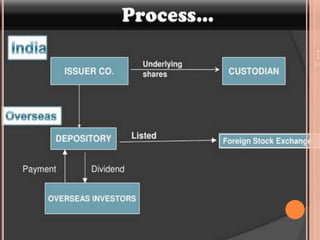

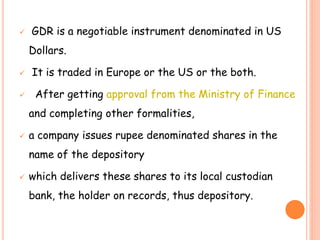

A Global Depository Receipt (GDR) is a negotiable instrument denominated in US dollars that represents shares of a non-US company. To issue a GDR, a company first issues rupee-denominated shares to an overseas depository bank, which then issues dollar-denominated depository receipts to foreign investors in exchange. GDRs offer companies advantages like less regulatory requirements and easier access to foreign capital, while providing foreign investors a way to invest in Indian companies without direct registration in India.