EMPLOYEE_NETAPS FOUNDATION.pptx

Goal Presentation_NEW EMPLOYEE_NETAPS FOUNDATION.pptx

2024 May - Clearbit Integration with Hubspot - Greenville HUG.pptx

2024 May - Clearbit Integration with Hubspot - Greenville HUG.pptx

Home Furnishings Ecommerce Platform Short Pitch 2024

Home Furnishings Ecommerce Platform Short Pitch 2024

Pre Engineered Building Manufacturers Hyderabad.pptx

Pre Engineered Building Manufacturers Hyderabad.pptx

Falcon Invoice Discounting: Aviate Your Cash Flow Challenges

Falcon Invoice Discounting: Aviate Your Cash Flow Challenges

Managerial Accounting 5th Edition by Stacey Whitecotton test bank.docx

Managerial Accounting 5th Edition by Stacey Whitecotton test bank.docx

Contact +971581248768 for 100% original and safe abortion pills available for...

Contact +971581248768 for 100% original and safe abortion pills available for...

Falcon Invoice Discounting: Empowering Your Business Growth

Falcon Invoice Discounting: Empowering Your Business Growth

Thompson_Taylor_MBBS_PB1_2024-03 (1)- Project & Portfolio 2.pptx

Thompson_Taylor_MBBS_PB1_2024-03 (1)- Project & Portfolio 2.pptx

The Vietnam Believer Newsletter_May 13th, 2024_ENVol. 007.pdf

The Vietnam Believer Newsletter_May 13th, 2024_ENVol. 007.pdf

10 Influential Leaders Defining the Future of Digital Banking in 2024.pdf

10 Influential Leaders Defining the Future of Digital Banking in 2024.pdf

Falcon Invoice Discounting: The best investment platform in india for investors

Falcon Invoice Discounting: The best investment platform in india for investors

SEO Case Study: How I Increased SEO Traffic & Ranking by 50-60% in 6 Months

SEO Case Study: How I Increased SEO Traffic & Ranking by 50-60% in 6 Months

HomeRoots Pitch Deck | Investor Insights | April 2024

HomeRoots Pitch Deck | Investor Insights | April 2024

Lundin Gold - Q1 2024 Conference Call Presentation (Revised)

Lundin Gold - Q1 2024 Conference Call Presentation (Revised)

obat aborsi bandung wa 081336238223 jual obat aborsi cytotec asli di bandung9...

obat aborsi bandung wa 081336238223 jual obat aborsi cytotec asli di bandung9...

Jual obat aborsi Hongkong ( 085657271886 ) Cytote pil telat bulan penggugur k...

Jual obat aborsi Hongkong ( 085657271886 ) Cytote pil telat bulan penggugur k...

Challenges and Opportunities: A Qualitative Study on Tax Compliance in Pakistan

Challenges and Opportunities: A Qualitative Study on Tax Compliance in Pakistan

Key differences between nbfc and bank

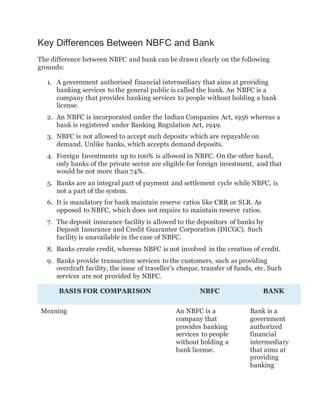

- 1. Key Differences Between NBFC and Bank The difference between NBFC and bank can be drawn clearly on the following grounds: 1. A government authorised financial intermediary that aims at providing banking services to the general public is called the bank. An NBFC is a company that provides banking services to people without holding a bank license. 2. An NBFC is incorporated under the Indian Companies Act, 1956 whereas a bank is registered under Banking Regulation Act, 1949. 3. NBFC is not allowed to accept such deposits which are repayable on demand. Unlike banks, which accepts demand deposits. 4. Foreign Investments up to 100% is allowed in NBFC. On the other hand, only banks of the private sector are eligible for foreign investment, and that would be not more than 74%. 5. Banks are an integral part of payment and settlement cycle while NBFC, is not a part of the system. 6. It is mandatory for bank maintain reserve ratios like CRR or SLR. As opposed to NBFC, which does not require to maintain reserve ratios. 7. The deposit insurance facility is allowed to the depositors of banks by Deposit Insurance and Credit Guarantee Corporation (DICGC). Such facility is unavailable in the case of NBFC. 8. Banks create credit, whereas NBFC is not involved in the creation of credit. 9. Banks provide transaction services to the customers, such as providing overdraft facility, the issue of traveller’s cheque, transfer of funds, etc. Such services are not provided by NBFC. BASIS FOR COMPARISON NBFC BANK Meaning An NBFC is a company that provides banking services to people without holding a bank license. Bank is a government authorized financial intermediary that aims at providing banking

- 2. BASIS FOR COMPARISON NBFC BANK services to the general public. Incorporated under Companies Act 1956 Banking Regulation Act, 1949 Demand Deposit Not Accepted Accepted Foreign Investment Allowed up to 100% Allowed up to 74% for private sector banks Payment and Settlement system Not a part of system. Integral part of the system. Maintenance of Reserve Ratios Not required Compulsory Deposit insurance facility Not available Available Credit creation NBFC do not create credit. Banks create credit. Transaction services Not provided by NBFC. Provided by banks. Branch Banking Unit Banking About A bank that is connected to one or more other banks in an area or outside of it. Provides all the usual financial services but is Single, usually small bank that provides financial services to its local

- 3. BASIS FOR COMPARISON NBFC BANK backed and ultimately controlled by a larger financial institution. community. Does not have other bank branches elsewhere. Stability Typically very resilient, able to withstand local recessions (e.g., a bad harvest season in a farming community) thanks to the backing of other branches. Extremely prone to failure when local economy struggles. Operational Freedom Less More Legal History Restricted or prohibited for most of U.S. history. Allowed in all 50 states following the Riegle- Neal Interstate Banking and Branching Efficiency Act of 1994. Preferred form of banking for most of U.S. history, despite its tendency to fail. Proponents were wary of branch banking's concentration of power and money. Loans and advances Loans and advances are based on merit, irrespective of the status . Loans and advances can be influenced by authority and power. Financial resources Larger financial resources in each branch. Larger financial resources in one branch Decision-making Delay in Decision- making as they have to depend on the head office. Time is saved as Decision- making is in the same branch.

- 4. BASIS FOR COMPARISON NBFC BANK Funds Funds are transferred from one branch to another.Underutilisation of funds by a branch would lead to regional imbalances Funds are allocated in one branch and no support of other branches.During financial crisis,unit bank has to close down.hence lead to regional imbalances or no balance growth Cost of supervision High Less Concentration of power in the hand of few people Yes No Specialisation Division of labour is possible and hence specialisation possible Specialisation not possible due to lack of trained staff and knowledge Competition High competiton with the branches Less competition within the bank Profits Shared by the bank with its branches Used for the development of the bank Specialised knowledge of the local borrowers Not possible and hence bad debits are high Possible and less risk of bad debts Distribution of Capital Proper distribution of capital and power. No proper distribution of capital and power.

- 5. BASIS FOR COMPARISON NBFC BANK Rate of interest Rate of interest is uniformed and specified by the head office or based on instructions from RBI. Rate of interest is not uniformed as the bank has own policies and rates. Deposits and assets Deposits and assets are diversified,scattered and hence risk is spead at various places. Deposits and assets are nt diversified and are at one place,hence risk is not spread.