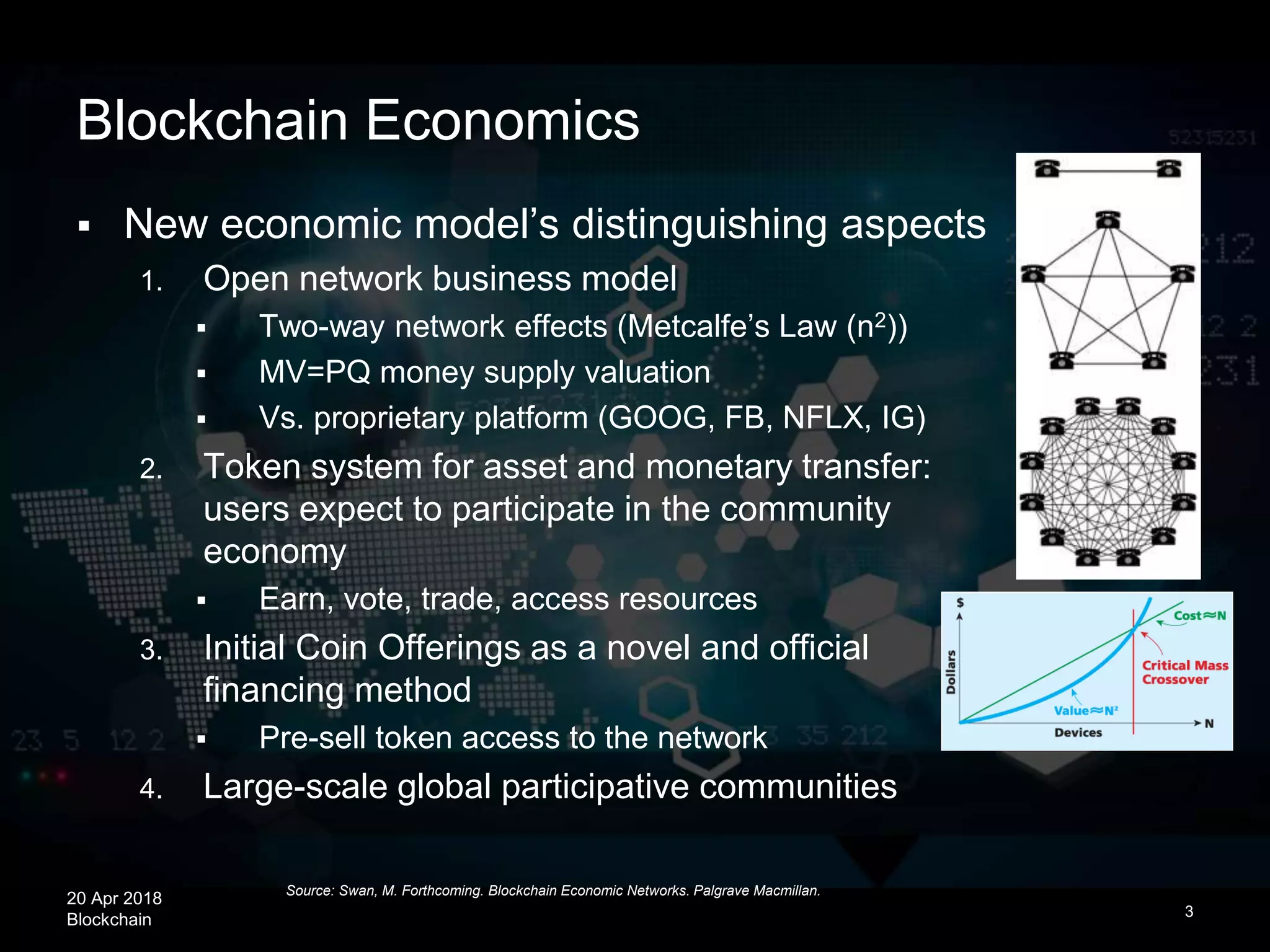

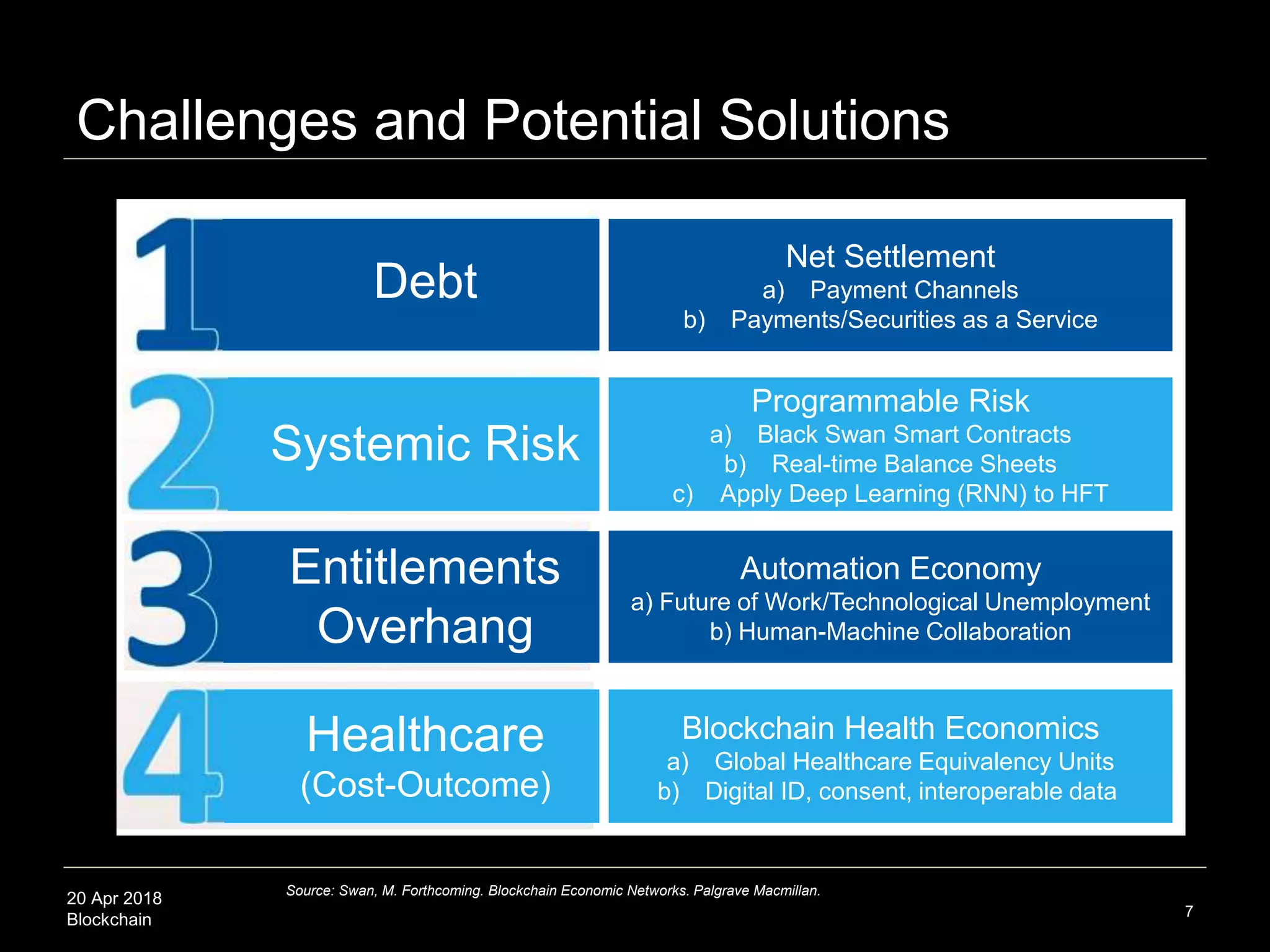

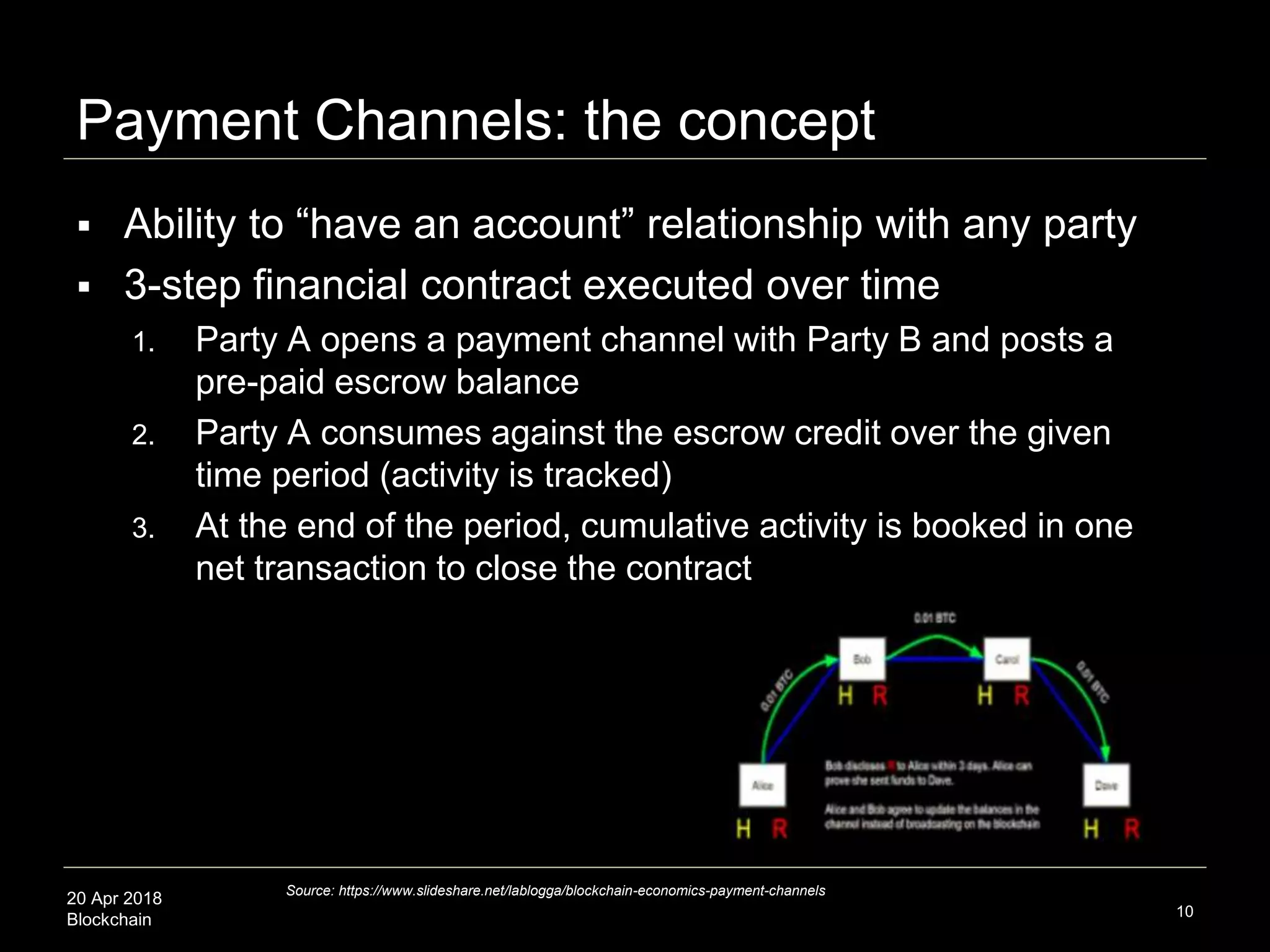

