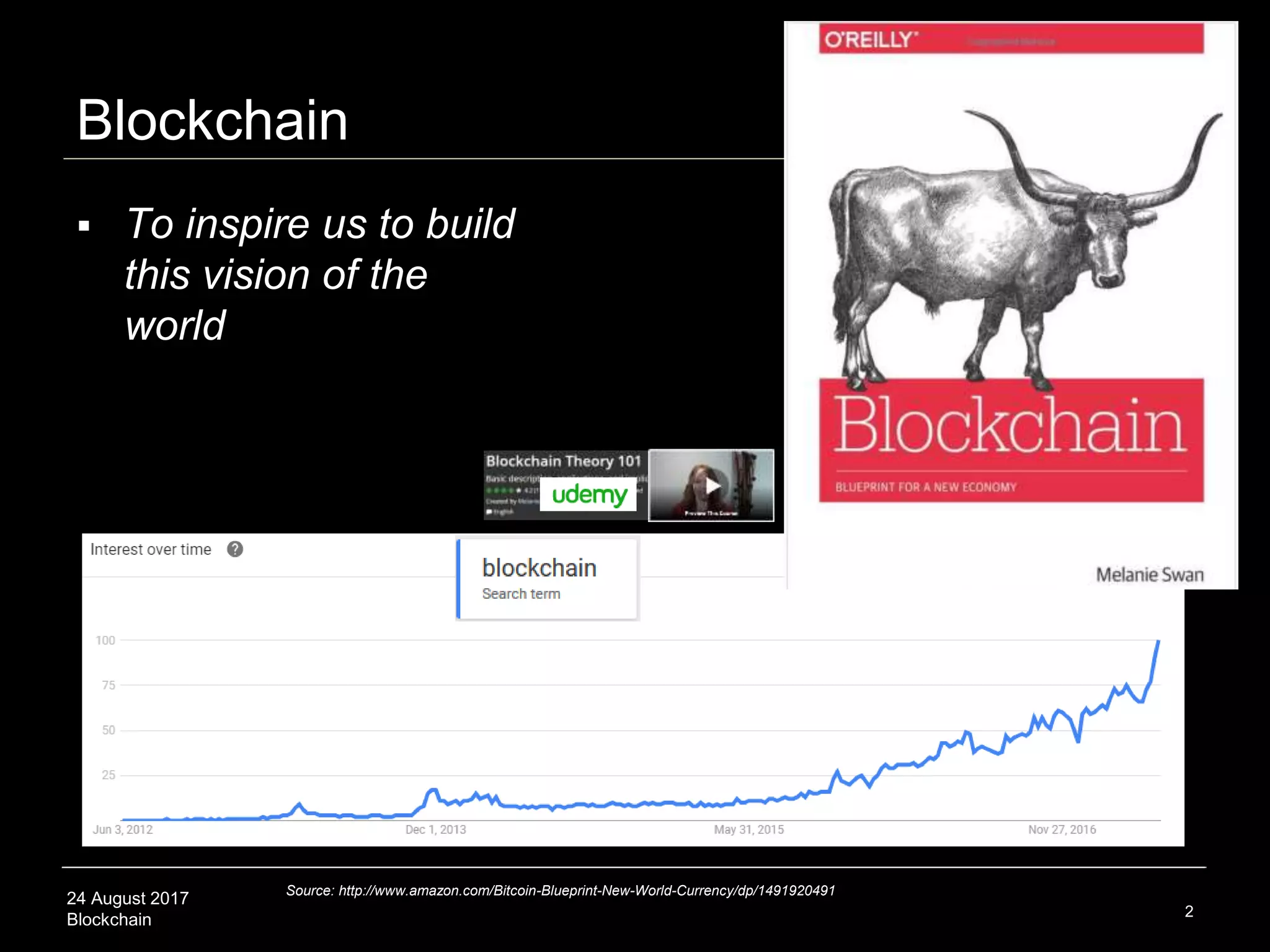

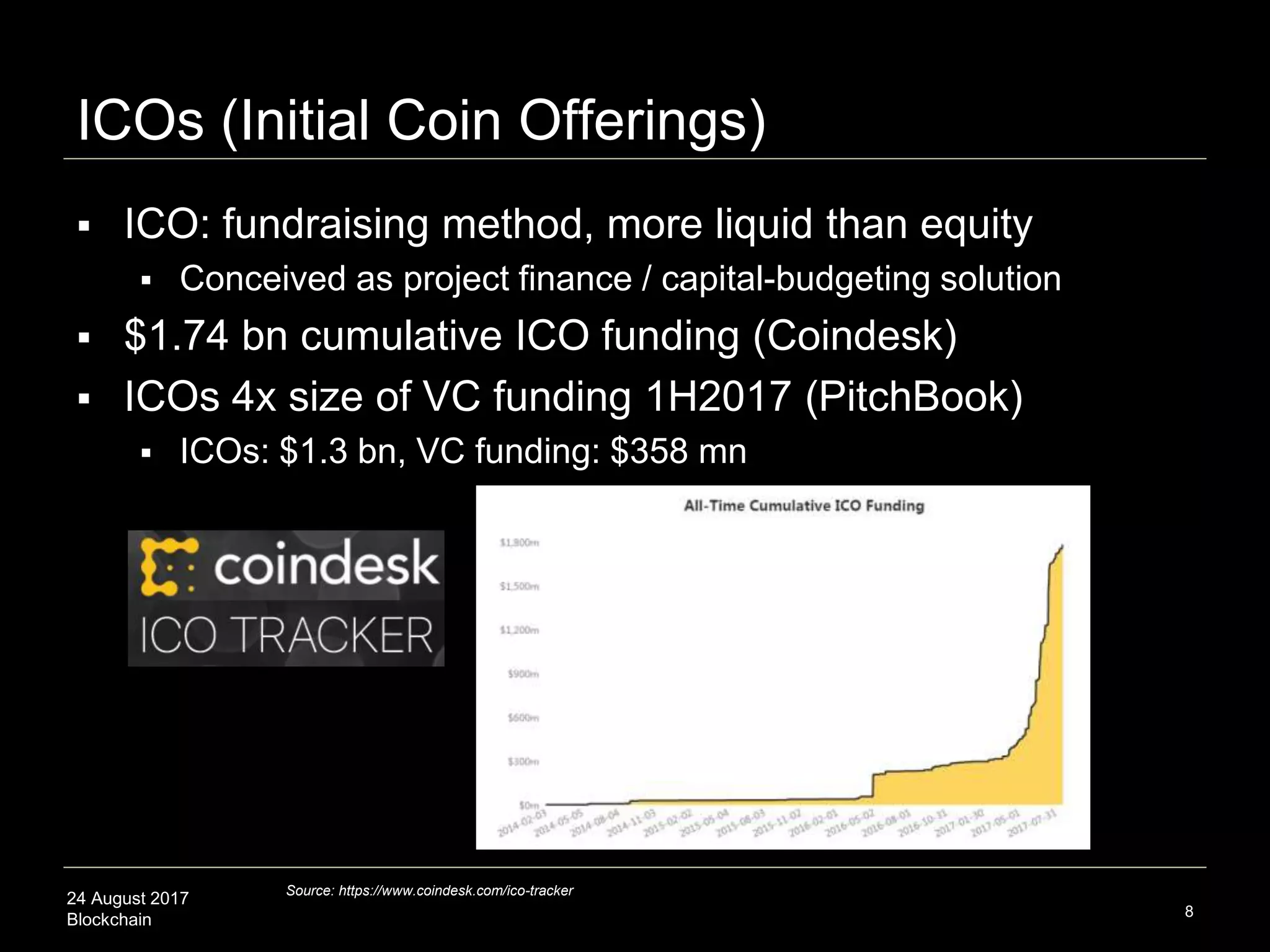

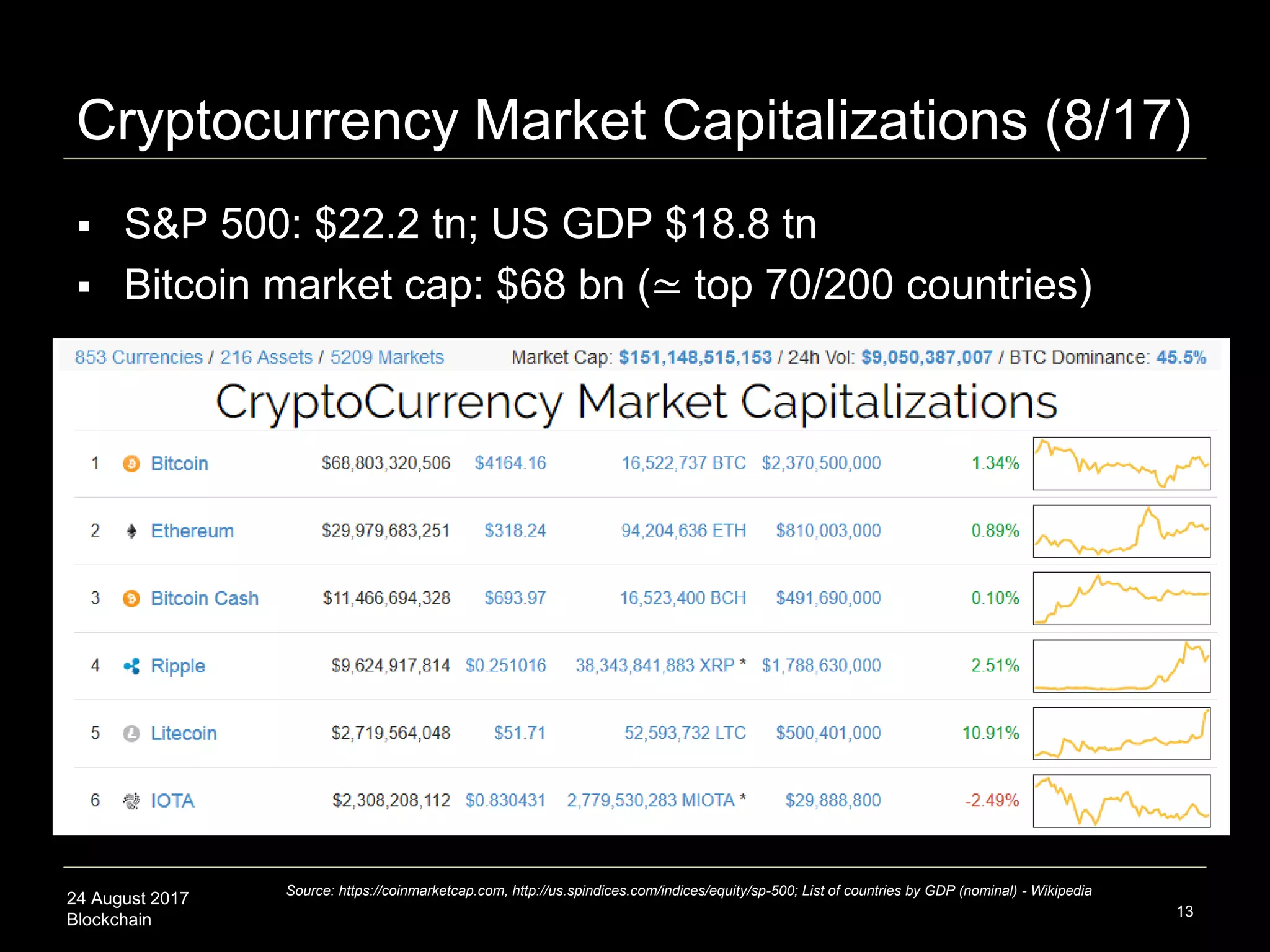

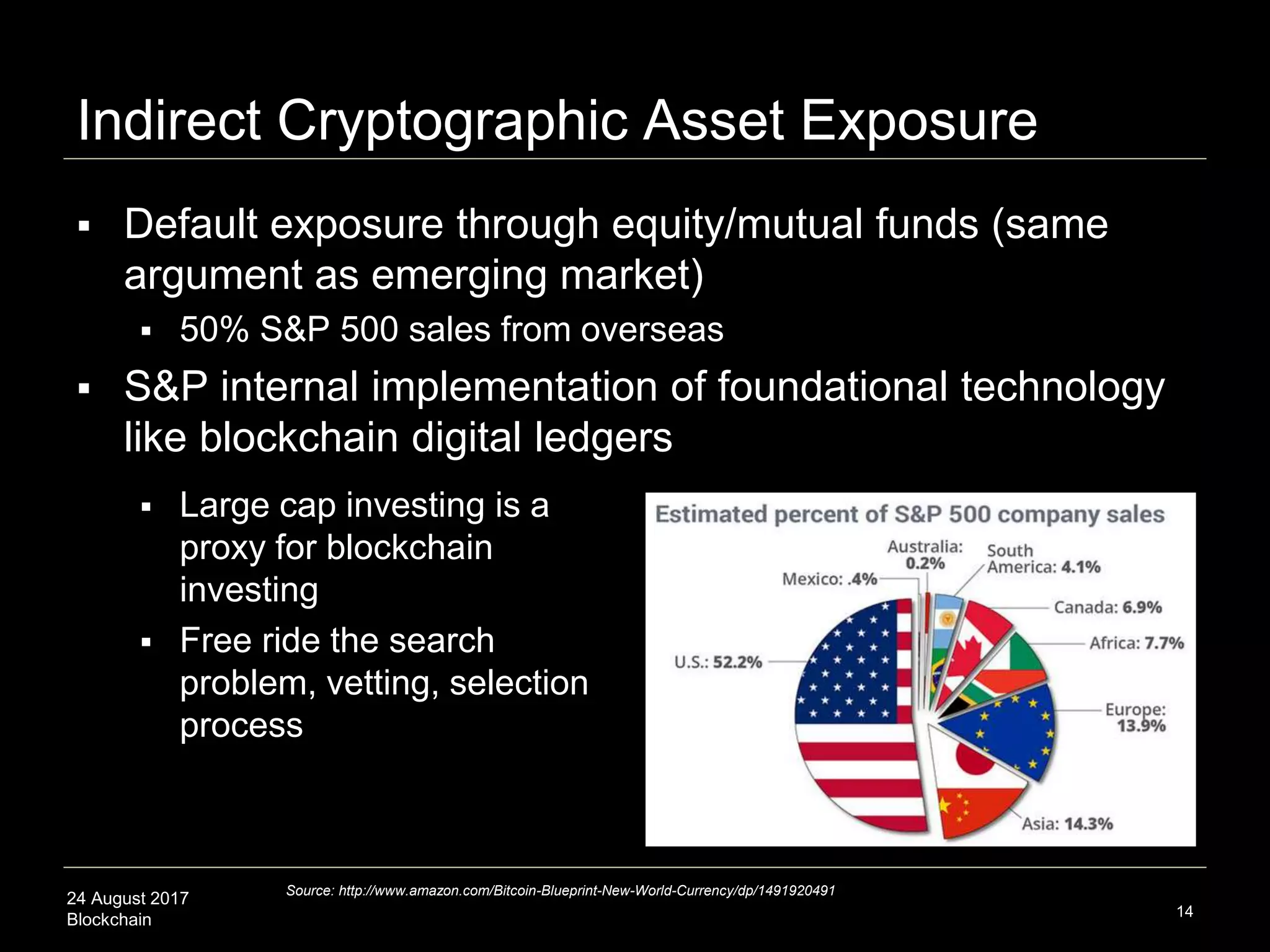

