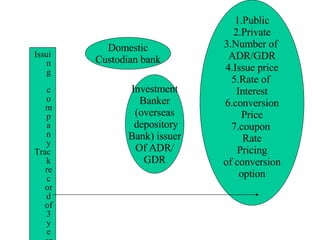

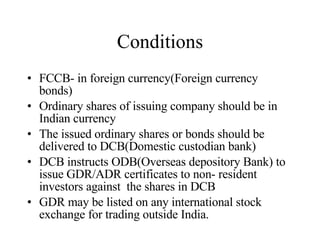

1. Global Depository Receipts (GDRs) and American Depository Receipts (ADRs) represent an interest in underlying shares of an Indian company that are held in custody by a domestic custodian bank on behalf of international depositories.

2. The international depositories then issue depository receipts to non-resident investors, entitling them to the underlying shares. Depository receipts can be listed and traded on international stock exchanges.

3. Indian companies can raise capital through issuing GDRs/ADRs/FCCBs without any investment ceilings. Eligible companies must have a consistent track record of good performance for at least 3 years.