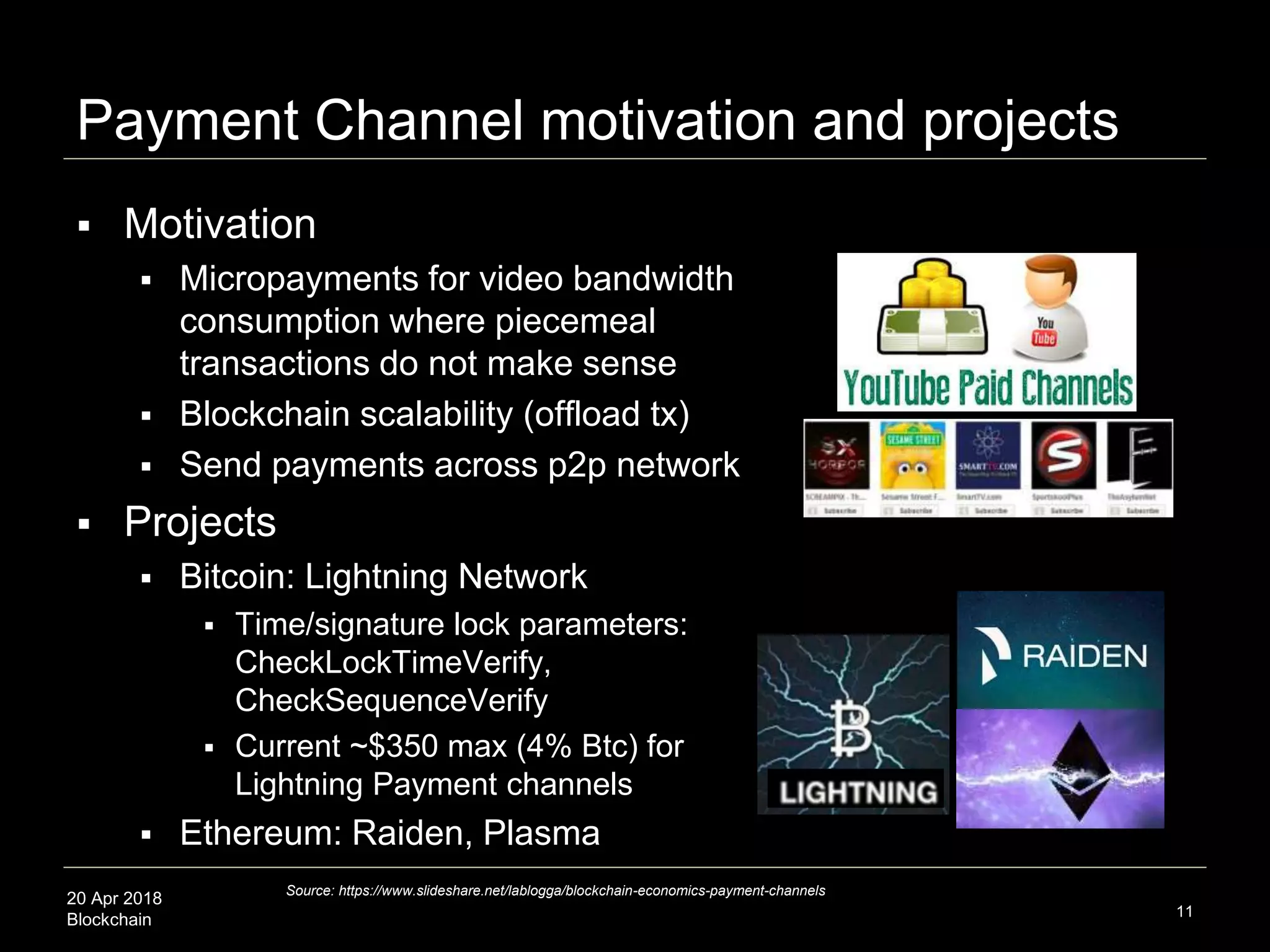

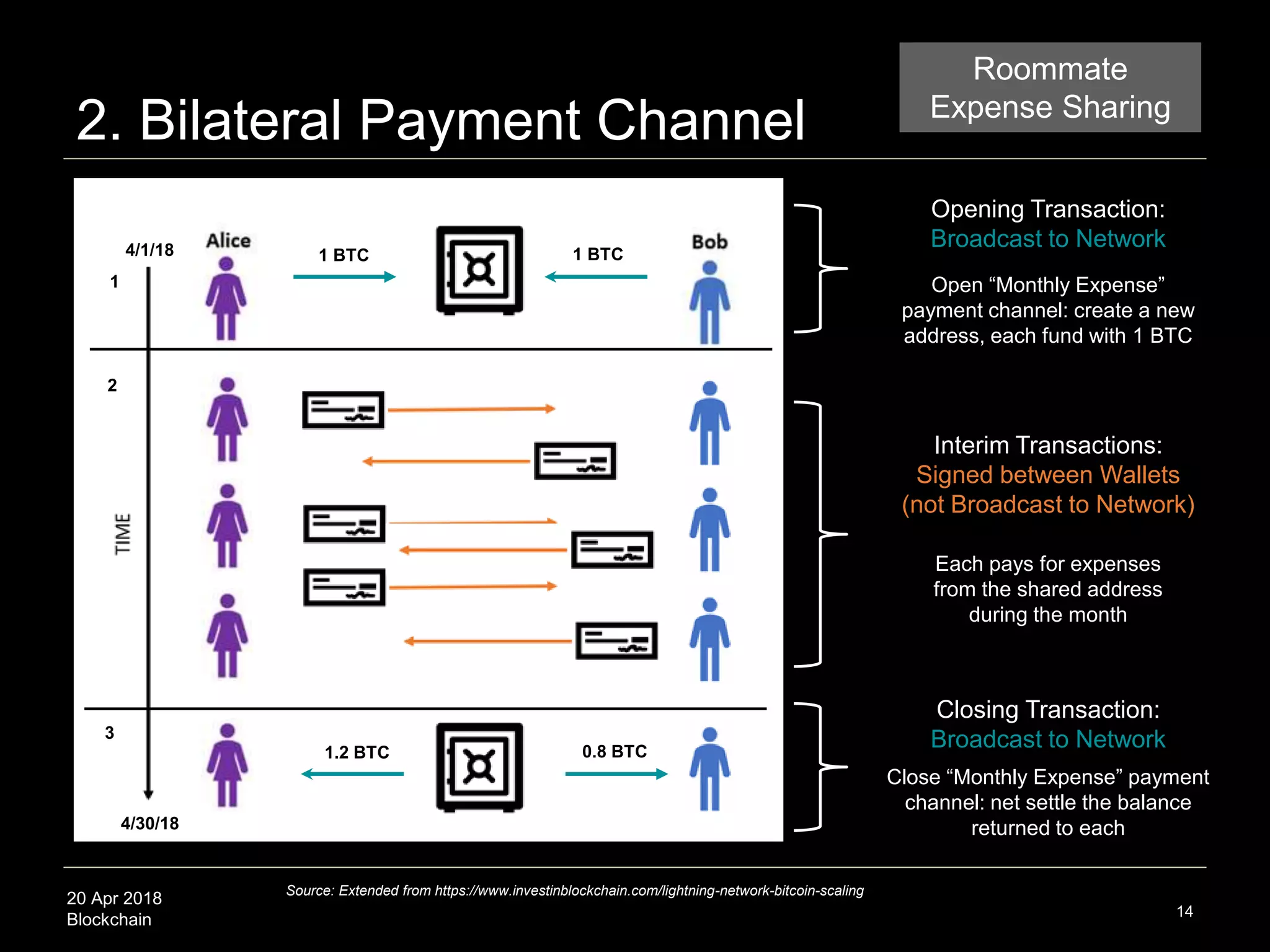

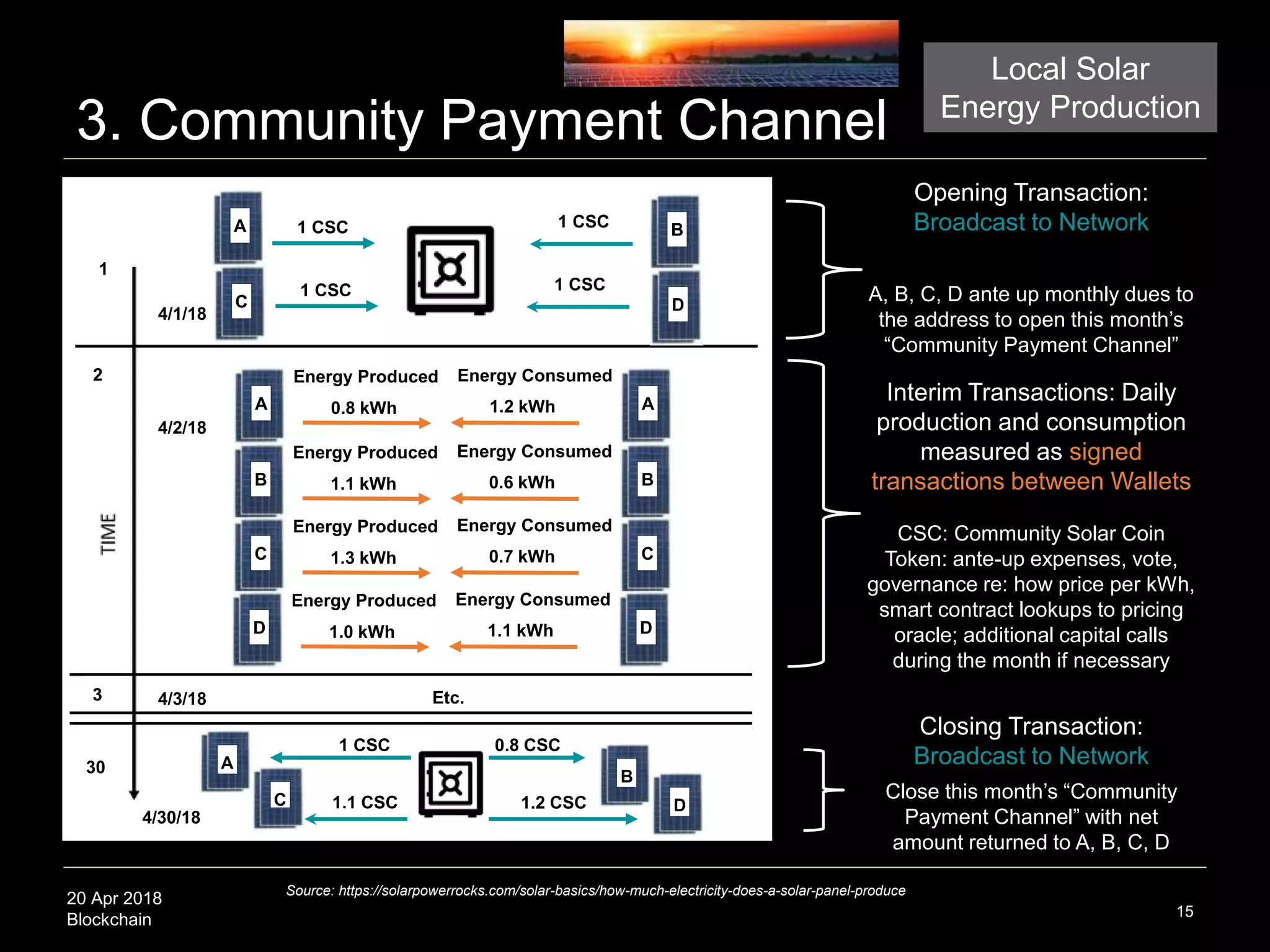