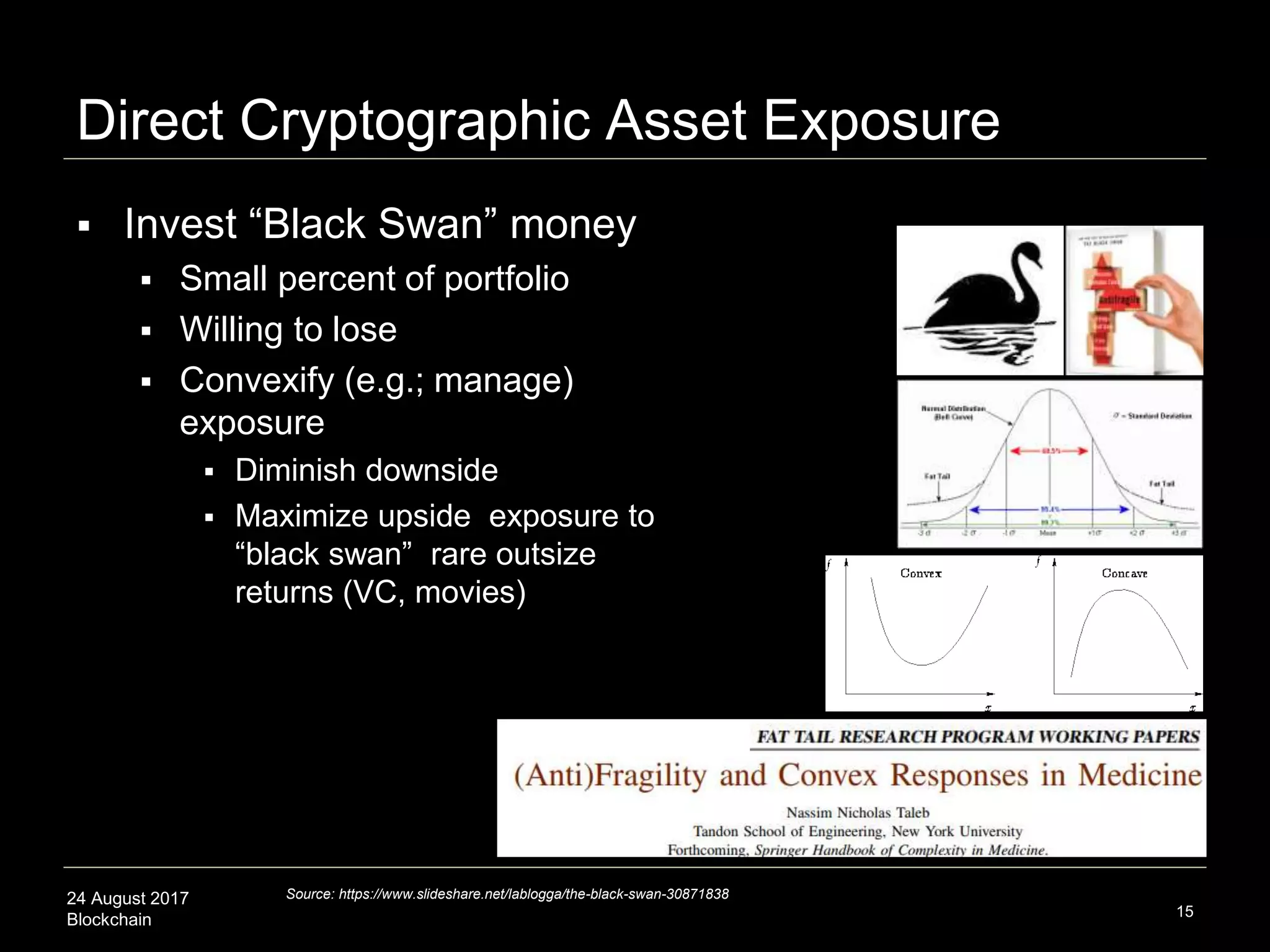

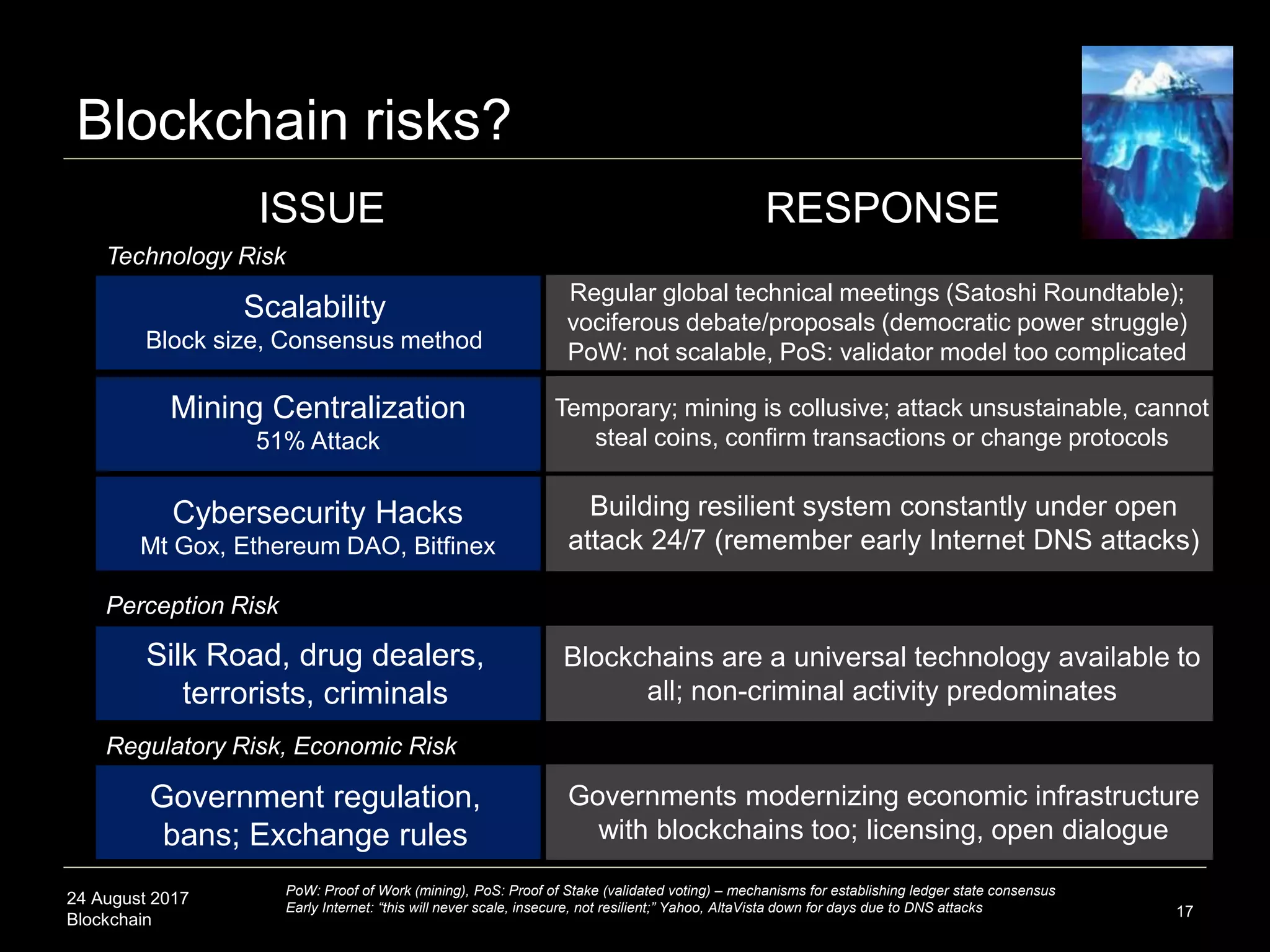

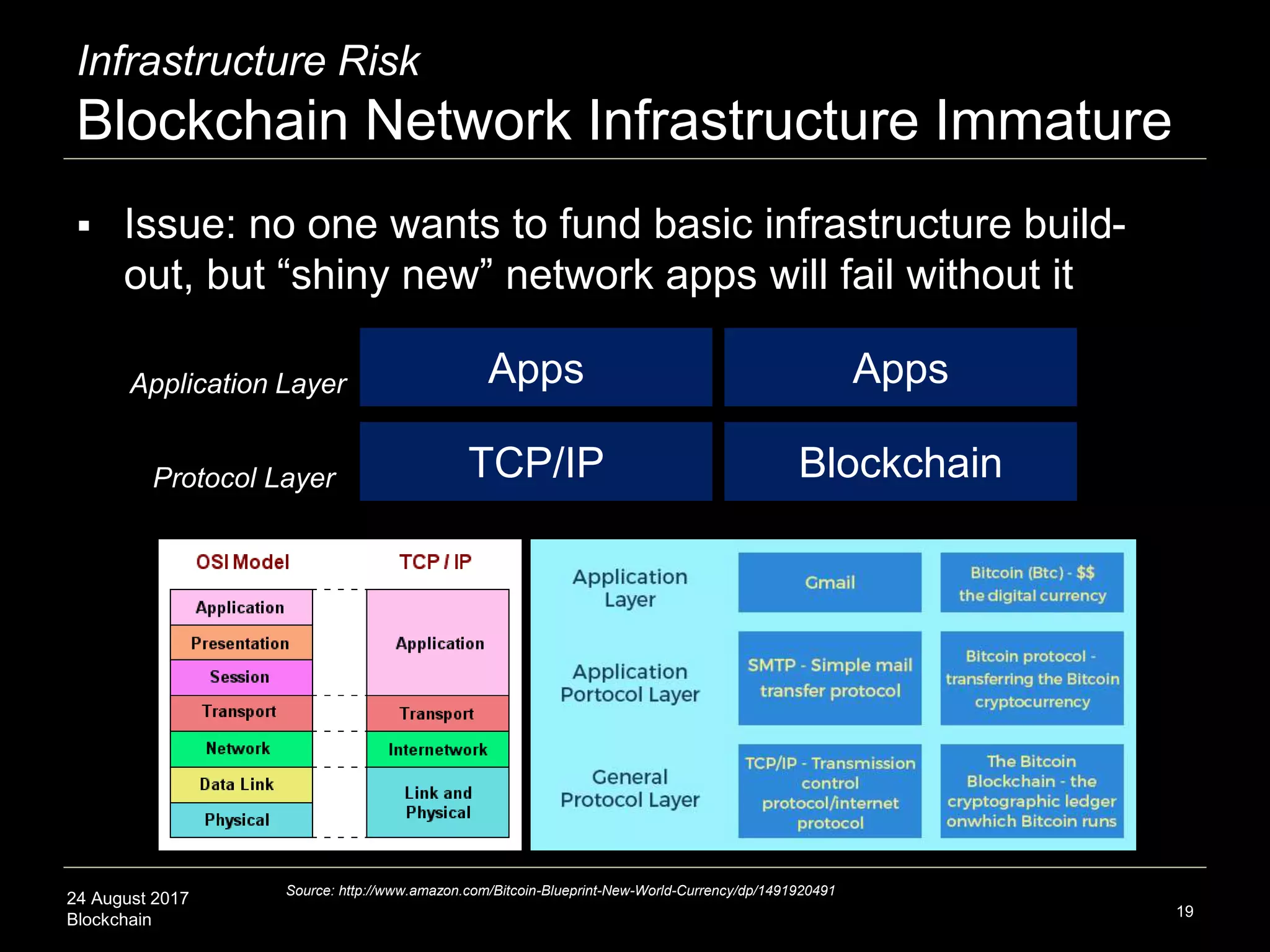

