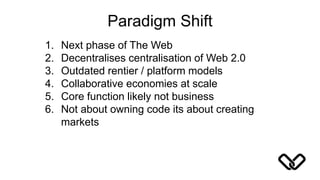

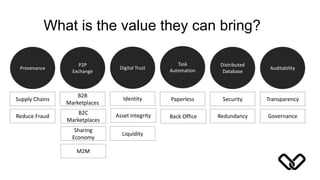

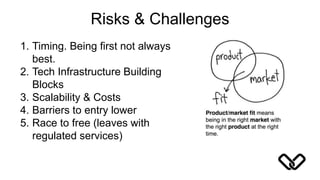

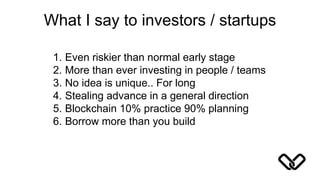

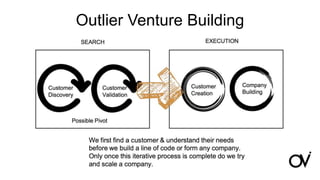

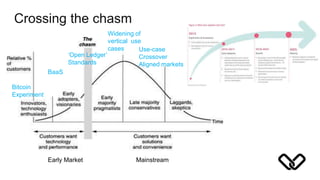

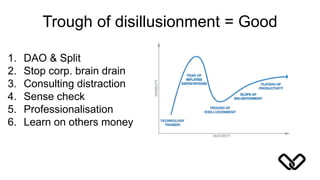

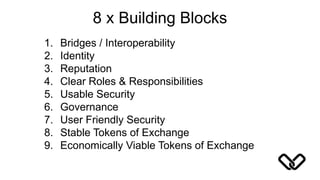

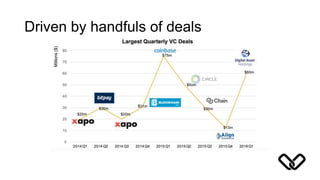

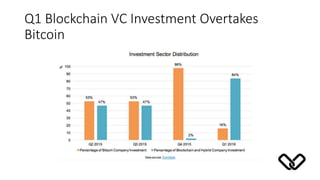

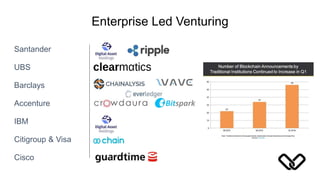

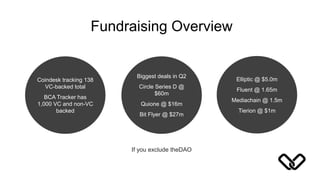

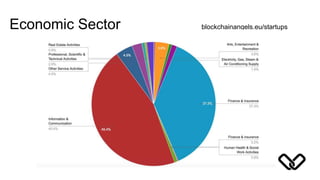

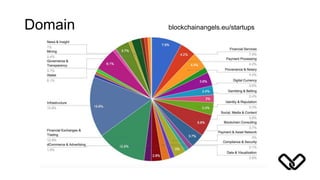

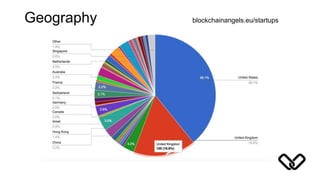

The document discusses the potential and challenges of blockchain technology from an investor's perspective, emphasizing a shift from traditional web models to decentralized collaborative economies. It outlines opportunities in fixing legacy systems and innovating in emerging markets while highlighting risks such as scalability and regulatory uncertainties. Key insights include the growing importance of peer-to-peer markets and the financial activities in the blockchain VC space, alongside the unique role of ICOs in fundraising.