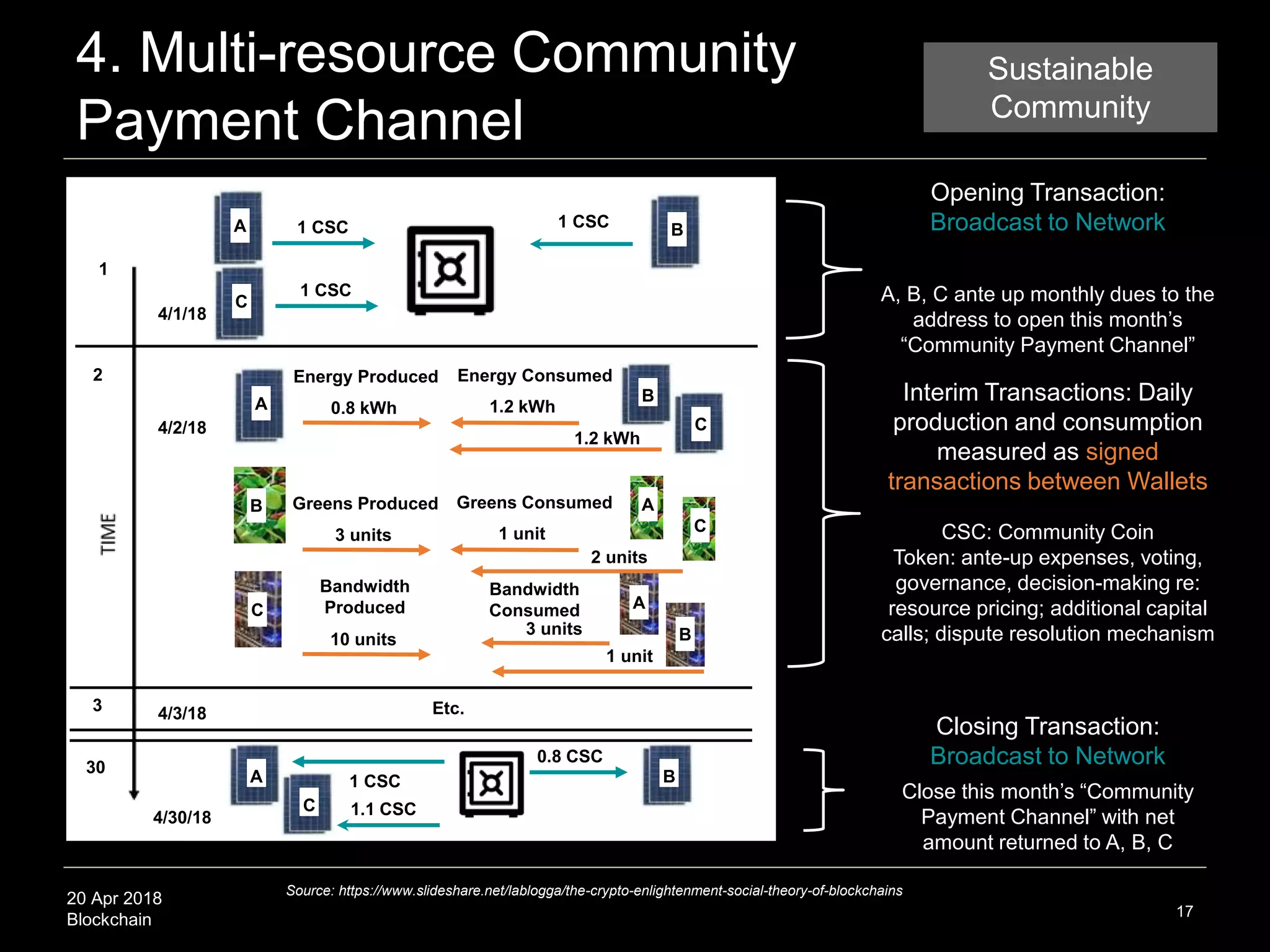

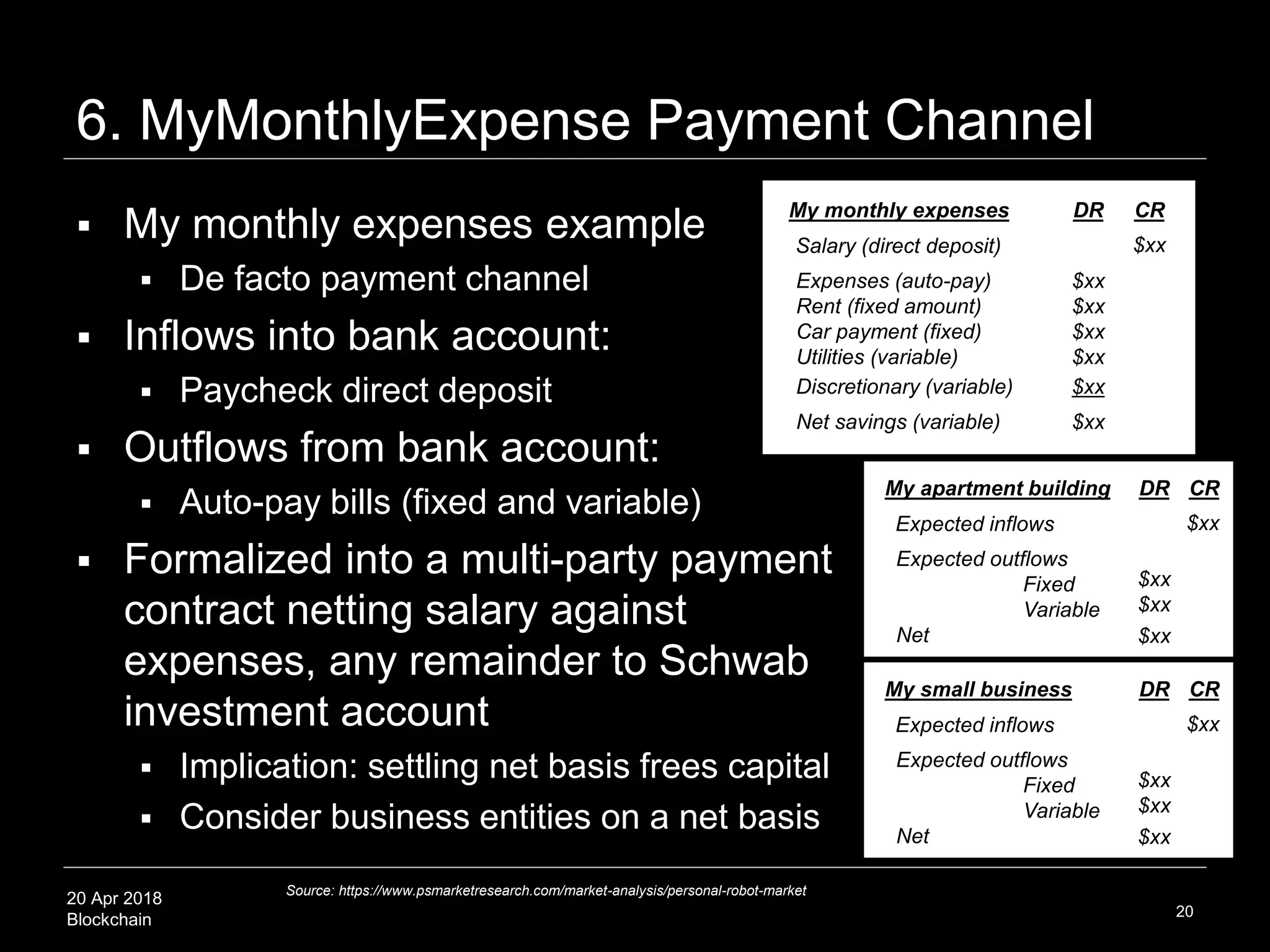

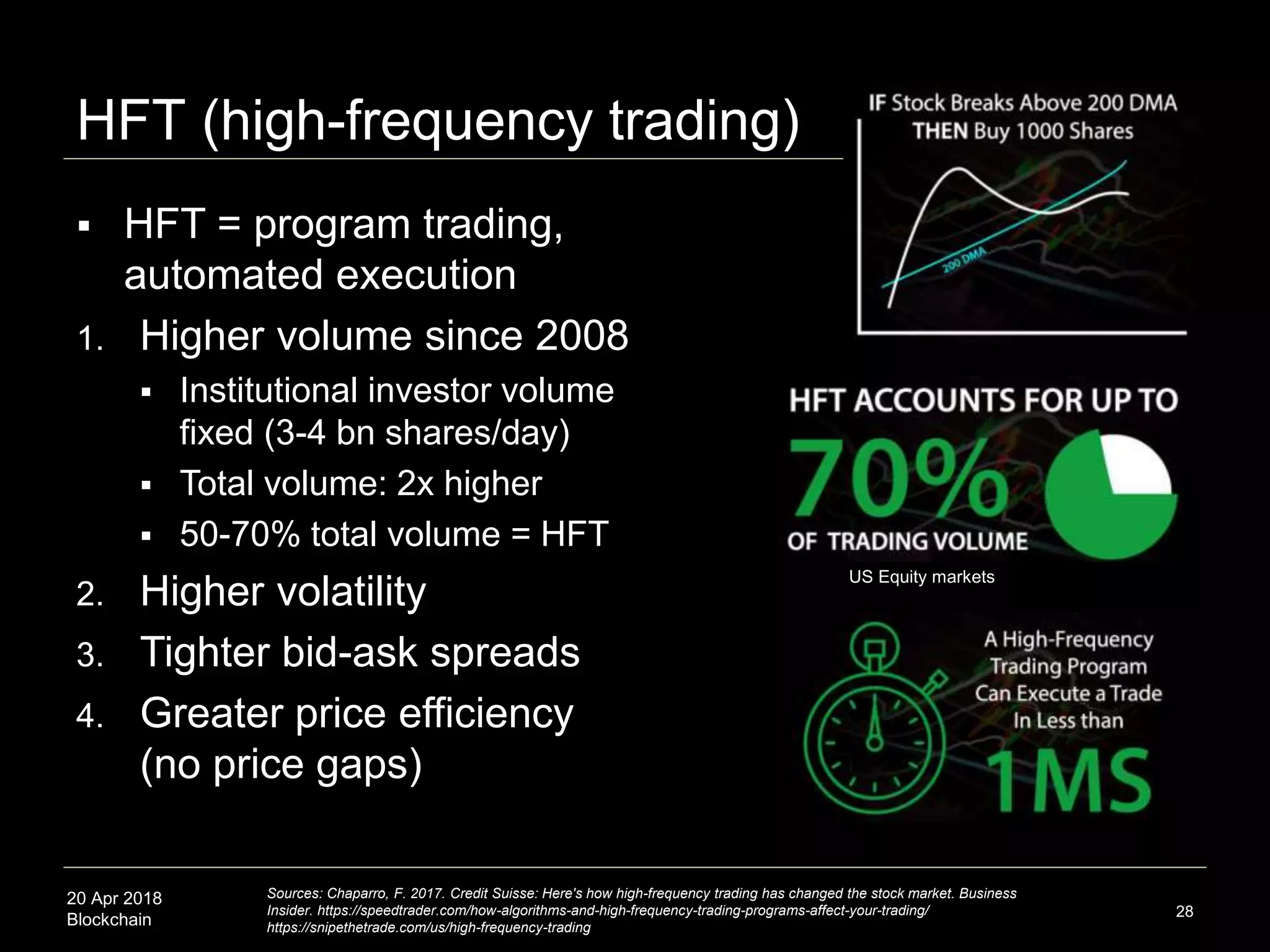