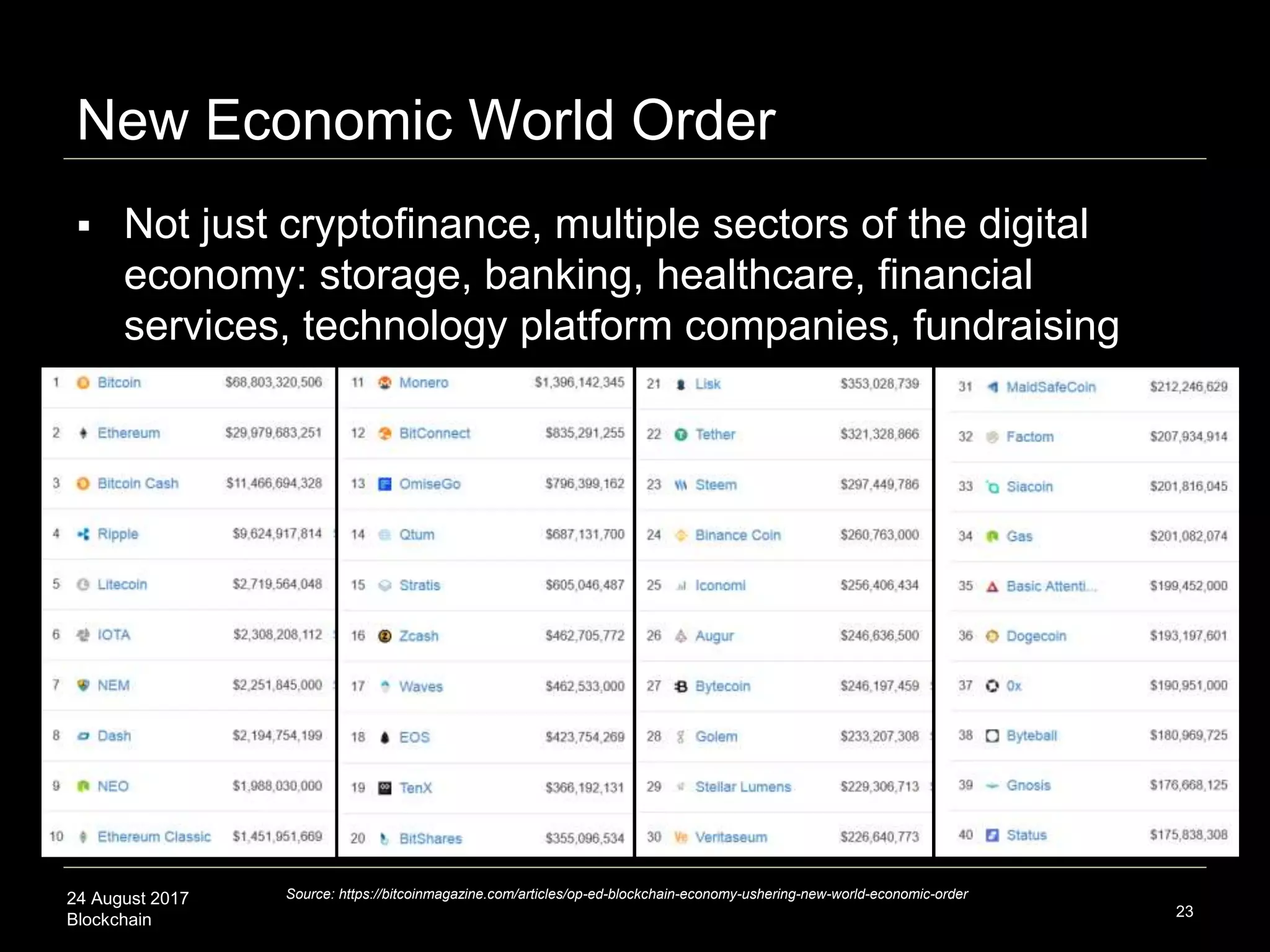

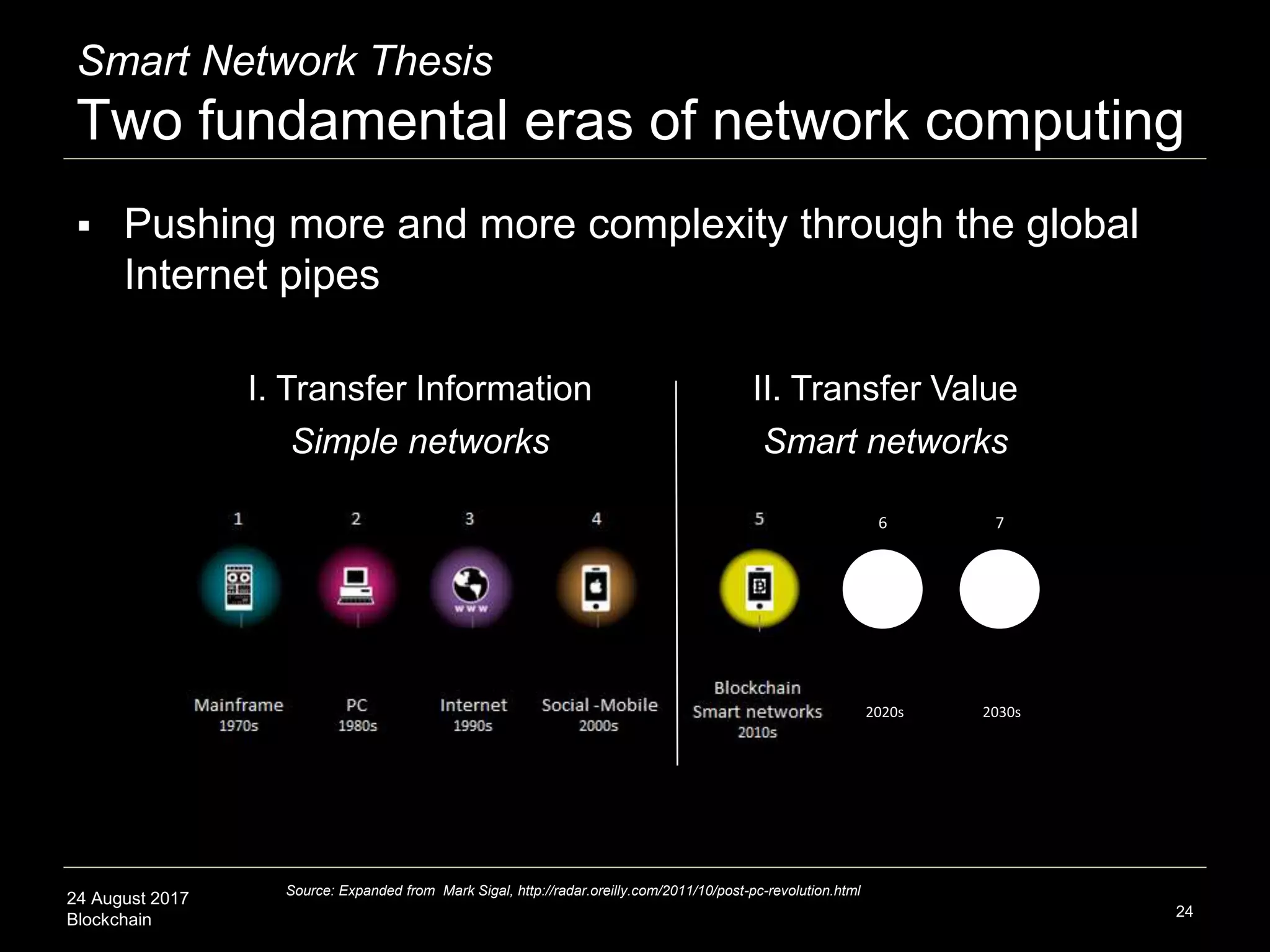

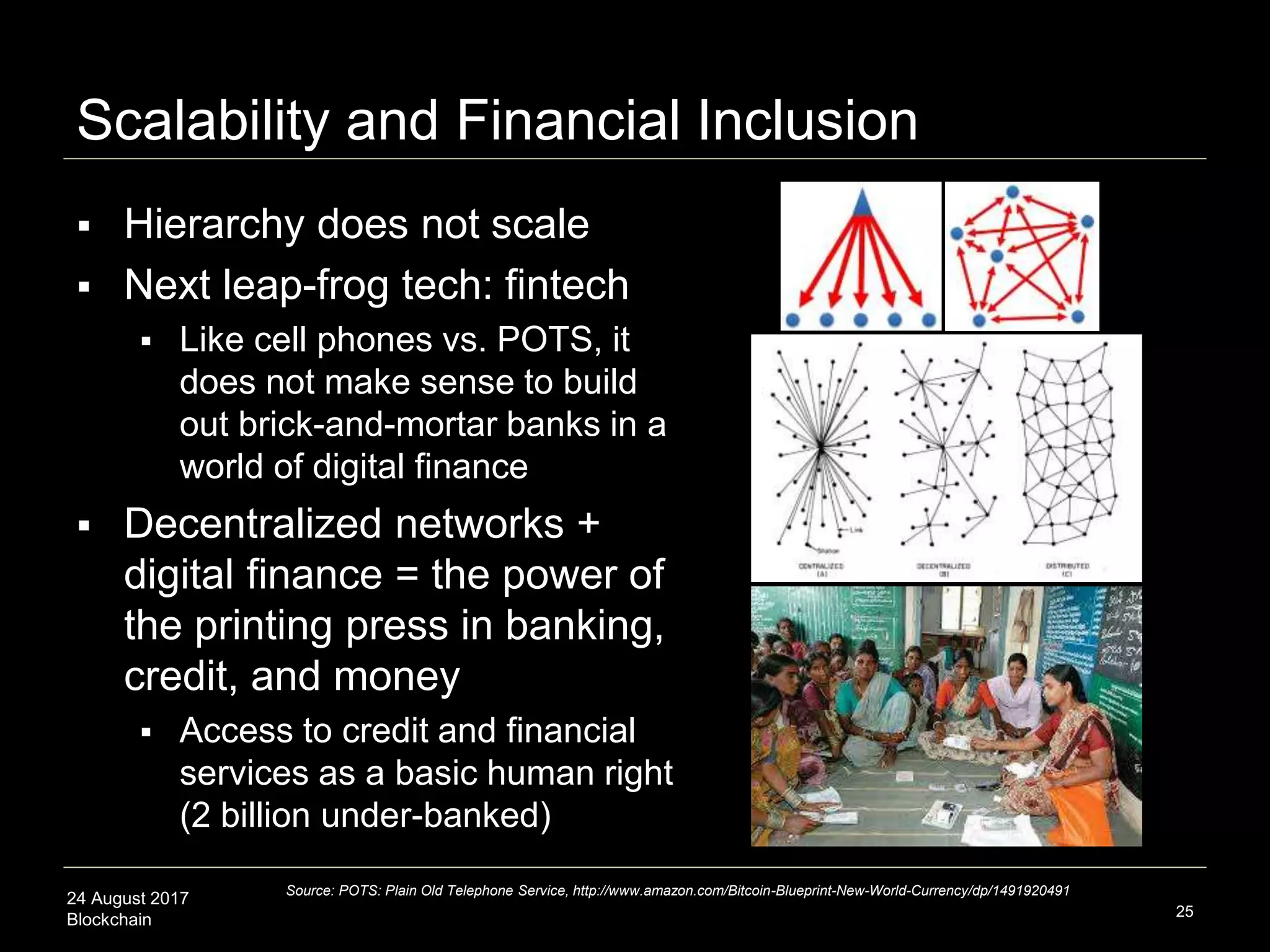

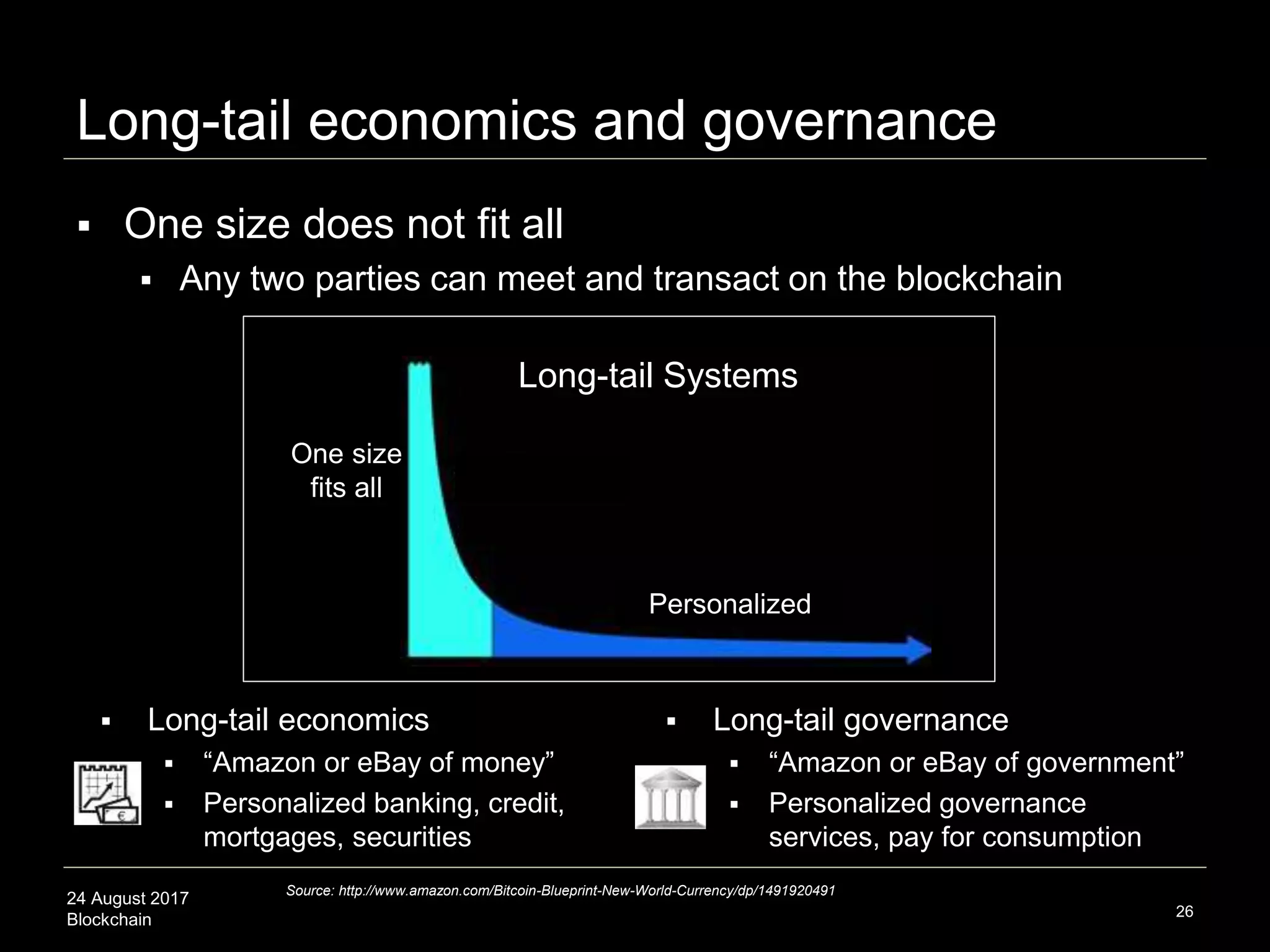

