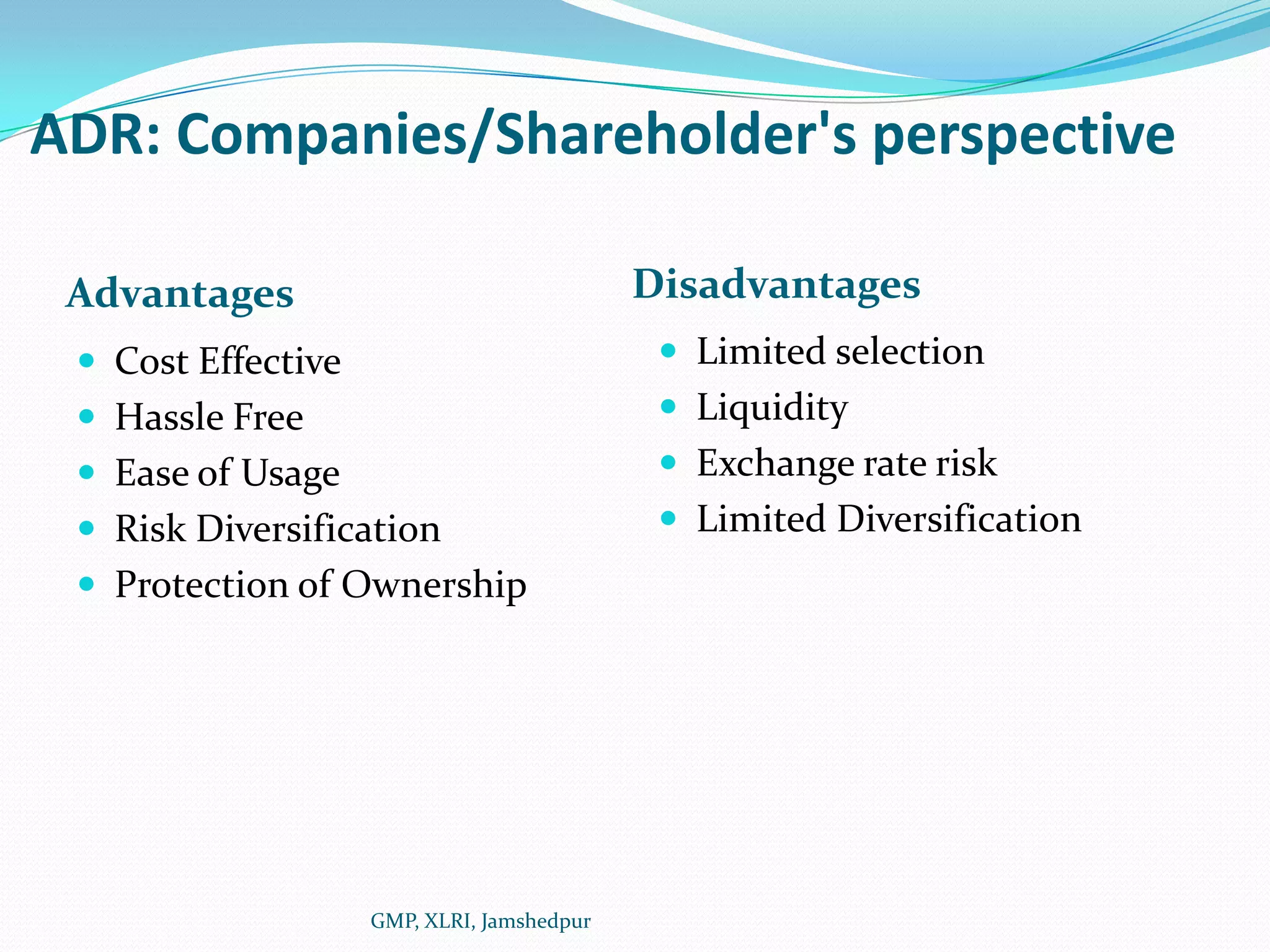

American Depository Receipts (ADRs) represent shares of a foreign company that trade on an American stock exchange. There are three levels of ADRs with different regulatory requirements. Level 1 ADRs trade over-the-counter with the least regulation, while Level 3 ADRs have the most rigorous regulations, potentially including raising capital from US investors. ADRs make it possible for US investors to gain international stock exposure without having to deal with foreign exchange or open overseas accounts. Global Depository Receipts (GDRs) operate similarly but trade on exchanges outside the US, while Indian Depository Receipts (IDRs) allow foreign companies to issue shares to Indian investors.