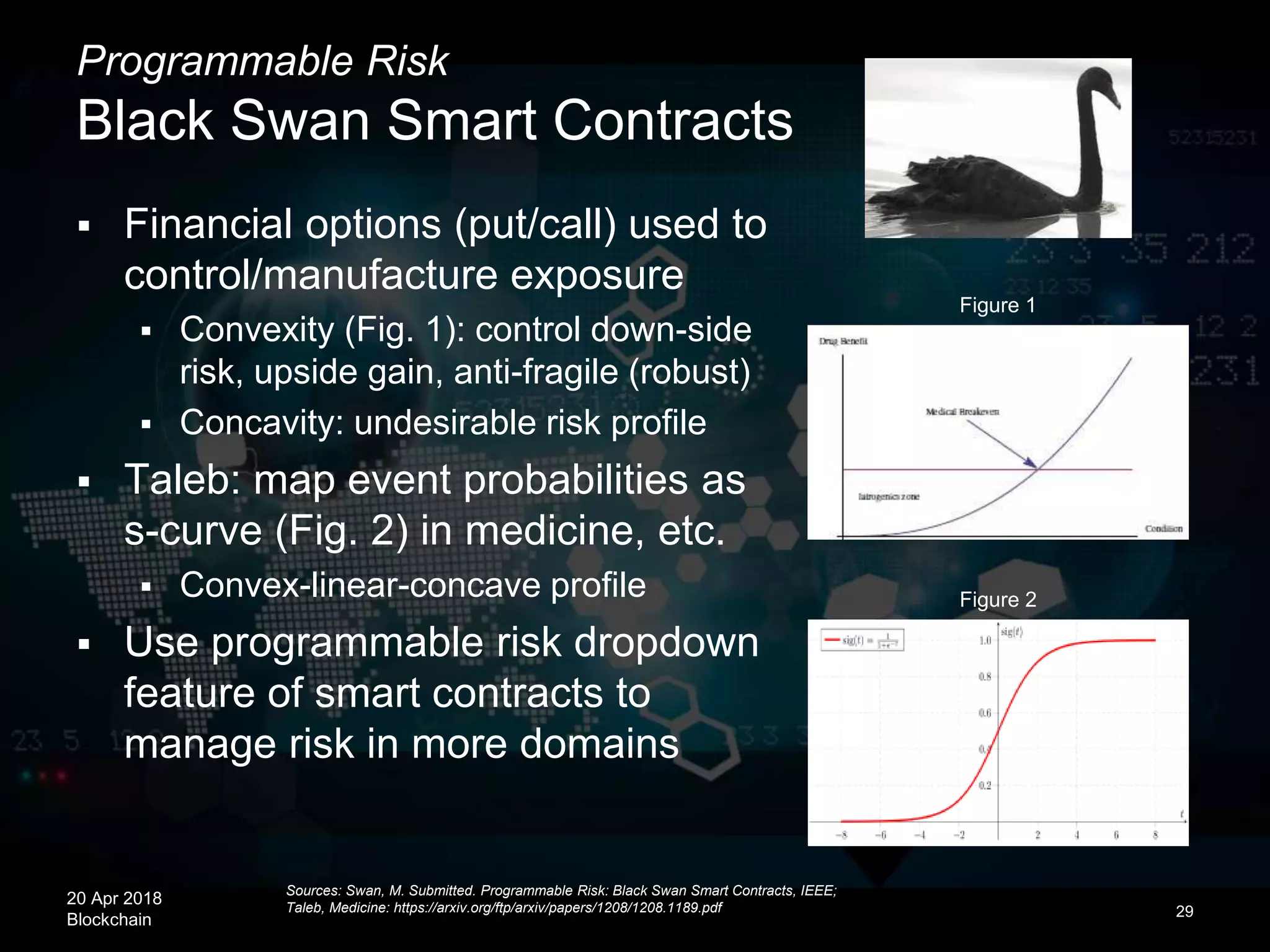

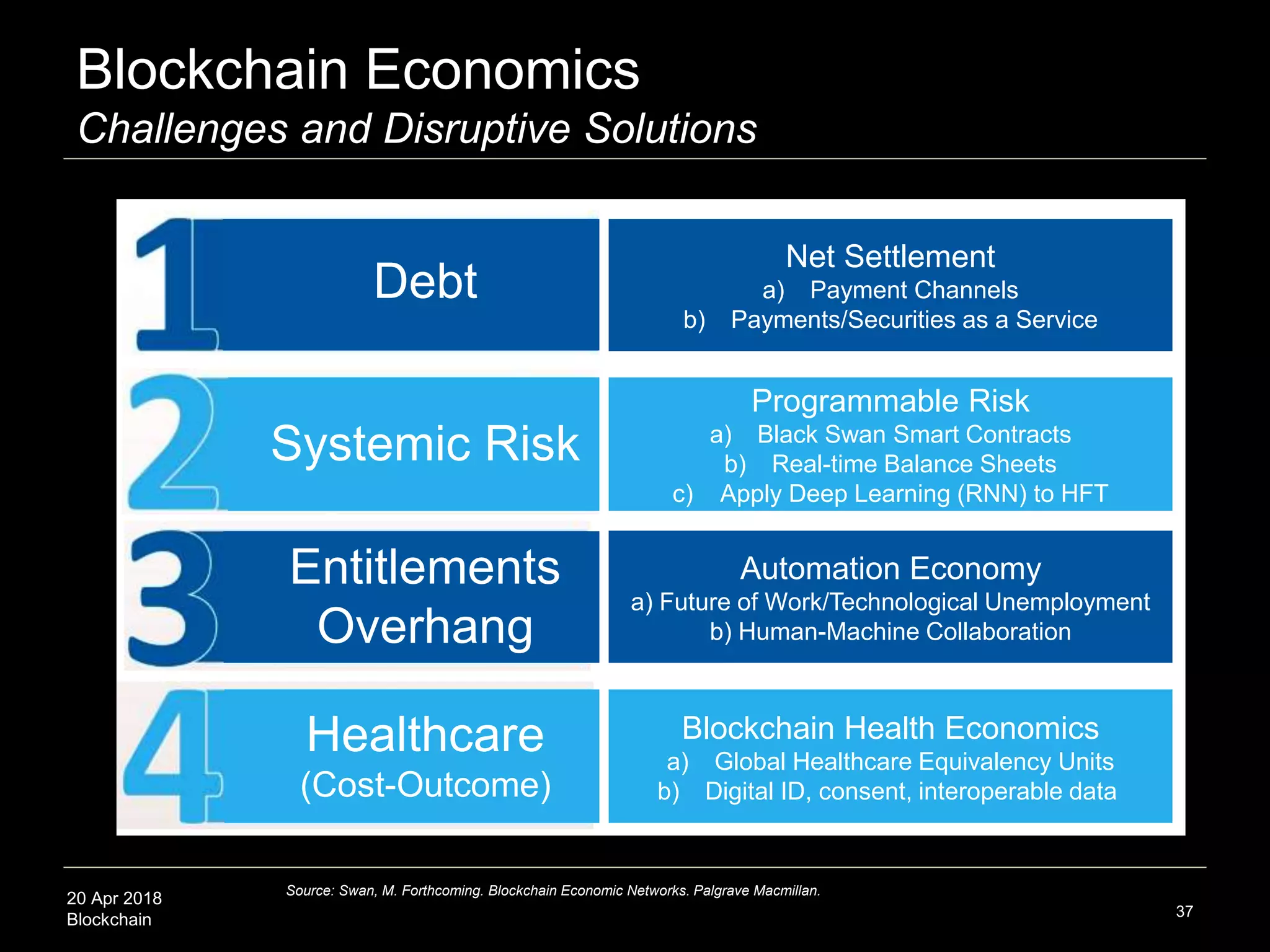

The document presents insights from the inaugural blockchain symposium in Blacksburg, VA, discussing blockchain economics and its potential to disrupt traditional financial systems. Melanie Swan outlines characteristics of blockchain economics, such as open network business models and token systems that encourage participation in community economies. It highlights various economic challenges and potential solutions leveraging blockchain technology, including payment channels and community-driven resource management.