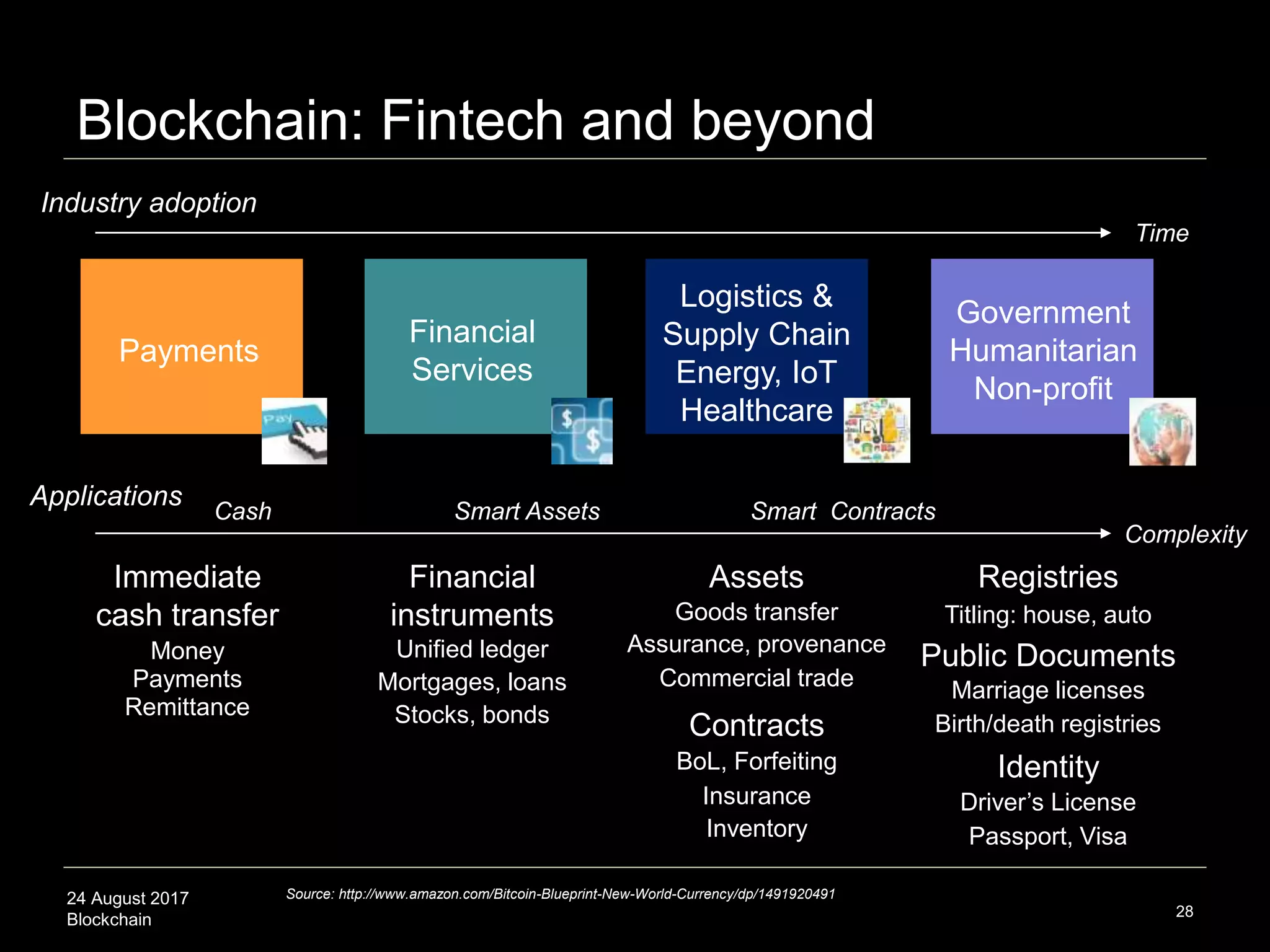

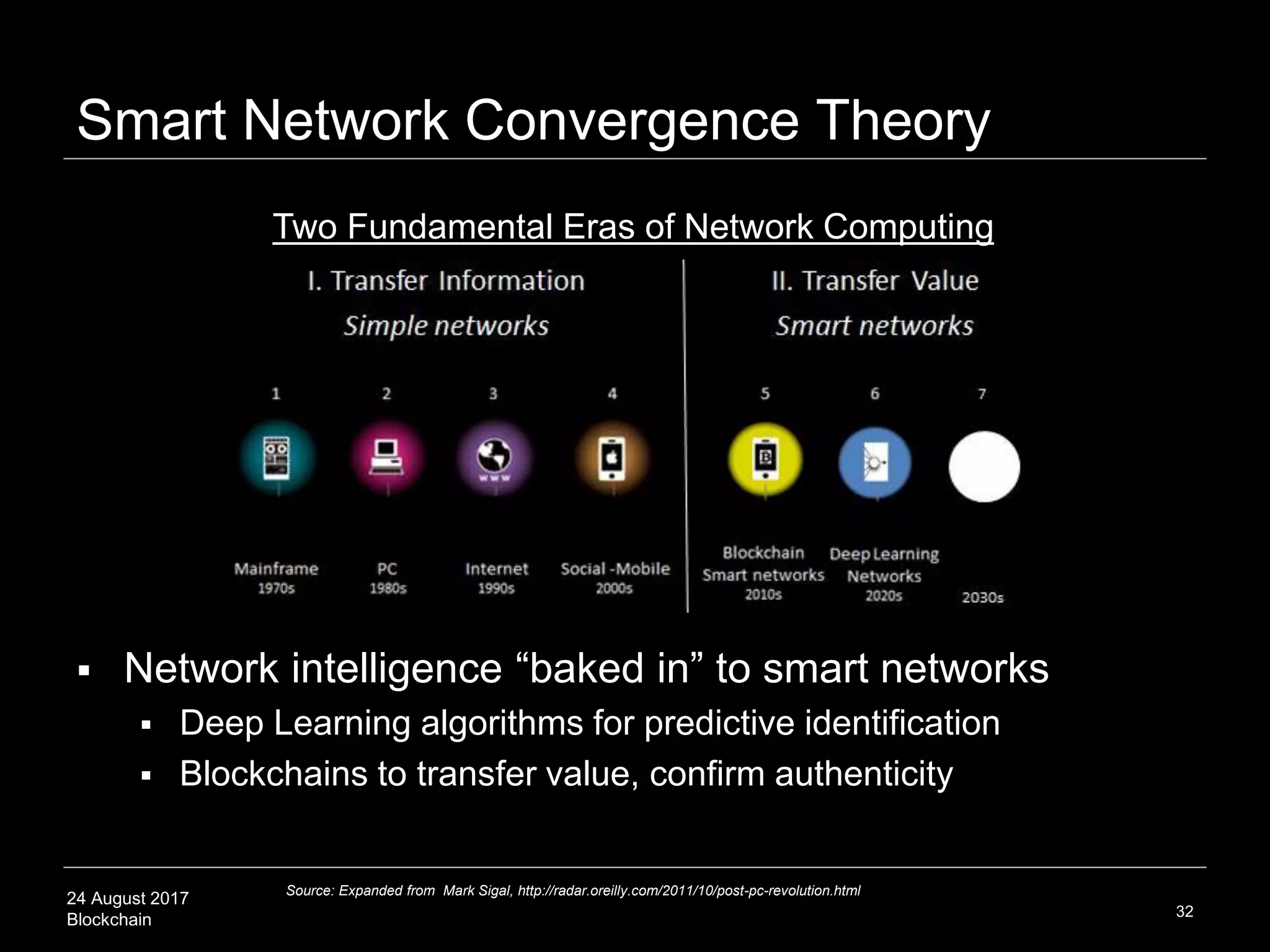

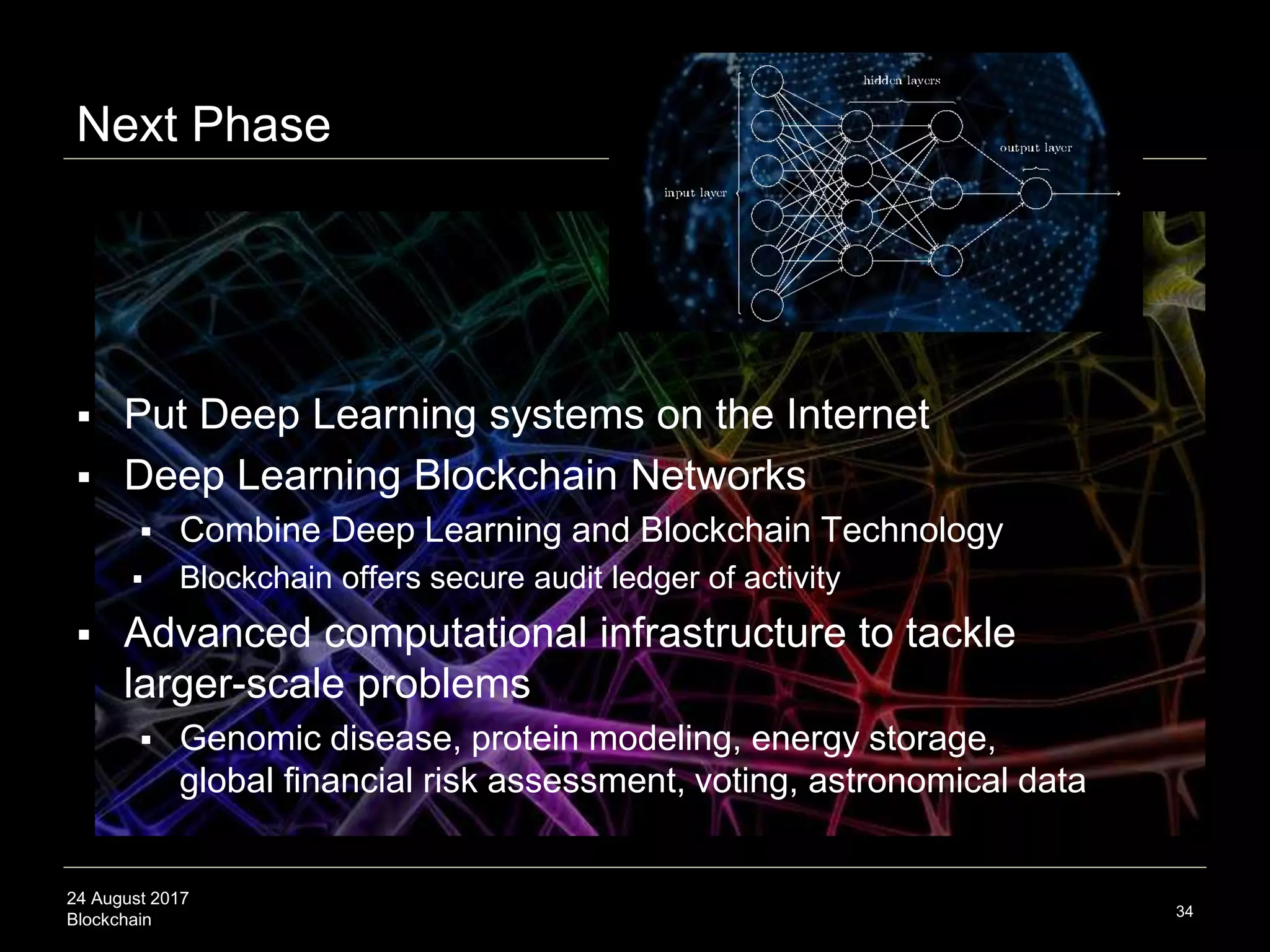

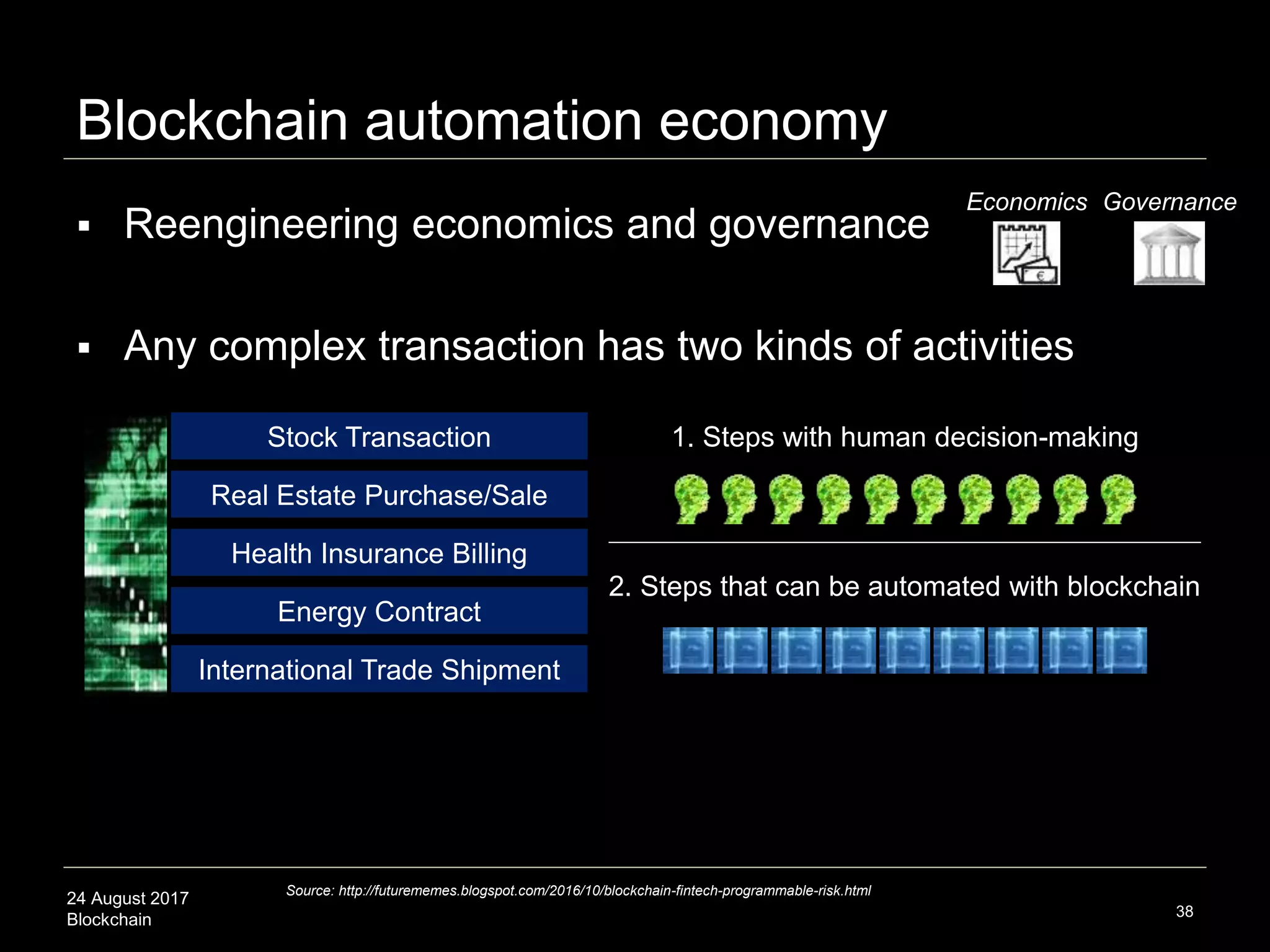

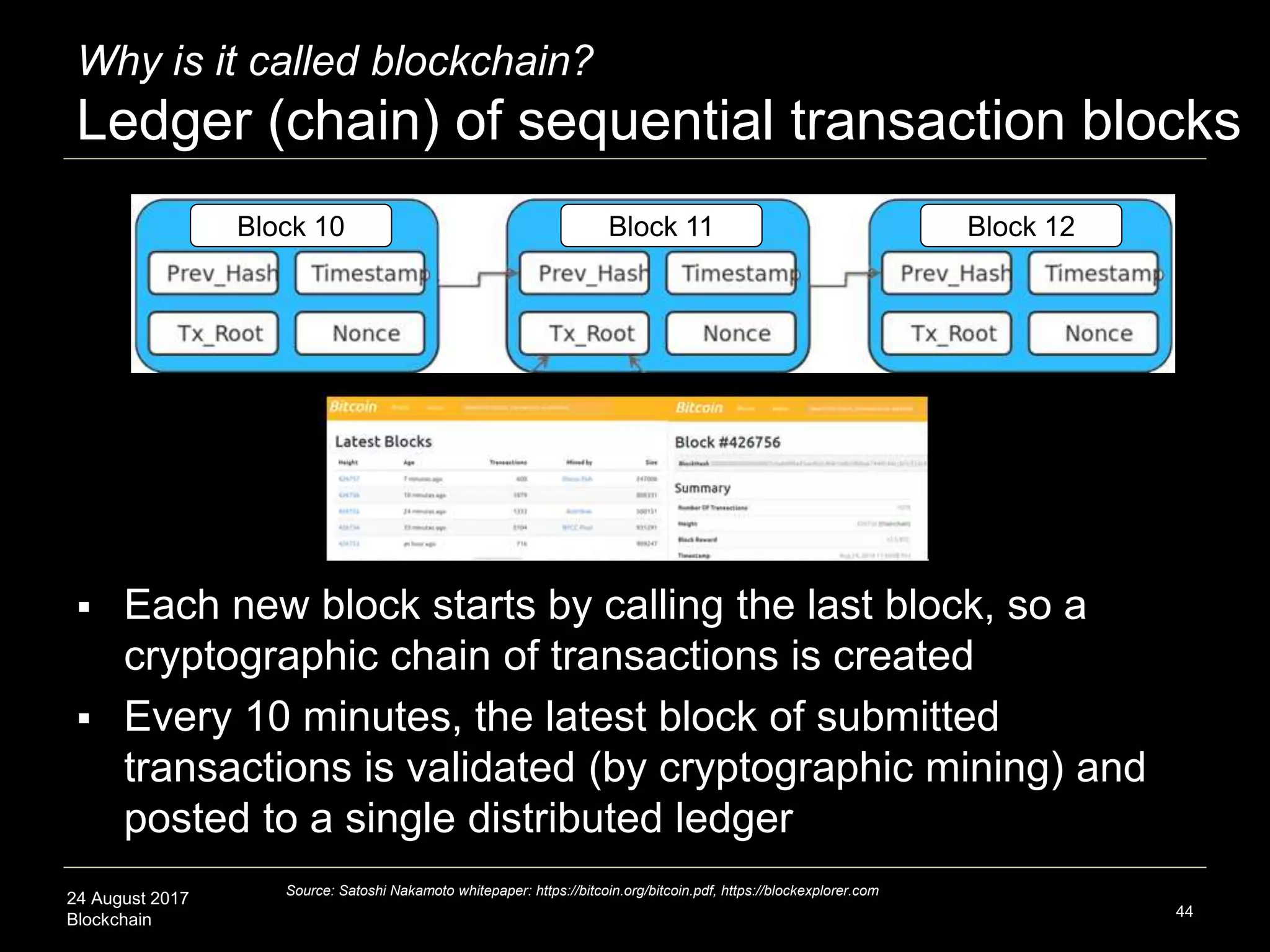

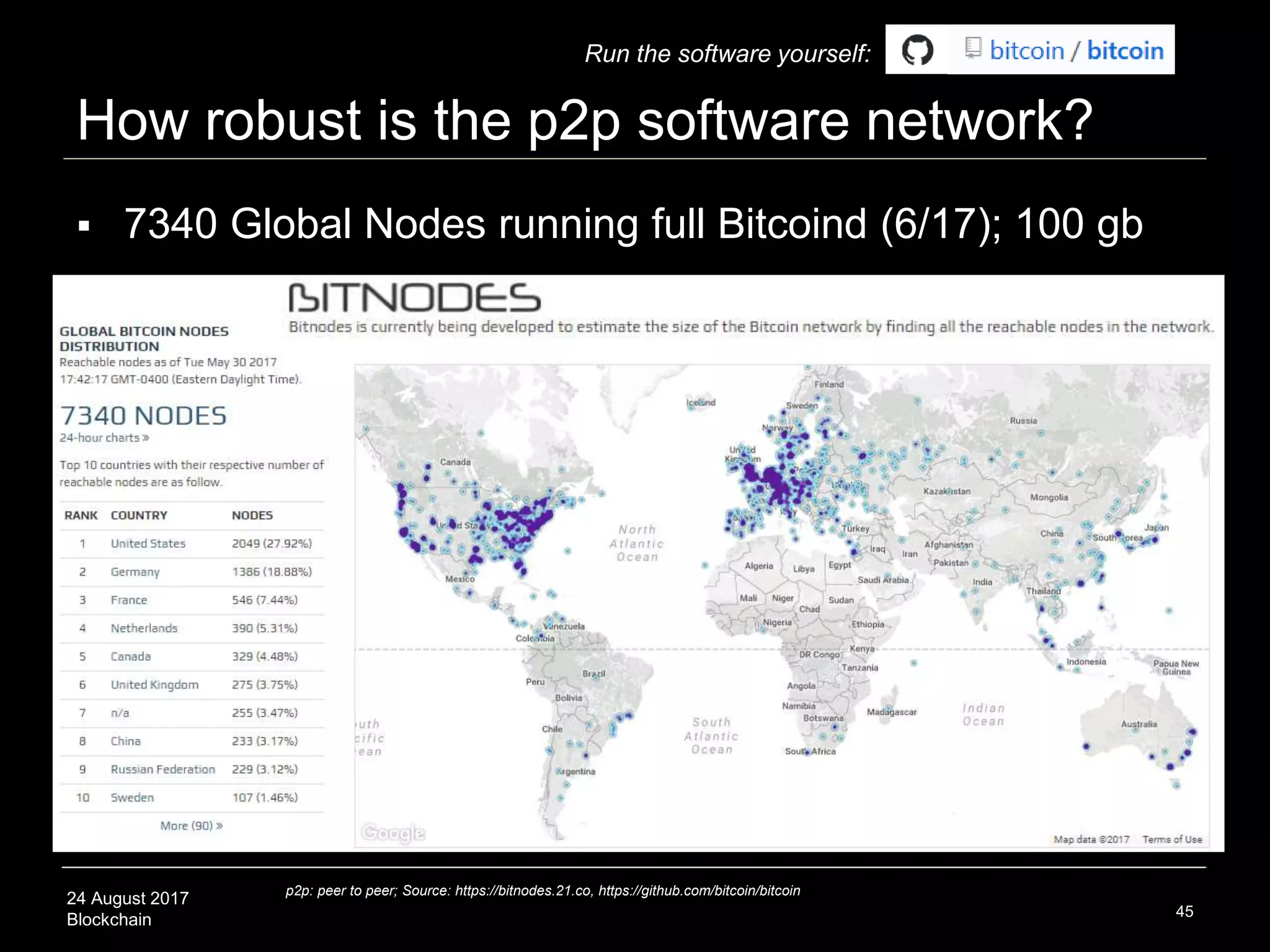

The document discusses blockchain investing and its economic implications, outlining its potential to revolutionize various sectors by enabling secure value transfer over networks. It emphasizes the growing demand for cryptographic assets and Initial Coin Offerings (ICOs) while highlighting the importance of regulatory clarity and infrastructure development. Additionally, it explores the convergence of blockchain technology and deep learning as a transformative force in the future of finance and governance.